- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:2480

Undiscovered Gems And 2 Other Small Caps With Strong Potential

Reviewed by Simply Wall St

As global markets navigate a mixed landscape with major indices showing varied performances, the focus on small-cap stocks remains intriguing, especially given their potential for growth amid fluctuating economic indicators. Despite some profit-taking and economic contraction signs in regions like Chicago, the resilience of small-cap indices such as the Russell 2000 suggests opportunities for discerning investors. In this context, identifying promising small-cap stocks involves looking for companies with strong fundamentals and innovative strategies that can thrive even when broader market sentiment is uncertain.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Pakistan National Shipping | 2.77% | 30.93% | 51.80% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Baazeem Trading | 9.82% | -2.04% | -2.06% | ★★★★★★ |

| Standard Bank | 0.13% | 27.78% | 30.36% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Keir International | 23.18% | 49.21% | -17.98% | ★★★★★☆ |

| Saudi Azm for Communication and Information Technology | 12.21% | 17.40% | 21.14% | ★★★★★☆ |

| Orient Pharma | 24.74% | 23.50% | 51.62% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Waja | 23.81% | 98.44% | 14.54% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Zoje Resources Investment (SZSE:002021)

Simply Wall St Value Rating: ★★★★★☆

Overview: Zoje Resources Investment Co., Ltd. focuses on the research, development, production, and sale of industrial sewing machines in China with a market cap of CN¥3.03 billion.

Operations: Zoje Resources Investment generates revenue primarily from its professional equipment manufacturing segment, amounting to CN¥840.74 million.

Zoje Resources Investment, a smaller player in the market, has recently turned profitable, which is noteworthy given the Machinery industry saw a 0.06% earnings growth last year. This profitability aligns with its attractive price-to-earnings ratio of 5x, significantly lower than the CN market's 32.7x. Over five years, Zoje has impressively reduced its debt-to-equity ratio from 23% to just under 2%, indicating sound financial management. While it doesn't generate free cash flow currently, its high-quality earnings and interest coverage suggest stability in operations and potential for future growth within its sector.

Stark Technology (TWSE:2480)

Simply Wall St Value Rating: ★★★★★☆

Overview: Stark Technology Inc. offers system integration services for information and communication technology products in Taiwan, with a market cap of NT$14.68 billion.

Operations: Stark Technology generates revenue primarily from its computer services segment, amounting to NT$7.27 billion.

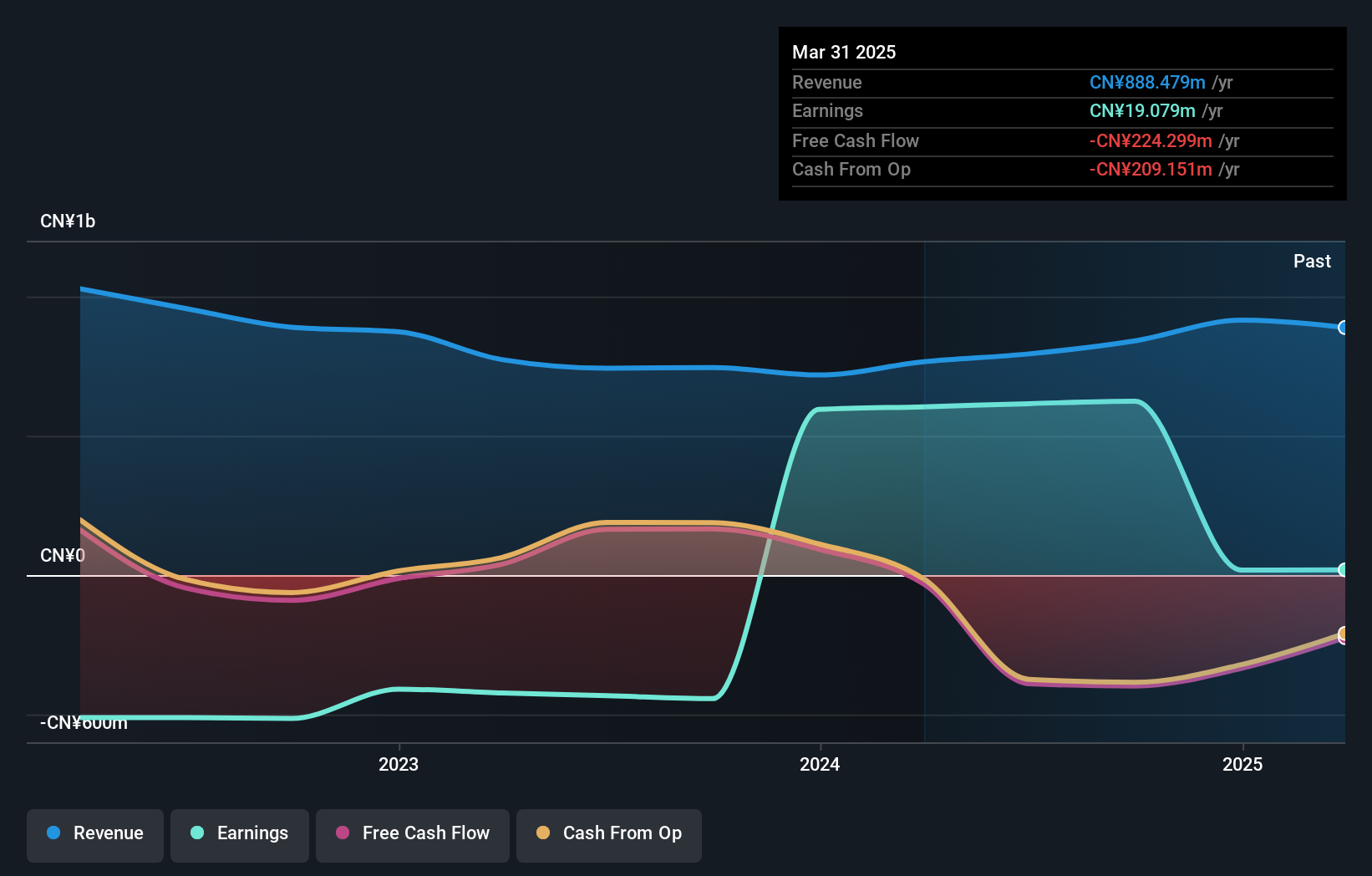

Stark Technology, a small cap player in the electronics sector, presents an intriguing mix of financials and prospects. Despite a slight negative earnings growth of -0.1% over the past year, it trades at 48.4% below its estimated fair value, suggesting potential undervaluation. The company's debt to equity ratio has increased from 1.3 to 2 over five years, yet it holds more cash than total debt, indicating a solid financial footing. With high-quality earnings and positive free cash flow reported recently, Stark seems well-positioned within its industry context despite recent challenges in growth comparisons.

- Click to explore a detailed breakdown of our findings in Stark Technology's health report.

Assess Stark Technology's past performance with our detailed historical performance reports.

Scientech (TWSE:3583)

Simply Wall St Value Rating: ★★★★★☆

Overview: Scientech Corporation focuses on the research, development, production, sale, and maintenance of process equipment for the semiconductor, LCD, LED, and solar power generation industries with a market cap of NT$31.53 billion.

Operations: Scientech generates revenue primarily from its brokerage and manufacturing segments, with NT$6.01 billion and NT$3.10 billion respectively. The company's financial performance is influenced by these core segments, which contribute significantly to its overall revenue stream.

Scientech, a small cap player in the electronics sector, has been making waves with its impressive earnings growth of 40.7% over the past year, outpacing the industry average of 6.6%. This company is not just about numbers; it boasts high-quality earnings and maintains a positive free cash flow position. Despite an increase in its debt-to-equity ratio from 0.4% to 37.1% over five years, Scientech's financial health seems robust as it holds more cash than total debt, ensuring interest payments are well-covered. Looking ahead, earnings are projected to grow at an annual rate of 50.43%, suggesting strong potential for future expansion and value creation within its niche market segment.

- Unlock comprehensive insights into our analysis of Scientech stock in this health report.

Review our historical performance report to gain insights into Scientech's's past performance.

Next Steps

- Click this link to deep-dive into the 4673 companies within our Undiscovered Gems With Strong Fundamentals screener.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2480

Stark Technology

Provides system integration services for information and communication technology products in Taiwan.

6 star dividend payer with excellent balance sheet.