- Taiwan

- /

- Tech Hardware

- /

- TWSE:6414

Exploring None And 2 Other High Growth Tech Stocks For Potential Expansion

Reviewed by Simply Wall St

In a week marked by significant market fluctuations, global indices saw mixed performance with the technology-focused Nasdaq Composite and S&P MidCap 400 Index briefly reaching record highs before retreating, while small-cap stocks demonstrated resilience compared to their larger counterparts. Amidst this backdrop of cautious earnings reports and economic uncertainties, investors are keenly observing high-growth tech stocks for their potential to navigate these volatile conditions effectively. In the current environment, a good stock is often characterized by its ability to maintain robust fundamentals and adapt swiftly to changing market dynamics.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Sarepta Therapeutics | 23.80% | 44.01% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| TG Therapeutics | 30.63% | 46.00% | ★★★★★★ |

| Scandion Oncology | 40.71% | 75.34% | ★★★★★★ |

| Pharma Mar | 26.94% | 55.09% | ★★★★★★ |

| Alkami Technology | 21.90% | 98.60% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

| Travere Therapeutics | 31.17% | 71.73% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1290 stocks from our High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

NNIT (CPSE:NNIT)

Simply Wall St Growth Rating: ★★★★★☆

Overview: NNIT A/S is an IT service provider catering to life sciences, public, and private sectors across Denmark, Europe, the United States, and Asia with a market cap of DKK2.57 billion.

Operations: NNIT A/S generates revenue primarily from its IT services, with Denmark contributing the largest share at DKK828.30 million, followed by Europe at DKK494.80 million. The company also serves the US and Asia markets, contributing DKK366.10 million and DKK139.30 million respectively to its revenue streams.

Despite recent challenges, NNIT has demonstrated resilience and strategic agility. The company's recalibration of capacity in response to a subdued market, particularly in Europe and the US, underscores its proactive stance amidst economic fluctuations. This adaptability is evident as NNIT secured a significant contract with ATP for their SAP Debtor system, valued at approximately DKK 240 million. Financially, NNIT forecasts an organic revenue growth of around 10.9% per year, outpacing the Danish market's 10.1%, with earnings expected to surge by 51.4% annually—significantly higher than the local market average of 12.7%. These figures reflect not only a robust operational strategy but also an effective alignment with evolving market demands and client needs.

- Click here and access our complete health analysis report to understand the dynamics of NNIT.

Understand NNIT's track record by examining our Past report.

Admicom Oyj (HLSE:ADMCM)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Admicom Oyj provides ERP cloud-based solutions in Finland and has a market capitalization of €245.33 million.

Operations: Admicom Oyj focuses on providing ERP cloud-based solutions in Finland, generating revenue primarily from its Software & Programming segment, which amounts to €34.78 million.

Admicom Oyj, navigating through a challenging landscape, has managed to position itself favorably in the Finnish software sector. With an expected revenue growth of 8.5% per year, Admicom outpaces the broader Finnish market's growth rate of 2.1%. Despite a recent one-off loss of €3.8M impacting its financials, the company's earnings are projected to rise by 19.9% annually, which is notably faster than the local market average of 14.3%. This growth trajectory is underpinned by Admicom’s strategic focus on enhancing operational efficiencies and investing in technology innovations that meet evolving customer needs—a move that could solidify its standing in an increasingly competitive industry.

- Navigate through the intricacies of Admicom Oyj with our comprehensive health report here.

Examine Admicom Oyj's past performance report to understand how it has performed in the past.

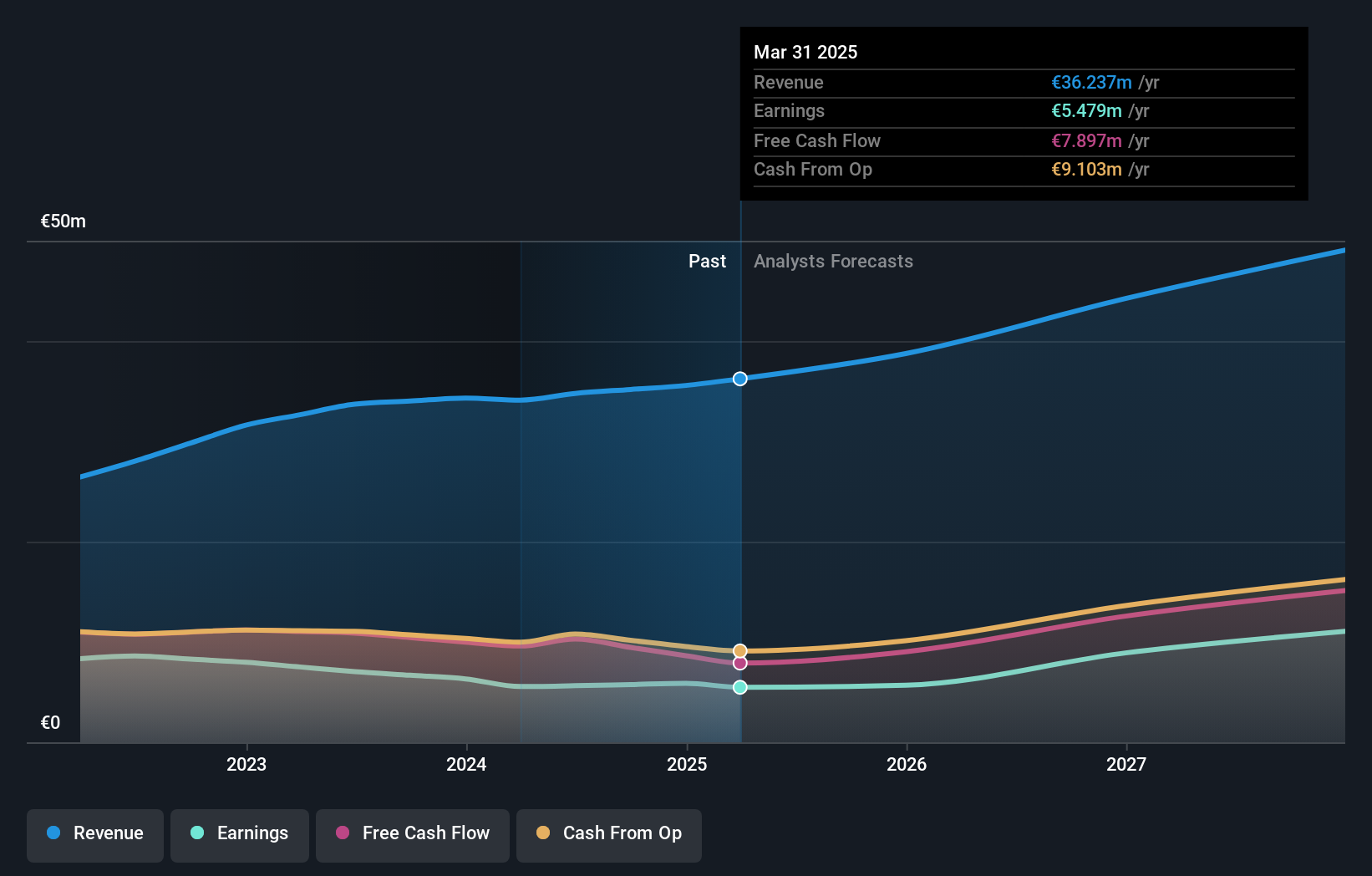

Ennoconn (TWSE:6414)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Ennoconn Corporation is engaged in the research, design, development, manufacturing, and sale of data storage and processing equipment as well as industrial motherboards, network communication products, and facility electromechanical systems both in Taiwan and globally; it has a market cap of NT$41.12 billion.

Operations: Ennoconn generates revenue primarily from its Factory System and Electromechanical System Service Business Department, contributing NT$58.79 billion, followed by the Information Systems Department with NT$49.78 billion. The Industrial Computer Software and Hardware Sales Department adds NT$26.69 billion to the company's revenue stream.

Ennoconn, amidst a competitive tech landscape, has shown resilience with a revenue increase to TWD 69.04 billion in the first half of 2024 from TWD 57.45 billion in the prior year, marking a growth of approximately 20%. This performance is complemented by an R&D expenditure that remains robust at 13.2% of revenues, reflecting the company's commitment to innovation despite a slight dip in net income from TWD 1.07 billion to TWD 1.14 billion year-over-year. Notably, Ennoconn's strategic focus on research has positioned it well for sustained advancements in technology sectors where it operates, potentially driving future growth as evidenced by its projected earnings surge of 22.5% annually.

Make It Happen

- Click through to start exploring the rest of the 1287 High Growth Tech and AI Stocks now.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ennoconn might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:6414

Ennoconn

Researches, designs, develops, manufactures, and sells data storage, processing equipment and industrial motherboard, and network communication in Taiwan, China, Europe, and internationally.

Flawless balance sheet, undervalued and pays a dividend.