- Taiwan

- /

- Communications

- /

- TWSE:3596

Asian Dividend Stocks To Boost Your Portfolio

Reviewed by Simply Wall St

As global markets face a mix of economic challenges, including inflationary pressures and trade tensions, investors are increasingly looking towards Asia for opportunities to diversify and strengthen their portfolios. In this environment, dividend stocks can offer a compelling option for stability and income generation, providing potential resilience against market volatility while contributing to long-term growth.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.44% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 4.01% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 5.12% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.12% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.00% | ★★★★★★ |

| Nissan Chemical (TSE:4021) | 3.81% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.27% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.27% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.49% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.22% | ★★★★★★ |

Click here to see the full list of 1126 stocks from our Top Asian Dividend Stocks screener.

We'll examine a selection from our screener results.

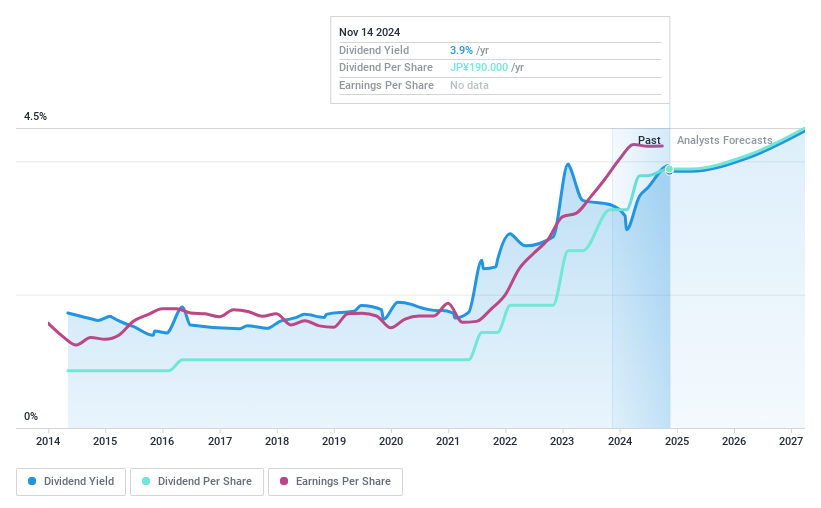

Mitsubishi Shokuhin (TSE:7451)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Mitsubishi Shokuhin Co., Ltd. is involved in the wholesale distribution of processed foods, frozen and chilled foods, alcoholic beverages, and confectioneries both in Japan and internationally, with a market cap of ¥216.87 billion.

Operations: Mitsubishi Shokuhin Co., Ltd.'s revenue segments include processed foods, frozen and chilled foods, alcoholic beverages, and confectioneries.

Dividend Yield: 3.8%

Mitsubishi Shokuhin's dividend stability is notable, with consistent growth over the past decade. However, its 3.8% yield is slightly below top-tier payers in Japan and isn't supported by free cash flow, raising sustainability concerns despite a low payout ratio of 33.5%. The stock trades at a favorable P/E ratio of 9.9x compared to the JP market average of 13.1x, suggesting good relative value but highlighting potential risks in dividend coverage from earnings alone.

- Delve into the full analysis dividend report here for a deeper understanding of Mitsubishi Shokuhin.

- Our valuation report here indicates Mitsubishi Shokuhin may be undervalued.

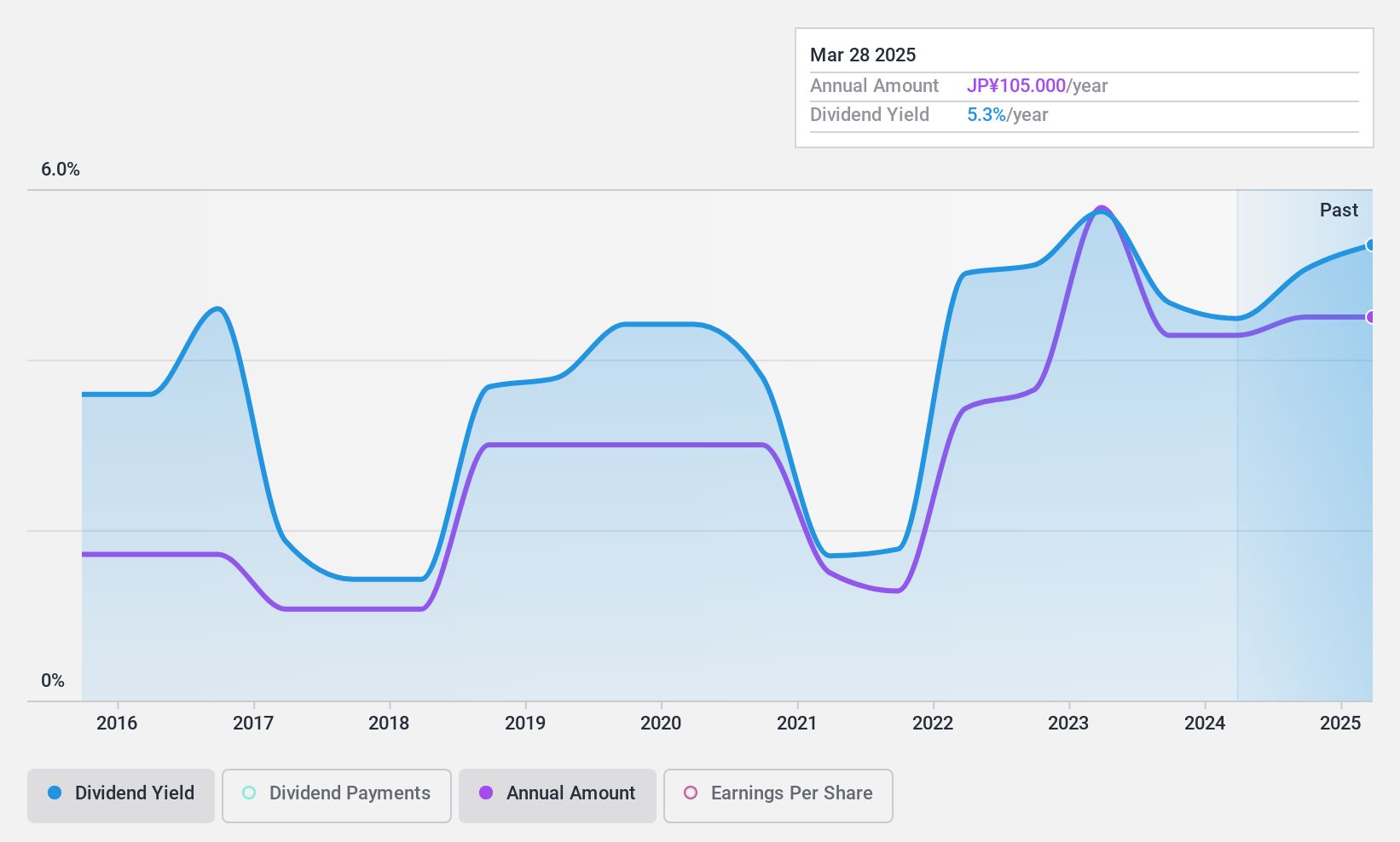

Sanshin Electronics (TSE:8150)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Sanshin Electronics Co., Ltd. is engaged in the sale and trade of electronic components and devices both in Japan and internationally, with a market cap of ¥25.98 billion.

Operations: Sanshin Electronics Co., Ltd.'s revenue is primarily derived from its Device Segment, which accounts for ¥130.97 billion, and its Solution Segment, contributing ¥15.90 billion.

Dividend Yield: 4.9%

Sanshin Electronics offers a compelling dividend profile with a 4.94% yield, ranking in the top 25% of Japanese payers. Its dividends are well-covered by earnings and cash flows, given payout ratios of 36.4% and 20.8%, respectively. Despite past volatility in dividend payments, recent earnings growth of 29.3% supports future payouts. The company is trading at an attractive value, though the recent follow-on equity offering may introduce dilution concerns for shareholders.

- Click to explore a detailed breakdown of our findings in Sanshin Electronics' dividend report.

- Our valuation report unveils the possibility Sanshin Electronics' shares may be trading at a discount.

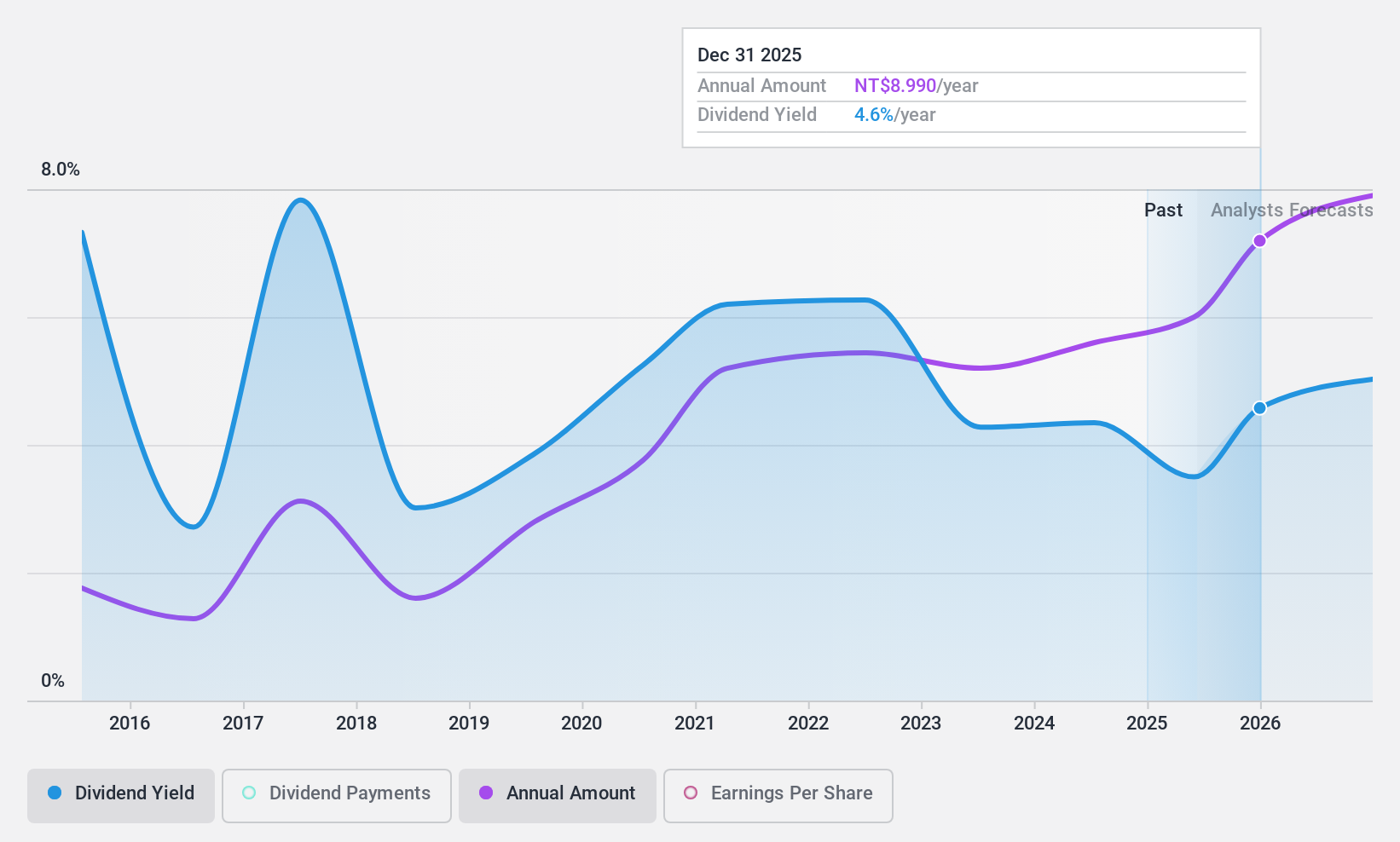

Arcadyan Technology (TWSE:3596)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Arcadyan Technology Corporation, along with its subsidiaries, focuses on the research, development, manufacture, and sale of broadband access, multimedia, and wireless infrastructure solutions with a market cap of NT$46.05 billion.

Operations: Arcadyan Technology Corporation generates revenue primarily from its Communication Network segment, which accounts for NT$48.97 billion.

Dividend Yield: 3.3%

Arcadyan Technology's dividends, covered by a 61% earnings payout ratio and a 20% cash payout ratio, are well-supported financially despite historical volatility. The dividend yield of 3.35% is below Taiwan's top payers, and the stock trades at a favorable P/E ratio of 18.5x compared to the market average of 21.5x. Recent earnings growth and amendments to its Articles of Incorporation could influence future dividend stability and shareholder value.

- Click here and access our complete dividend analysis report to understand the dynamics of Arcadyan Technology.

- Insights from our recent valuation report point to the potential overvaluation of Arcadyan Technology shares in the market.

Where To Now?

- Gain an insight into the universe of 1126 Top Asian Dividend Stocks by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:3596

Arcadyan Technology

Primarily engages in the research, development, manufacture, and sale of broadband access, multimedia, and wireless infrastructure solutions.

Flawless balance sheet with proven track record and pays a dividend.