- Taiwan

- /

- Tech Hardware

- /

- TWSE:6669

Wiwynn Corporation Beat Analyst Estimates: See What The Consensus Is Forecasting For Next Year

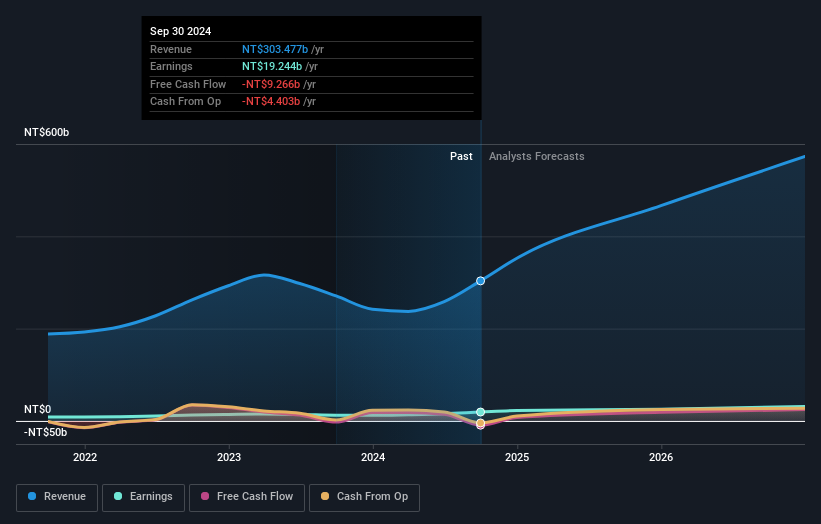

Wiwynn Corporation (TWSE:6669) investors will be delighted, with the company turning in some strong numbers with its latest results. The company beat expectations with revenues of NT$98b arriving 3.7% ahead of forecasts. Statutory earnings per share (EPS) were NT$33.56, 6.8% ahead of estimates. Following the result, the analysts have updated their earnings model, and it would be good to know whether they think there's been a strong change in the company's prospects, or if it's business as usual. So we collected the latest post-earnings statutory consensus estimates to see what could be in store for next year.

See our latest analysis for Wiwynn

Following the latest results, Wiwynn's 16 analysts are now forecasting revenues of NT$466.3b in 2025. This would be a huge 54% improvement in revenue compared to the last 12 months. Per-share earnings are expected to jump 33% to NT$138. Yet prior to the latest earnings, the analysts had been anticipated revenues of NT$469.6b and earnings per share (EPS) of NT$138 in 2025. So it's pretty clear that, although the analysts have updated their estimates, there's been no major change in expectations for the business following the latest results.

The analysts reconfirmed their price target of NT$2,702, showing that the business is executing well and in line with expectations. There's another way to think about price targets though, and that's to look at the range of price targets put forward by analysts, because a wide range of estimates could suggest a diverse view on possible outcomes for the business. There are some variant perceptions on Wiwynn, with the most bullish analyst valuing it at NT$3,235 and the most bearish at NT$2,075 per share. There are definitely some different views on the stock, but the range of estimates is not wide enough as to imply that the situation is unforecastable, in our view.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the Wiwynn's past performance and to peers in the same industry. The analysts are definitely expecting Wiwynn's growth to accelerate, with the forecast 41% annualised growth to the end of 2025 ranking favourably alongside historical growth of 13% per annum over the past five years. Compare this with other companies in the same industry, which are forecast to grow their revenue 21% annually. Factoring in the forecast acceleration in revenue, it's pretty clear that Wiwynn is expected to grow much faster than its industry.

The Bottom Line

The most obvious conclusion is that there's been no major change in the business' prospects in recent times, with the analysts holding their earnings forecasts steady, in line with previous estimates. Fortunately, they also reconfirmed their revenue numbers, suggesting that it's tracking in line with expectations. Additionally, our data suggests that revenue is expected to grow faster than the wider industry. There was no real change to the consensus price target, suggesting that the intrinsic value of the business has not undergone any major changes with the latest estimates.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. At Simply Wall St, we have a full range of analyst estimates for Wiwynn going out to 2026, and you can see them free on our platform here..

Even so, be aware that Wiwynn is showing 4 warning signs in our investment analysis , and 1 of those doesn't sit too well with us...

Valuation is complex, but we're here to simplify it.

Discover if Wiwynn might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:6669

Wiwynn

Engages in the research, development, design, testing, and sales of semi products, and peripheral equipment and parts in the United States, Europe, Asia, and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

This one is all about the tax benefits

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026