- Japan

- /

- Metals and Mining

- /

- TSE:7231

3 Reliable Dividend Stocks Offering Up To 4.7% Yield

Reviewed by Simply Wall St

In a week marked by volatility and competitive pressures in the AI sector, global markets have experienced mixed results with U.S. stocks mostly lower, while European indices hit record highs thanks to strong earnings and interest rate cuts by the ECB. Amid these fluctuations, investors often seek stability through dividend stocks, which can provide a steady income stream even when market conditions are uncertain.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Totech (TSE:9960) | 3.84% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.33% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 4.05% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.47% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.01% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.01% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.41% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.46% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.70% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.05% | ★★★★★★ |

Click here to see the full list of 1984 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

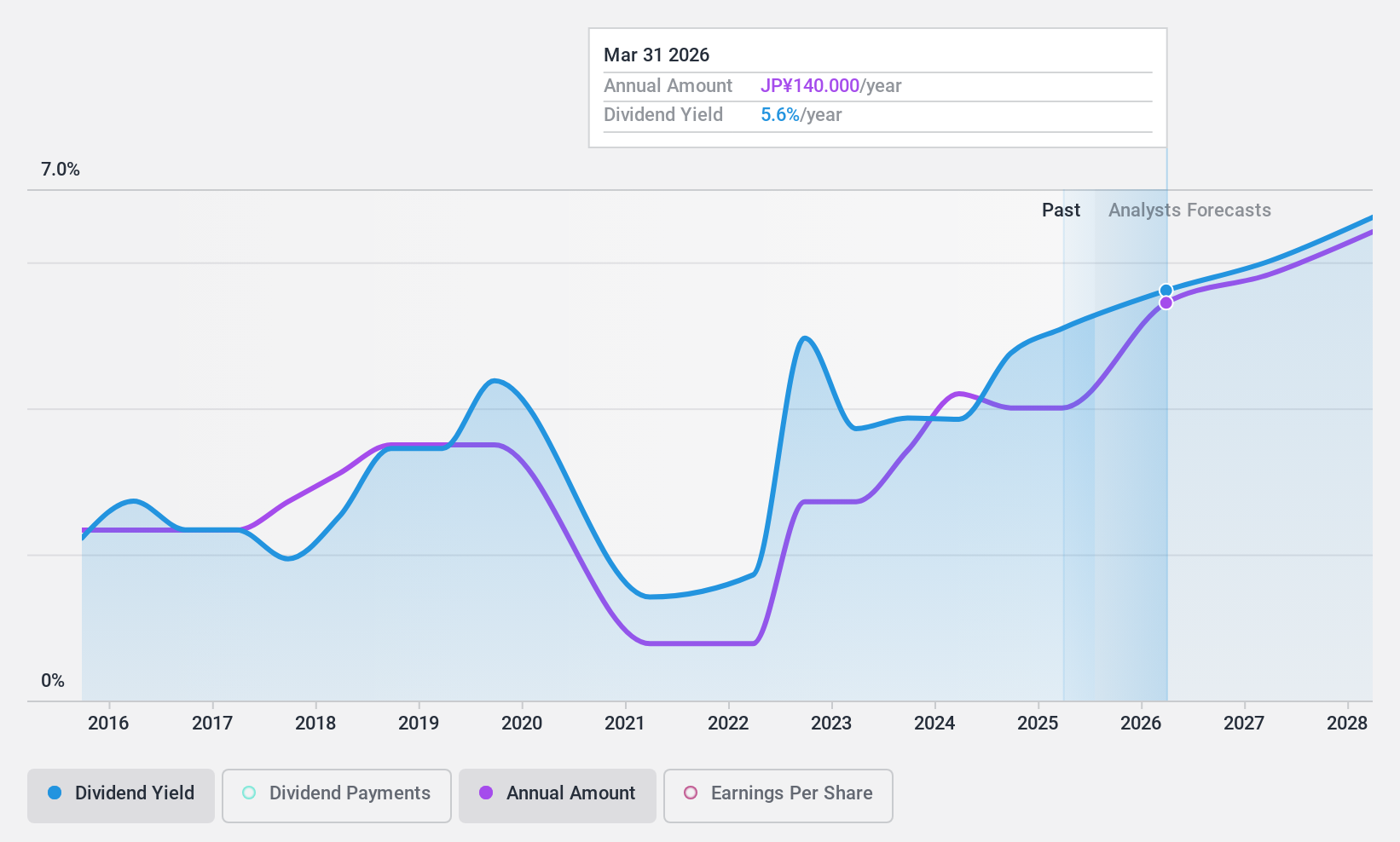

Topy Industries (TSE:7231)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Topy Industries, Limited operates in the steel, automotive, and industrial machinery components sectors in Japan with a market cap of ¥46.53 billion.

Operations: Topy Industries, Limited's revenue is primarily derived from its Steel Business, which contributes ¥127.57 billion, and the Automobile & Industrial Machinery Parts segment, which generates ¥193.90 billion.

Dividend Yield: 4.7%

Topy Industries' dividend yield of 4.71% ranks in the top 25% of Japanese market payers, yet its dividends have been volatile and unreliable over the past decade, with a high payout ratio of 115.1%, indicating unsustainable coverage by earnings. Despite this, dividends are well-covered by cash flows due to a low cash payout ratio. Recent share repurchase plans aim to manage capital efficiently amidst revised lower earnings guidance for fiscal year ending March 2025.

- Get an in-depth perspective on Topy Industries' performance by reading our dividend report here.

- Our expertly prepared valuation report Topy Industries implies its share price may be too high.

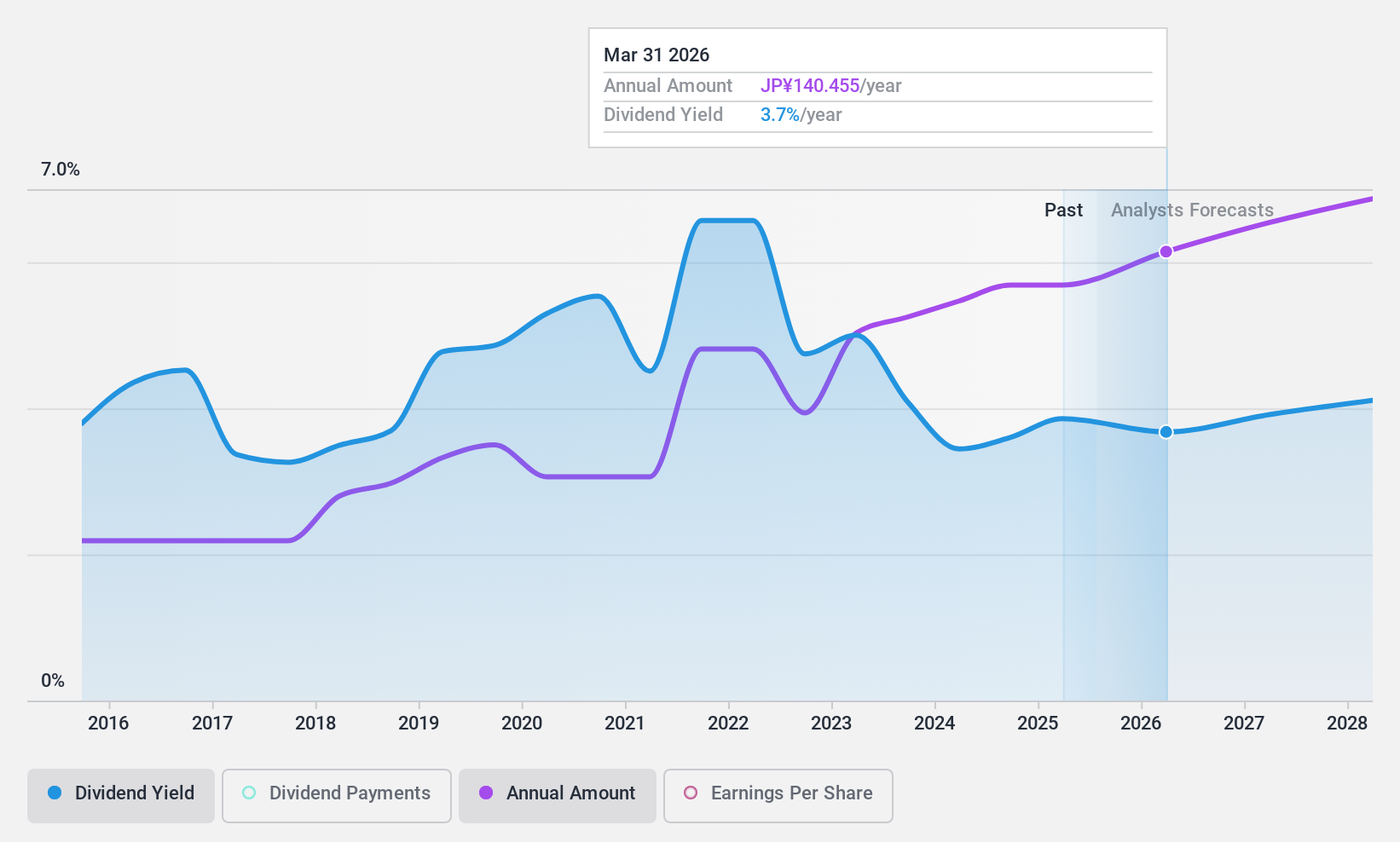

Sumitomo (TSE:8053)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sumitomo Corporation operates as a general trading company with a market capitalization of ¥4 trillion.

Operations: Sumitomo Corporation's revenue is primarily derived from its Steel segment at ¥1.66 billion, Media & Digital at ¥508.61 million, and Transportation & Construction Systems at ¥1.43 billion.

Dividend Yield: 3.7%

Sumitomo's dividend yield of 3.73% is slightly below the top 25% in Japan, but its payout ratios indicate sustainable coverage by both earnings and cash flows. Despite an unstable dividend track record, payments have grown over the past decade. However, financial positioning is challenged by debt not being well-covered by operating cash flow. Recent executive changes and strategic partnerships may influence future growth and stability in dividends as Sumitomo navigates market dynamics.

- Dive into the specifics of Sumitomo here with our thorough dividend report.

- Our comprehensive valuation report raises the possibility that Sumitomo is priced lower than what may be justified by its financials.

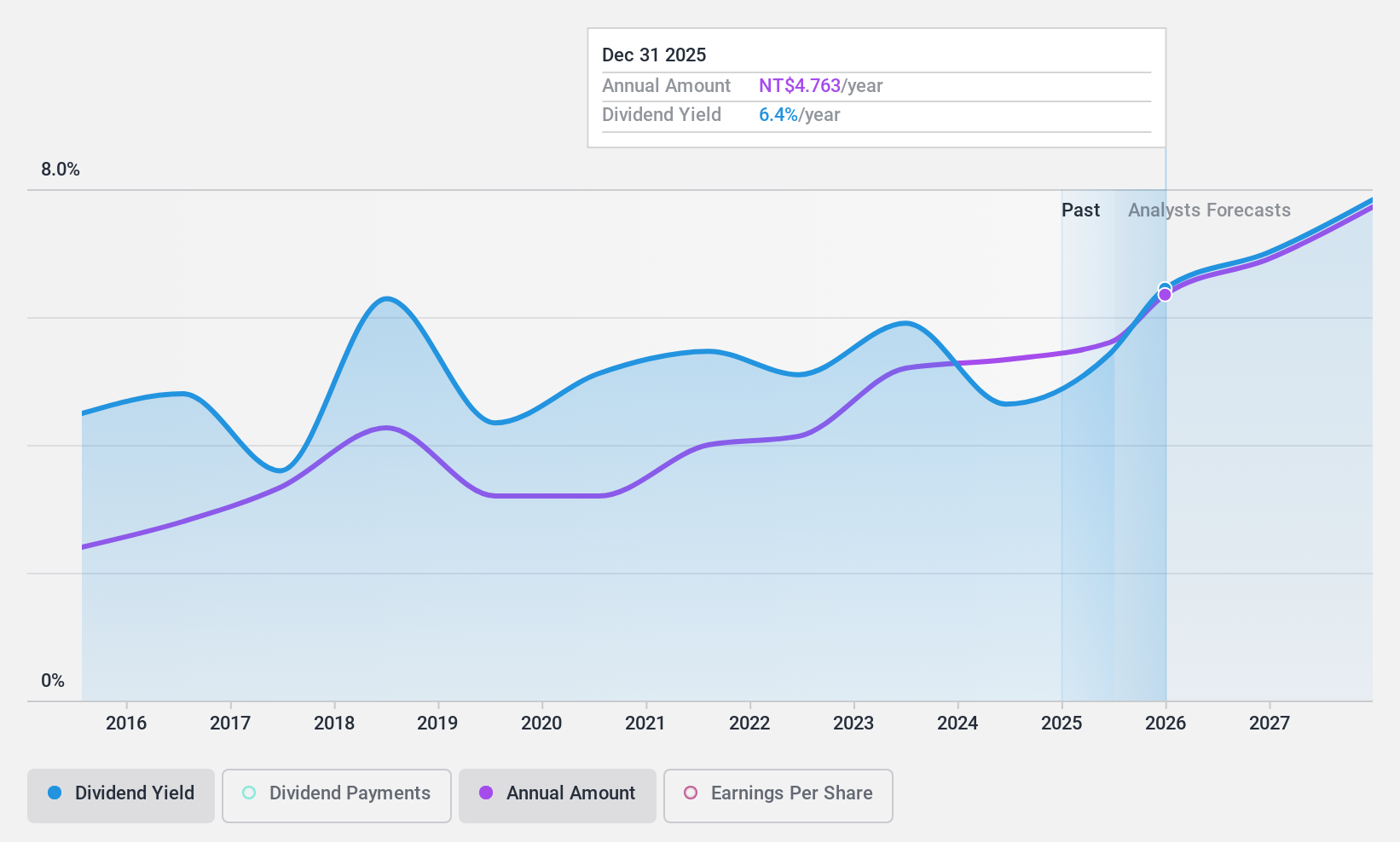

Primax Electronics (TWSE:4915)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Primax Electronics Ltd. and its subsidiaries manufacture and sell computer and non-computer peripherals globally, with a market cap of NT$39.40 billion.

Operations: Primax Electronics Ltd. generates revenue from two main segments: the Computer Peripheral Equipment Business Group, which accounts for NT$24.11 billion, and the Non-Computer Peripheral Equipment Business Group, contributing NT$34.93 billion.

Dividend Yield: 4.7%

Primax Electronics offers a dividend yield in the top 25% of the Taiwan market, supported by a payout ratio of 70.6%, indicating sustainable coverage by earnings and cash flows. Despite trading at good value with a price-to-earnings ratio below the market average, its dividend history is marked by volatility and unreliability over the past decade. Recent earnings growth and positive quarterly results suggest potential for future stability in dividends if sustained.

- Click here to discover the nuances of Primax Electronics with our detailed analytical dividend report.

- In light of our recent valuation report, it seems possible that Primax Electronics is trading behind its estimated value.

Key Takeaways

- Navigate through the entire inventory of 1984 Top Dividend Stocks here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Topy Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7231

Topy Industries

Engages in the steel, automotive, industrial machinery components, and other businesses in Japan.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives