As global markets navigate a landscape marked by rate cuts from the ECB and SNB, and anticipation of a similar move by the Federal Reserve, the technology-heavy Nasdaq Composite has reached an all-time high despite broader declines in major indexes. In this environment, where growth stocks continue to outperform value stocks, identifying high-growth tech companies with strong fundamentals becomes crucial for investors looking to capitalize on the sector's resilience.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| eWeLLLtd | 27.24% | 28.74% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| Alkami Technology | 21.94% | 98.60% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Travere Therapeutics | 31.70% | 72.51% | ★★★★★★ |

Click here to see the full list of 1287 stocks from our High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

SoftwareONE Holding (SWX:SWON)

Simply Wall St Growth Rating: ★★★★☆☆

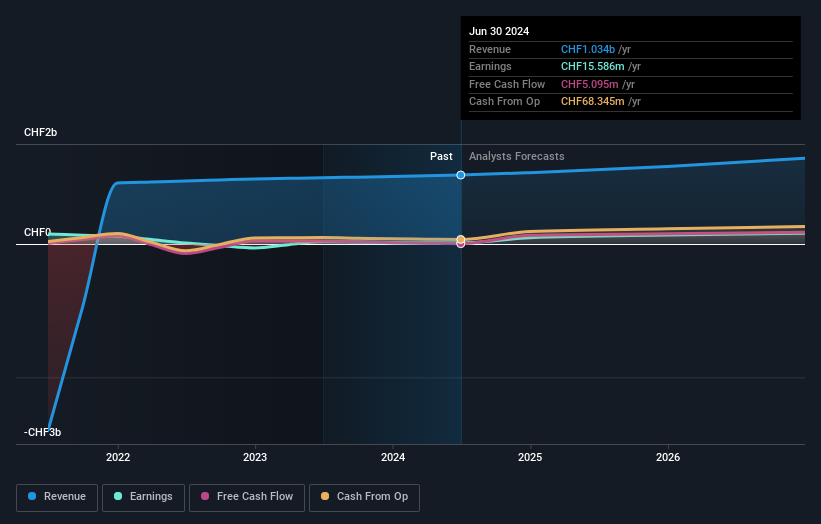

Overview: SoftwareONE Holding AG is a company that offers software and cloud solutions across various regions including Switzerland, Europe, the Middle East, Africa, North America, Latin America, and the Asia Pacific with a market capitalization of approximately CHF998.69 million.

Operations: SoftwareONE Holding AG generates revenue primarily from its regional operations, with the EMEA region contributing CHF611.29 million and North America adding CHF158.45 million. The company focuses on software and cloud solutions across multiple continents, leveraging its global presence to drive sales.

Amidst a challenging backdrop, SoftwareONE Holding AG is strategically positioning itself for growth through potential mergers, notably with Crayon Group Holding ASA. This move could significantly enhance its market presence in Europe, aligning with the company's revised 2026 revenue targets which anticipate robust double-digit growth. Despite recent volatility and a downward revision in 2024 revenue projections to 2-5% growth, SoftwareONE's R&D investments remain pivotal. The firm dedicates substantial resources to innovation—evidenced by R&D expenses that are crucial for developing competitive advantages in the swiftly evolving tech landscape. Moreover, under new leadership with CEO Raphael Erb, who brings extensive regional experience and a proven track record from within the company, SoftwareONE may navigate current market challenges more effectively. These strategic decisions underscore its commitment to long-term value creation amidst immediate financial pressures.

Micro-Star International (TWSE:2377)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Micro-Star International Co., Ltd. is a global manufacturer and seller of motherboards, interface cards, notebook computers, and other electronic products with a market cap of NT$143.20 billion.

Operations: The company generates revenue primarily from its Computer and Peripherals Segment, which accounts for NT$195.51 billion.

Micro-Star International (MSI) is capturing attention with its robust commitment to research and development, which is evident from its recent unveiling of advanced AI servers at Supercomputing 2024. These innovations are critical as MSI's R&D expenses, crucial for maintaining competitive edge in tech innovation, have notably aligned with industry demands—particularly in high-performance computing (HPC) and data centers. Despite facing a slight dip in net income to TWD 1,732.03 million from TWD 2,349.7 million year-over-year for Q3 2024, MSI's strategic focus on AI and server solutions demonstrates a proactive approach to leveraging cutting-edge technology to boost performance. This strategy is underscored by an earnings forecast projecting significant growth of approximately 26.5% annually, showcasing potential amid challenging market conditions and setting the stage for future advancements in tech infrastructure.

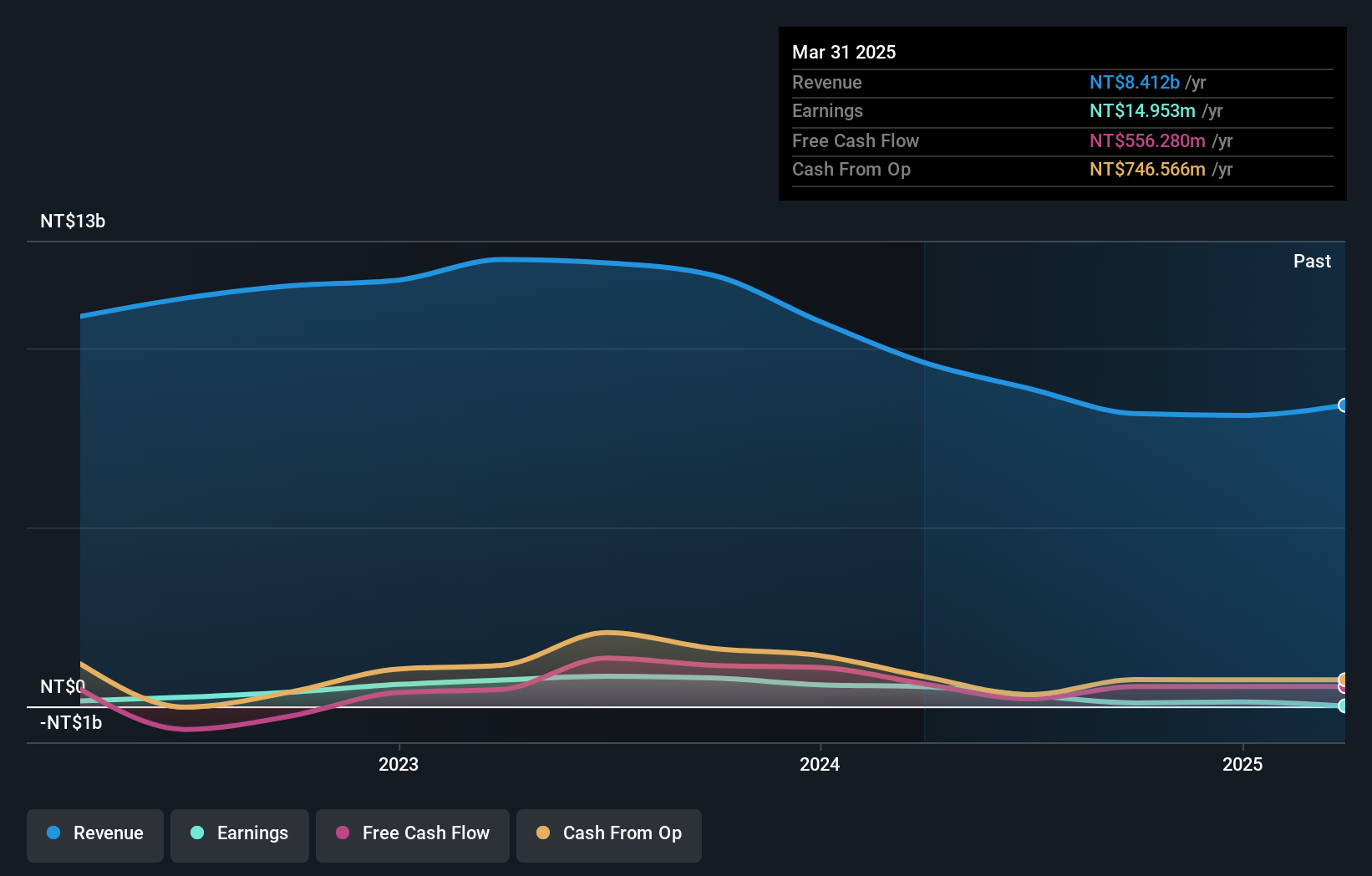

Nidec Chaun-Choung Technology (TWSE:6230)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Nidec Chaun-Choung Technology Corporation specializes in the processing, manufacturing, and trading of heat dissipation components and thermal management products both in Taiwan and globally, with a market capitalization of NT$17.40 billion.

Operations: The company generates revenue primarily through its Taiwan and Mainland business sectors, contributing NT$6.27 billion and NT$6.20 billion, respectively.

Nidec Chaun-Choung Technology has faced significant challenges recently, as evidenced by a sharp decline in quarterly sales from TWD 2.85 billion to TWD 2.14 billion and transitioning from a net income of TWD 186.38 million to a net loss of TWD 31.78 million year-over-year for Q3 2024. Despite these setbacks, the company's commitment to innovation remains robust with R&D expenses aimed at revitalizing its product offerings and competitive stance in the electronics sector. Intriguingly, earnings are forecasted to surge by approximately 111.7% annually, suggesting potential resilience and recovery ahead, bolstered by an anticipated revenue growth rate of 17.9% per year which outpaces the broader Taiwanese market's growth projections.

- Click to explore a detailed breakdown of our findings in Nidec Chaun-Choung Technology's health report.

Gain insights into Nidec Chaun-Choung Technology's past trends and performance with our Past report.

Taking Advantage

- Click this link to deep-dive into the 1287 companies within our High Growth Tech and AI Stocks screener.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:SWON

SoftwareONE Holding

Provides software and cloud solutions in Switzerland, Europe, the Middle East, Africa, the United States, Canada, Latin America, and the Asia Pacific.

Good value with reasonable growth potential.

Market Insights

Community Narratives