- South Korea

- /

- Electrical

- /

- KOSE:A373220

Global Market Highlights 3 Stocks Possibly Priced Below Intrinsic Value Estimates

Reviewed by Simply Wall St

As global markets navigate a landscape of solid corporate earnings and fluctuating inflation rates, major indices like the S&P 500 and Nasdaq Composite have reached new heights, reflecting investor confidence amid economic resilience. Yet, in this environment of mixed market signals and economic data, identifying stocks that may be undervalued relative to their intrinsic value can offer potential opportunities for investors seeking to capitalize on discrepancies between market price and fundamental worth.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Zhuhai CosMX Battery (SHSE:688772) | CN¥14.09 | CN¥27.90 | 49.5% |

| Shin Maint HoldingsLtd (TSE:6086) | ¥1170.00 | ¥2320.99 | 49.6% |

| Medhelp Care Aktiebolag (OM:MEDHLP) | SEK5.00 | SEK9.94 | 49.7% |

| KeePer Technical Laboratory (TSE:6036) | ¥3425.00 | ¥6782.98 | 49.5% |

| HL Holdings (KOSE:A060980) | ₩40650.00 | ₩81088.40 | 49.9% |

| Hibino (TSE:2469) | ¥2344.00 | ¥4646.57 | 49.6% |

| Forum Engineering (TSE:7088) | ¥1208.00 | ¥2408.07 | 49.8% |

| Echo Investment (WSE:ECH) | PLN5.36 | PLN10.70 | 49.9% |

| Digital Workforce Services Oyj (HLSE:DWF) | €3.40 | €6.78 | 49.9% |

| Aquila Part Prod Com (BVB:AQ) | RON1.45 | RON2.87 | 49.5% |

Below we spotlight a couple of our favorites from our exclusive screener.

LG Energy Solution (KOSE:A373220)

Overview: LG Energy Solution, Ltd. is a global provider of energy solutions with a market capitalization of ₩78.74 trillion.

Operations: The company generates revenue of ₩25.76 billion from its energy solutions segment globally.

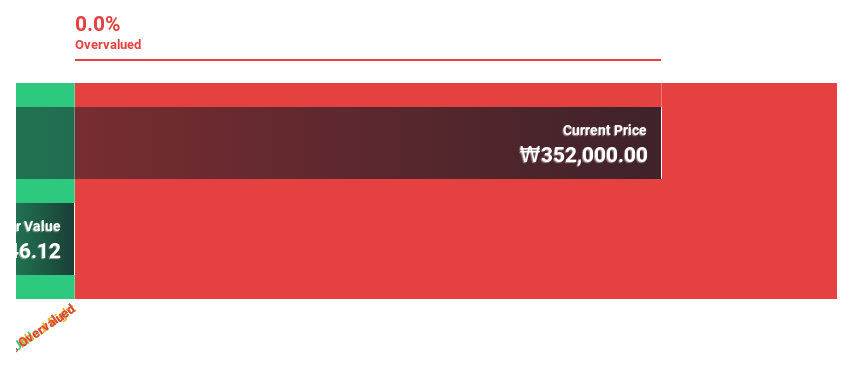

Estimated Discount To Fair Value: 46.1%

LG Energy Solution is trading significantly below its fair value, presenting potential for investors focused on cash flow undervaluation. Forecasts suggest robust earnings growth of 51.99% annually, with profitability expected within three years, outpacing market averages. However, interest payments are not well covered by current earnings. Recent strategic alliances in battery recycling with Toyota Tsusho and Derichebourg highlight efforts to enhance raw material sourcing and sustainability through closed-loop systems, potentially strengthening future cash flows and competitive positioning.

- The analysis detailed in our LG Energy Solution growth report hints at robust future financial performance.

- Delve into the full analysis health report here for a deeper understanding of LG Energy Solution.

GEM (SZSE:002340)

Overview: GEM Co., Ltd. operates in the waste resource comprehensive utilization industry both in China and internationally, with a market cap of CN¥33.30 billion.

Operations: GEM Co., Ltd. generates its revenue from the comprehensive utilization of waste resources both domestically and internationally.

Estimated Discount To Fair Value: 48.6%

GEM is trading 48.6% below its estimated fair value, with earnings expected to grow significantly at 34.9% annually, surpassing the CN market's growth rate. Despite this, dividends remain poorly covered by free cash flows and debt coverage by operating cash flow is weak. Recent share buybacks totaling CN¥138.05 million could indicate management's confidence in undervaluation, while revenue growth of 14.4% outpaces the market but remains below high-growth thresholds.

- Our earnings growth report unveils the potential for significant increases in GEM's future results.

- Navigate through the intricacies of GEM with our comprehensive financial health report here.

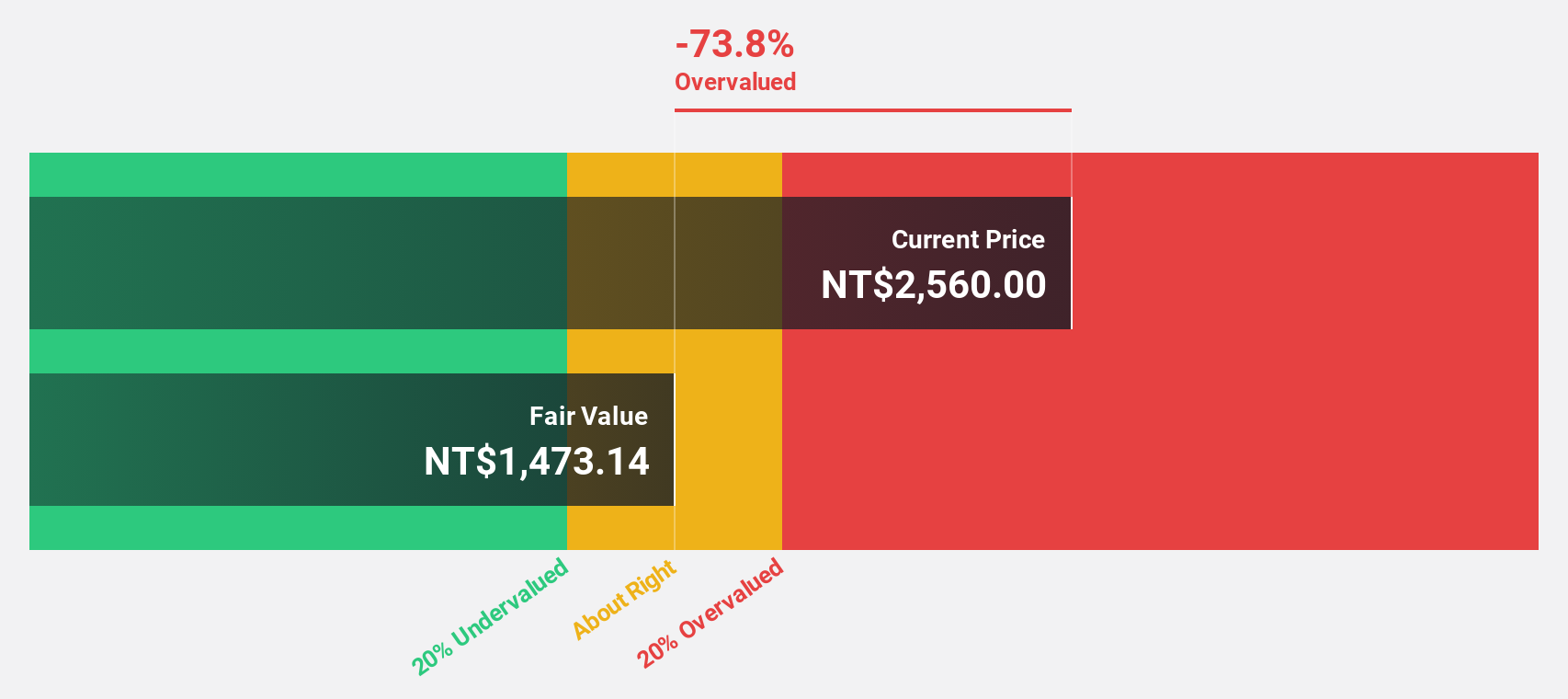

Wiwynn (TWSE:6669)

Overview: Wiwynn Corporation is involved in the research, development, design, testing, and sales of semiconductor products and peripheral equipment globally, with a market capitalization of NT$454.38 billion.

Operations: The company's revenue is primarily derived from its Computer Hardware segment, which generated NT$461.57 billion.

Estimated Discount To Fair Value: 34.8%

Wiwynn's stock is trading 34.8% below its estimated fair value of NT$3839.42, with earnings projected to grow at 15.3% annually, outpacing the TW market. Revenue growth forecasts are also strong at 23.8% per year, driven by innovations in AI server technology and cooling solutions showcased at Computex 2025. Recent dividend increases reflect robust cash flow management despite executive changes, indicating a focus on sustainable shareholder returns amidst evolving leadership dynamics.

- Our growth report here indicates Wiwynn may be poised for an improving outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Wiwynn.

Taking Advantage

- Investigate our full lineup of 473 Undervalued Global Stocks Based On Cash Flows right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A373220

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives