- Taiwan

- /

- Tech Hardware

- /

- TWSE:6933

Amax Holding Co., Ltd. (TWSE:6933) insiders, who hold 42% of the firm would be disappointed by the recent pullback

Key Insights

- Significant insider control over Amax Holding implies vested interests in company growth

- 52% of the business is held by the top 4 shareholders

- Ownership research, combined with past performance data can help provide a good understanding of opportunities in a stock

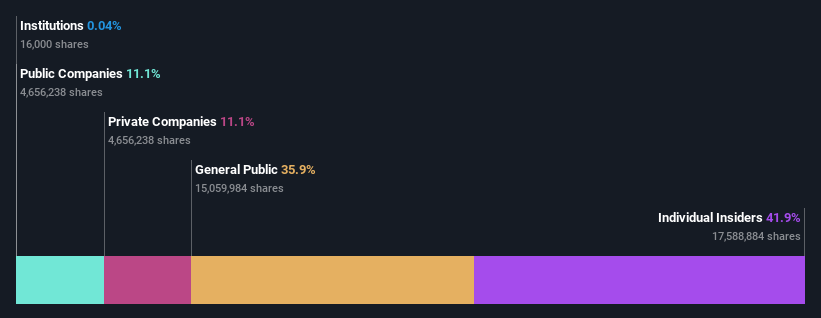

A look at the shareholders of Amax Holding Co., Ltd. (TWSE:6933) can tell us which group is most powerful. We can see that individual insiders own the lion's share in the company with 42% ownership. That is, the group stands to benefit the most if the stock rises (or lose the most if there is a downturn).

As market cap fell to NT$7.8b last week, insiders would have faced the highest losses than any other shareholder groups of the company.

Let's take a closer look to see what the different types of shareholders can tell us about Amax Holding.

See our latest analysis for Amax Holding

What Does The Lack Of Institutional Ownership Tell Us About Amax Holding?

We don't tend to see institutional investors holding stock of companies that are very risky, thinly traded, or very small. Though we do sometimes see large companies without institutions on the register, it's not particularly common.

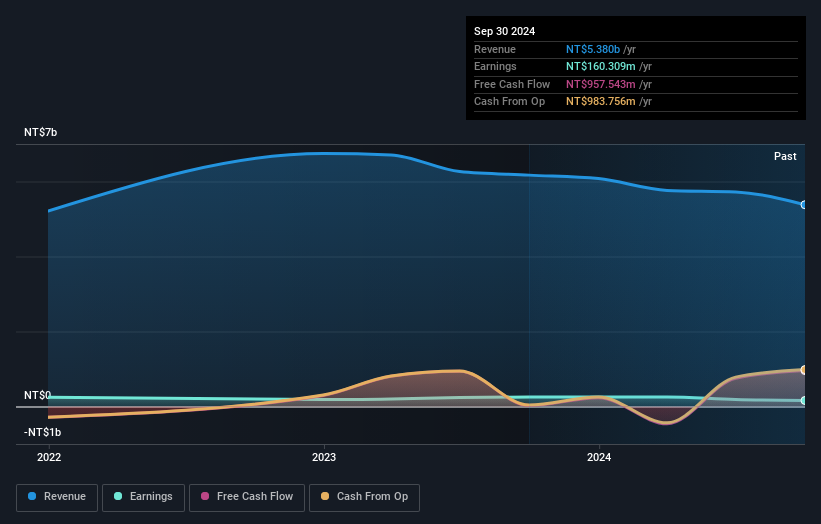

There are many reasons why a company might not have any institutions on the share registry. It may be hard for institutions to buy large amounts of shares, if liquidity (the amount of shares traded each day) is low. If the company has not needed to raise capital, institutions might lack the opportunity to build a position. On the other hand, it's always possible that professional investors are avoiding a company because they don't think it's the best place for their money. Amax Holding's earnings and revenue track record (below) may not be compelling to institutional investors -- or they simply might not have looked at the business closely.

Hedge funds don't have many shares in Amax Holding. Jerry Shih is currently the largest shareholder, with 16% of shares outstanding. In comparison, the second and third largest shareholders hold about 13% and 12% of the stock. Note that the second and third-largest shareholders are also Chief Executive Officer and Member of the Board of Directors, respectively, meaning that the company's top shareholders are insiders.

Our research also brought to light the fact that roughly 52% of the company is controlled by the top 4 shareholders suggesting that these owners wield significant influence on the business.

While it makes sense to study institutional ownership data for a company, it also makes sense to study analyst sentiments to know which way the wind is blowing. We're not picking up on any analyst coverage of the stock at the moment, so the company is unlikely to be widely held.

Insider Ownership Of Amax Holding

The definition of an insider can differ slightly between different countries, but members of the board of directors always count. Management ultimately answers to the board. However, it is not uncommon for managers to be executive board members, especially if they are a founder or the CEO.

Insider ownership is positive when it signals leadership are thinking like the true owners of the company. However, high insider ownership can also give immense power to a small group within the company. This can be negative in some circumstances.

Our most recent data indicates that insiders own a reasonable proportion of Amax Holding Co., Ltd.. It has a market capitalization of just NT$7.8b, and insiders have NT$3.3b worth of shares in their own names. It is great to see insiders so invested in the business. It might be worth checking if those insiders have been buying recently.

General Public Ownership

With a 36% ownership, the general public, mostly comprising of individual investors, have some degree of sway over Amax Holding. While this group can't necessarily call the shots, it can certainly have a real influence on how the company is run.

Private Company Ownership

It seems that Private Companies own 11%, of the Amax Holding stock. Private companies may be related parties. Sometimes insiders have an interest in a public company through a holding in a private company, rather than in their own capacity as an individual. While it's hard to draw any broad stroke conclusions, it is worth noting as an area for further research.

Public Company Ownership

We can see that public companies hold 11% of the Amax Holding shares on issue. This may be a strategic interest and the two companies may have related business interests. It could be that they have de-merged. This holding is probably worth investigating further.

Next Steps:

While it is well worth considering the different groups that own a company, there are other factors that are even more important.

I always like to check for a history of revenue growth. You can too, by accessing this free chart of historic revenue and earnings in this detailed graph.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

If you're looking to trade Amax Holding, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:6933

Amax Holding

Engages in the design and provision of advanced computing solutions.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives