- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:6861

InnoCare Optoelectronics (TWSE:6861) Is Paying Out Less In Dividends Than Last Year

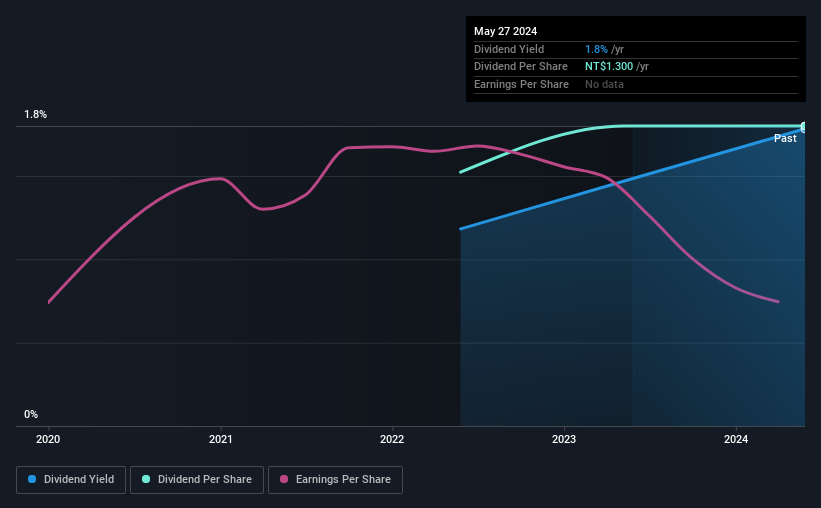

InnoCare Optoelectronics Corporation (TWSE:6861) is reducing its dividend to NT$1.10 on the 16th of Julywhich is 15% less than last year's comparable payment of NT$1.30. This payment takes the dividend yield to 1.8%, which only provides a modest boost to overall returns.

View our latest analysis for InnoCare Optoelectronics

InnoCare Optoelectronics' Earnings Easily Cover The Distributions

Even a low dividend yield can be attractive if it is sustained for years on end. InnoCare Optoelectronics is quite easily earning enough to cover the dividend, however it is being let down by weak cash flows. With the company not bringing in any cash, paying out to shareholders is bound to become difficult at some point.

EPS is set to fall by 0.04% over the next 12 months if recent trends continue. If the dividend continues along recent trends, we estimate the payout ratio could be 35%, which we consider to be quite comfortable, with most of the company's earnings left over to grow the business in the future.

InnoCare Optoelectronics Is Still Building Its Track Record

The dividend hasn't seen any major cuts in the past, but the company has only been paying a dividend for 2 years, which isn't that long in the grand scheme of things. Since 2022, the annual payment back then was NT$1.10, compared to the most recent full-year payment of NT$1.30. This works out to be a compound annual growth rate (CAGR) of approximately 8.7% a year over that time. InnoCare Optoelectronics has been growing its dividend at a decent rate, and the payments have been stable. However, the payment history is very short, so there is no evidence yet that the dividend can be sustained over a full economic cycle.

InnoCare Optoelectronics May Find It Hard To Grow The Dividend

The company's investors will be pleased to have been receiving dividend income for some time. However, things aren't all that rosy. Although it's important to note that InnoCare Optoelectronics' earnings per share has basically not grown from where it was five years ago, which could erode the purchasing power of the dividend over time.

The Dividend Could Prove To Be Unreliable

In summary, dividends being cut isn't ideal, however it can bring the payment into a more sustainable range. While the low payout ratio is a redeeming feature, this is offset by the minimal cash to cover the payments. Overall, we don't think this company has the makings of a good income stock.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. However, there are other things to consider for investors when analysing stock performance. Case in point: We've spotted 5 warning signs for InnoCare Optoelectronics (of which 1 doesn't sit too well with us!) you should know about. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:6861

InnoCare Optoelectronics

Engages in the design, development, manufacture, and sale of X-ray flat panel detectors and sensors for healthcare, veterinary, security, and industrial applications in Taiwan and internationally.

Excellent balance sheet and good value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026