- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:2428

Top Dividend Stocks To Consider In January 2025

Reviewed by Simply Wall St

As we step into January 2025, global markets are showcasing a mixed bag of performances with U.S. stocks closing out another strong year despite some recent volatility and economic indicators like the Chicago PMI highlighting challenges in the manufacturing sector. In this environment, dividend stocks can offer investors a measure of stability and income potential, making them an attractive option for those looking to navigate uncertain market conditions while benefiting from consistent returns.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.58% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.11% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.25% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.77% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.63% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.41% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.42% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.91% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.14% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.01% | ★★★★★★ |

Click here to see the full list of 1978 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

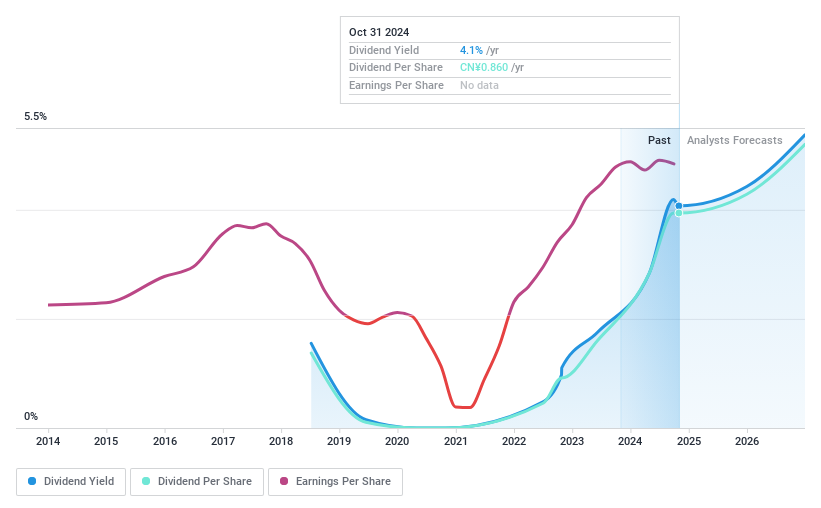

Zhongman Petroleum and Natural Gas GroupLtd (SHSE:603619)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Zhongman Petroleum and Natural Gas Group Corp., Ltd. is an oil and gas company involved in drilling and completion engineering services as well as petroleum equipment manufacturing, with a market cap of CN¥8.97 billion.

Operations: Zhongman Petroleum and Natural Gas Group Corp., Ltd. generates revenue through its operations in drilling and completion engineering services and the manufacturing of petroleum equipment.

Dividend Yield: 4.3%

Zhongman Petroleum and Natural Gas Group Ltd. offers a mixed dividend profile. While the company trades at 72.1% below its estimated fair value, suggesting good relative value, its dividend track record is unstable with payments being volatile over six years. Dividends are covered by earnings (payout ratio: 47.3%) and cash flows (cash payout ratio: 78.3%), but shareholder dilution occurred last year despite a top-tier yield of 4.29% in the CN market.

- Delve into the full analysis dividend report here for a deeper understanding of Zhongman Petroleum and Natural Gas GroupLtd.

- Our valuation report here indicates Zhongman Petroleum and Natural Gas GroupLtd may be undervalued.

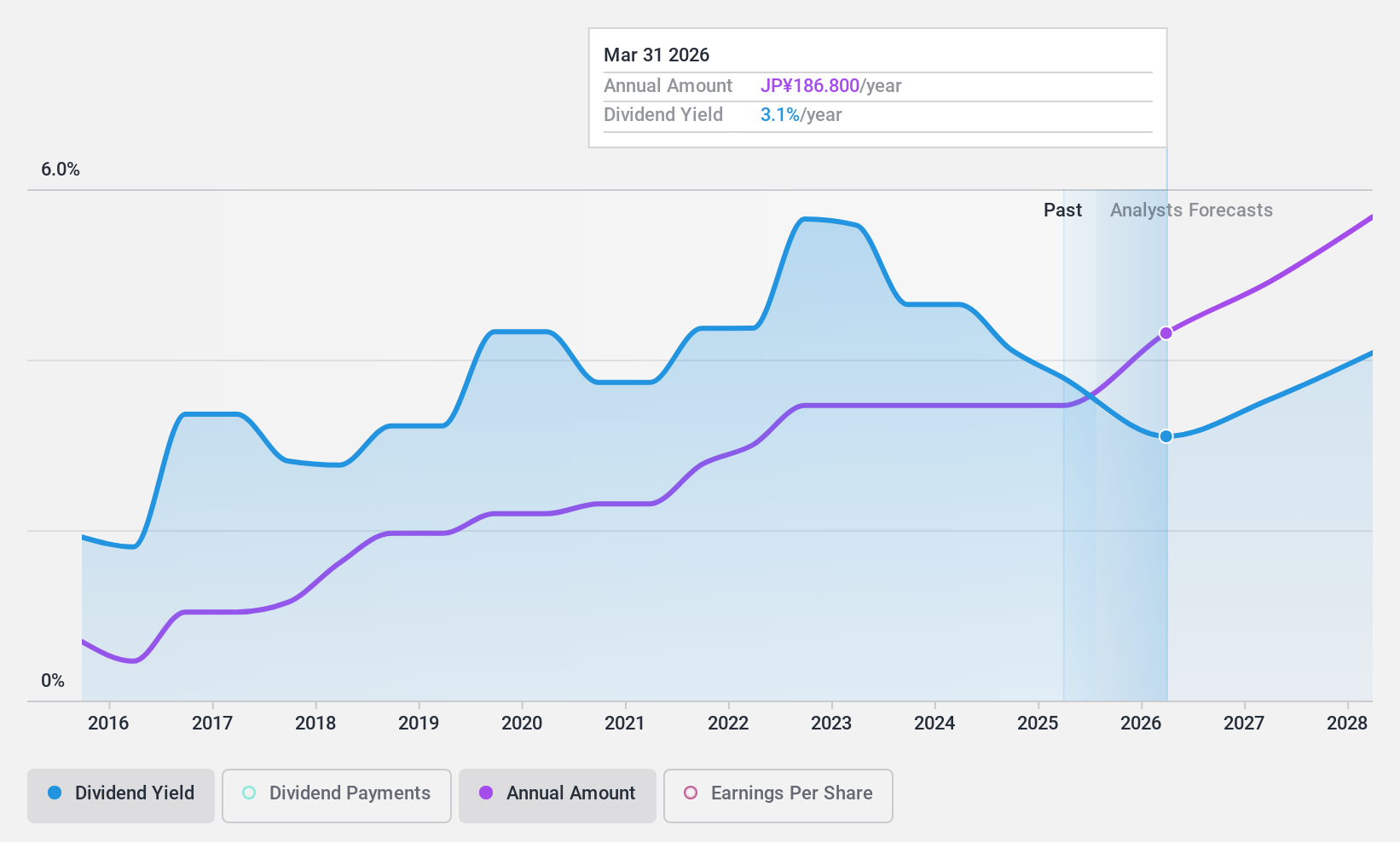

SBI Holdings (TSE:8473)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: SBI Holdings, Inc. operates in the online securities and investment sectors in Japan and Saudi Arabia, with a market cap of ¥1.21 trillion.

Operations: SBI Holdings, Inc. generates its revenue through online securities and investment activities across Japan and Saudi Arabia.

Dividend Yield: 3.6%

SBI Holdings presents a complex dividend profile. The company's dividends are covered by earnings (payout ratio: 55.1%) and cash flows (cash payout ratio: 2.4%), indicating sustainability, yet its dividend history is unreliable due to past volatility. Recent strategic moves, including a JPY 30 per share dividend announcement and expanding biotechnology ventures in Saudi Arabia, highlight growth potential but don't guarantee consistent dividends despite trading at good value compared to peers and industry.

- Take a closer look at SBI Holdings' potential here in our dividend report.

- The analysis detailed in our SBI Holdings valuation report hints at an deflated share price compared to its estimated value.

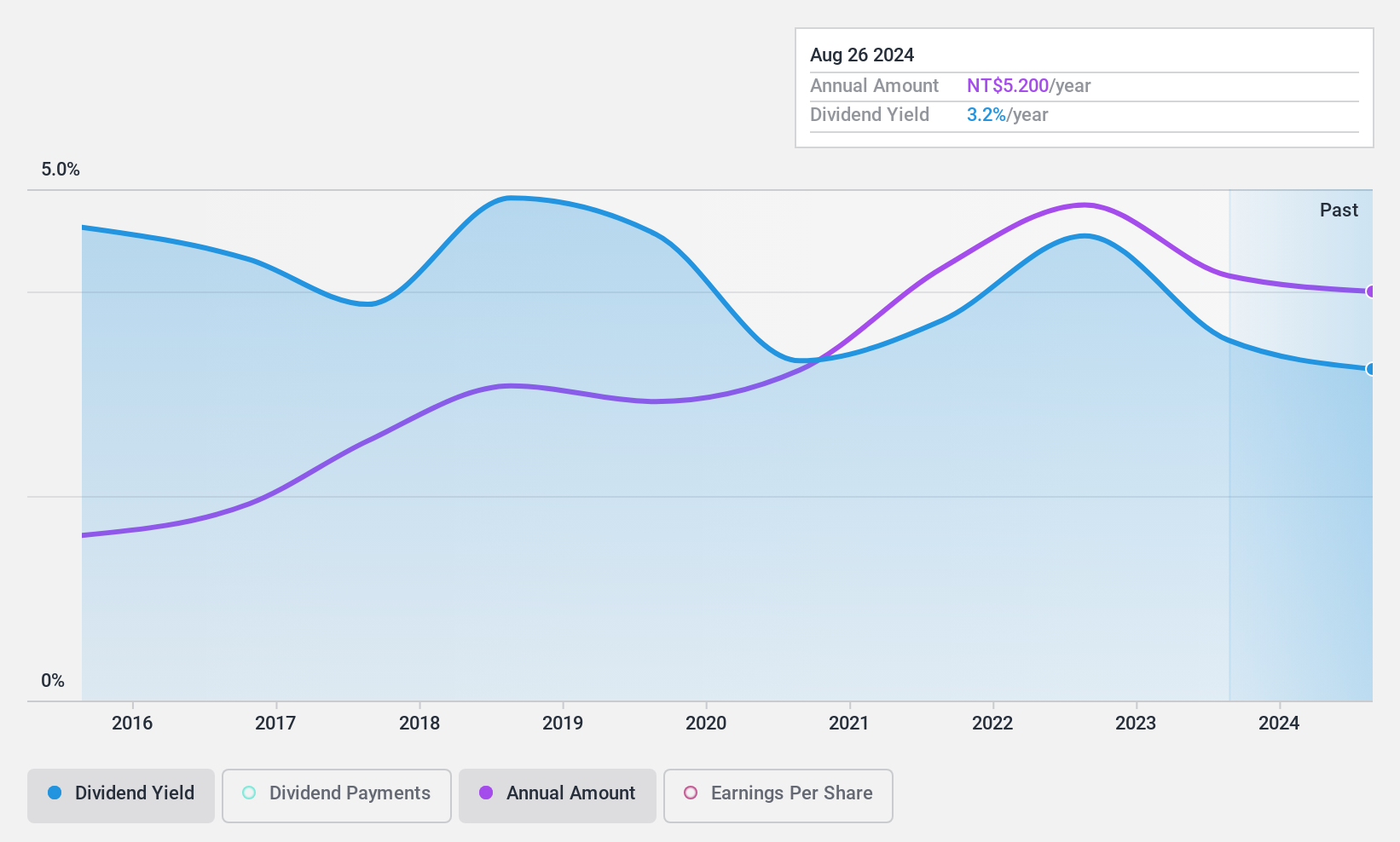

Thinking Electronic Industrial (TWSE:2428)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Thinking Electronic Industrial Co., Ltd. is engaged in the manufacturing, processing, and sale of electric devices, thermistors, varistors, and wires across Taiwan, China, and international markets with a market cap of NT$19.60 billion.

Operations: Thinking Electronic Industrial Co., Ltd.'s revenue segments include NT$3.35 billion from Xing Qin, NT$2.98 billion from Thinking (Changzhou) Electronic Co., Ltd., and NT$3.90 billion from Dongguan Welkin Electronic Co (including Weiqin Xingjing).

Dividend Yield: 3.3%

Thinking Electronic Industrial's dividend payments are well-covered by earnings (payout ratio: 44%) and cash flows (cash payout ratio: 47.9%), demonstrating sustainability. The company has maintained stable and growing dividends over the past decade, although its yield of 3.32% is below the top tier in Taiwan's market. Recent revenue growth, with November year-to-date revenues up to TWD 6.75 billion, supports a positive outlook for continued dividend reliability amidst ongoing business expansion efforts.

- Dive into the specifics of Thinking Electronic Industrial here with our thorough dividend report.

- According our valuation report, there's an indication that Thinking Electronic Industrial's share price might be on the expensive side.

Seize The Opportunity

- Click through to start exploring the rest of the 1975 Top Dividend Stocks now.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Thinking Electronic Industrial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2428

Thinking Electronic Industrial

Manufactures, processes, and sells electric devices, thermistors, varistors, and wires in Taiwan, China, and internationally.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives