- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:6278

Investors Continue Waiting On Sidelines For Taiwan Surface Mounting Technology Corp. (TWSE:6278)

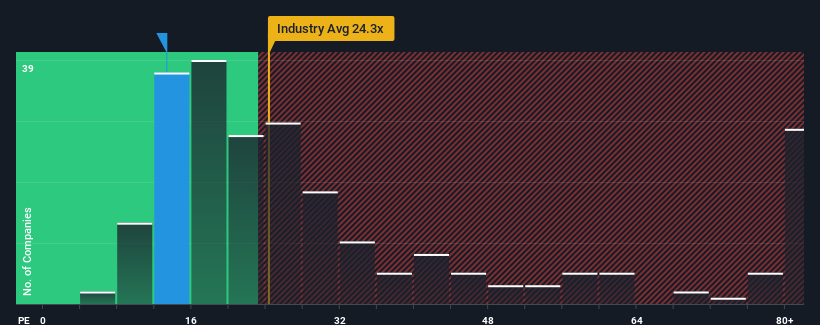

Taiwan Surface Mounting Technology Corp.'s (TWSE:6278) price-to-earnings (or "P/E") ratio of 13.3x might make it look like a buy right now compared to the market in Taiwan, where around half of the companies have P/E ratios above 24x and even P/E's above 41x are quite common. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Taiwan Surface Mounting Technology has been struggling lately as its earnings have declined faster than most other companies. It seems that many are expecting the dismal earnings performance to persist, which has repressed the P/E. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. Or at the very least, you'd be hoping the earnings slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

See our latest analysis for Taiwan Surface Mounting Technology

Is There Any Growth For Taiwan Surface Mounting Technology?

Taiwan Surface Mounting Technology's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 38%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 14% overall rise in EPS. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been mostly respectable for the company.

Looking ahead now, EPS is anticipated to climb by 52% during the coming year according to the three analysts following the company. That's shaping up to be materially higher than the 26% growth forecast for the broader market.

With this information, we find it odd that Taiwan Surface Mounting Technology is trading at a P/E lower than the market. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What We Can Learn From Taiwan Surface Mounting Technology's P/E?

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Taiwan Surface Mounting Technology currently trades on a much lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Taiwan Surface Mounting Technology you should know about.

Of course, you might also be able to find a better stock than Taiwan Surface Mounting Technology. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Taiwan Surface Mounting Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:6278

Taiwan Surface Mounting Technology

Engages in the design, processing, manufacturing, and trading of TFT-LCD panels, general electronic information products, and PCB surface mount packaging worldwide.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026