- Taiwan

- /

- Tech Hardware

- /

- TWSE:3005

Top 3 Dividend Stocks To Consider Now

Reviewed by Simply Wall St

As global markets navigate mixed performances and economic uncertainties, dividend stocks continue to attract investors seeking stable income amidst volatility. In the current climate, characterized by fluctuating indices and economic data surprises, a good dividend stock is often one that offers consistent payouts and demonstrates resilience in diverse market conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.11% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.25% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.77% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.63% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.41% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.42% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.91% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.81% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.14% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.01% | ★★★★★★ |

Click here to see the full list of 1973 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

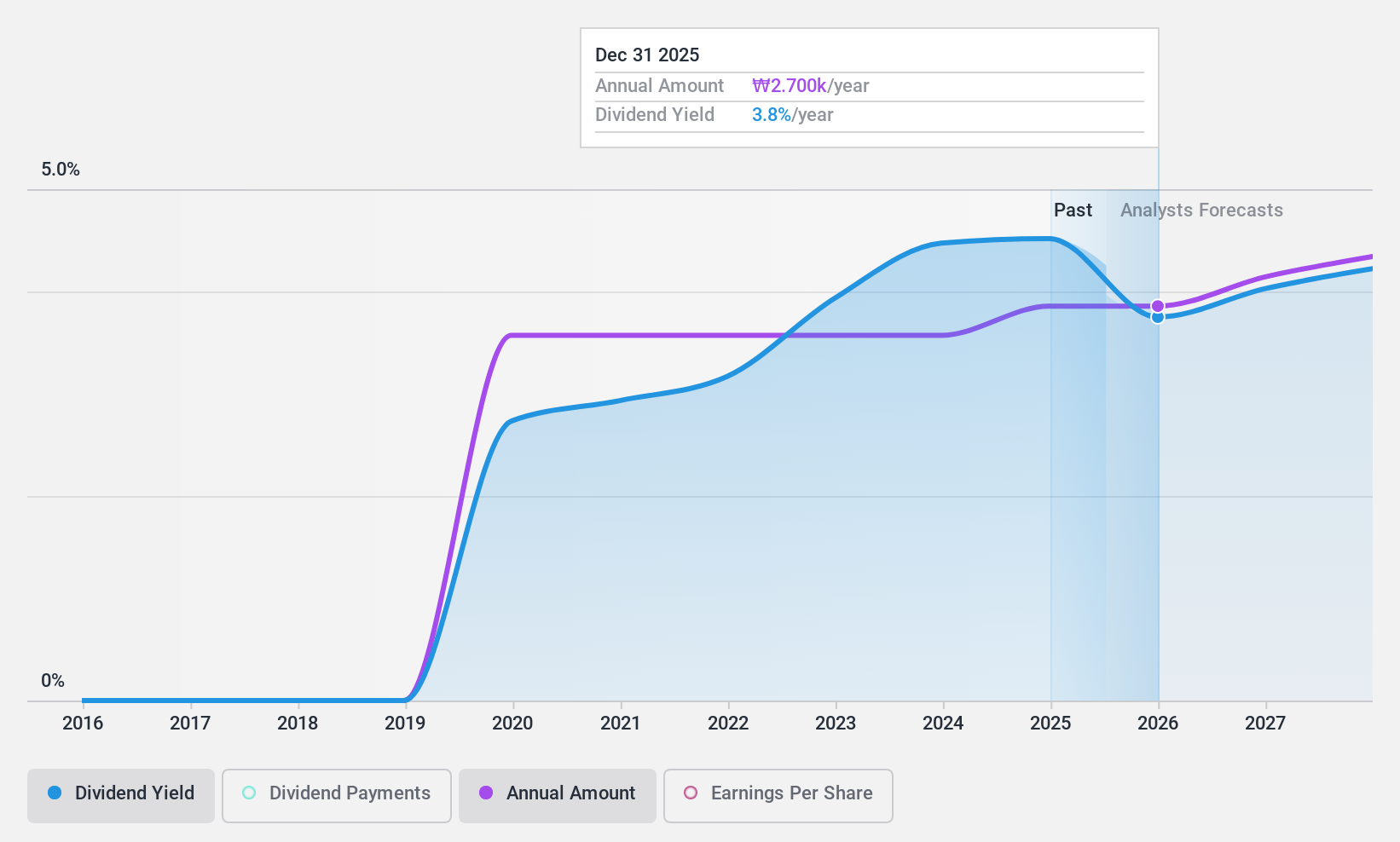

S-1 (KOSE:A012750)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: S-1 Corporation offers safety and security services both in South Korea and internationally, with a market cap of ₩1.99 trillion.

Operations: S-1 Corporation's revenue primarily comes from its Security Service Sector, generating ₩1.36 trillion, and its Infrastructure Service Sector, contributing ₩1.56 trillion.

Dividend Yield: 4.5%

S-1 Corporation's dividend payments are well-covered by earnings and cash flows, with payout ratios of 46.5% and 31.8%, respectively. The company has shown stable dividends over five years, though its history is relatively short. Recent earnings growth of 22.9% supports sustainability, while the dividend yield is competitive in the Korean market. Trading at a significant discount to estimated fair value suggests potential for capital appreciation alongside income generation from dividends.

- Unlock comprehensive insights into our analysis of S-1 stock in this dividend report.

- Upon reviewing our latest valuation report, S-1's share price might be too pessimistic.

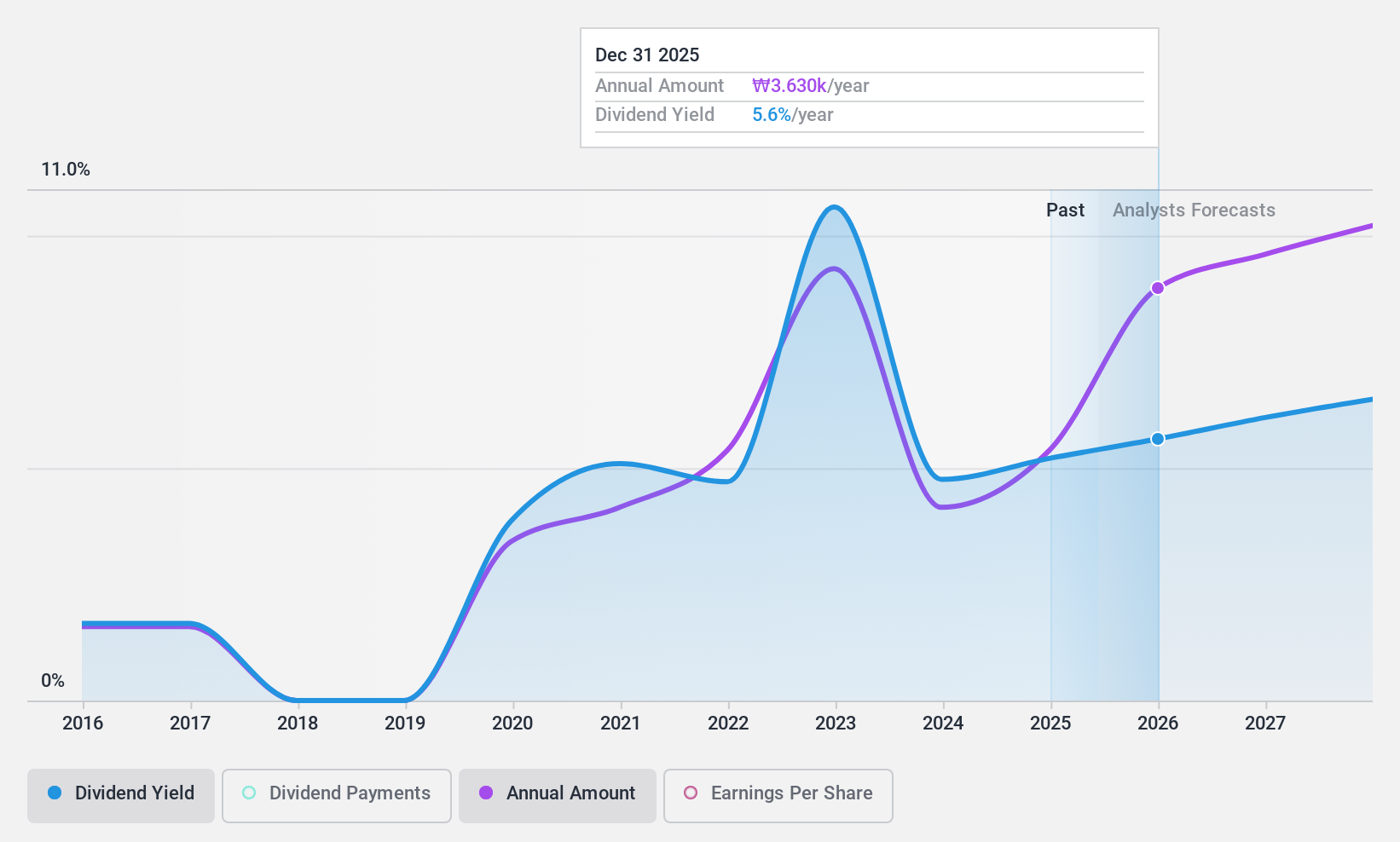

Samsung SecuritiesLtd (KOSE:A016360)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Samsung Securities Co., Ltd. is a financial investment company operating in South Korea and internationally, with a market cap of ₩3.83 trillion.

Operations: Samsung Securities Co., Ltd. generates revenue through various segments, including Selling and buying on consignment (₩1.42 trillion), S&T (₩217.87 billion), Futures brokerage business (₩160.16 billion), Floor trading (₩49.58 billion), Corporate Finance (₩45.54 billion), and International Sales (₩19.04 billion).

Dividend Yield: 5%

Samsung Securities Ltd.'s dividend yield of 4.98% ranks in the top 25% of Korean market payers, yet its payments have been volatile over the past decade. Despite a low payout ratio of 26.4%, dividends aren't covered by free cash flows, raising sustainability concerns. Recent earnings growth and improved net income suggest potential for future stability, but reliance on non-cash earnings may impact long-term reliability. The stock trades at a significant discount to estimated fair value.

- Delve into the full analysis dividend report here for a deeper understanding of Samsung SecuritiesLtd.

- The valuation report we've compiled suggests that Samsung SecuritiesLtd's current price could be quite moderate.

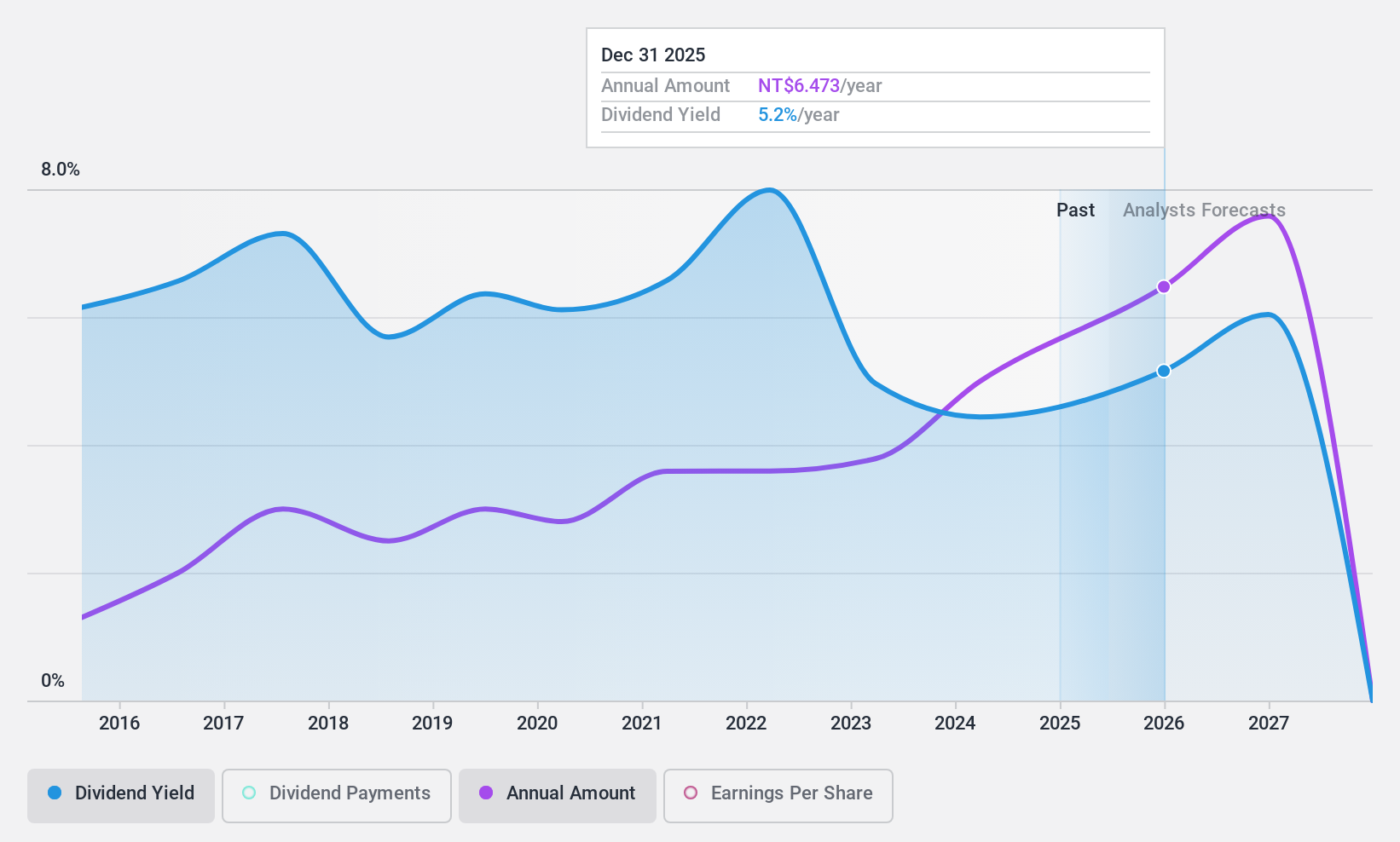

Getac Holdings (TWSE:3005)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Getac Holdings Corporation, along with its subsidiaries, engages in the research, development, manufacture, and sale of notebook computers and related products across China, the United States, Europe, and other international markets; it has a market cap of approximately NT$65.83 billion.

Operations: Getac Holdings Corporation generates revenue through its segments, including Machine Parts (NT$13.61 billion), Electronic Parts (NT$18.43 billion), and Aerospace Fasteners (NT$3.43 billion).

Dividend Yield: 4.6%

Getac Holdings' dividend yield of 4.6% is among the top 25% in Taiwan, though its payments have been volatile over the past decade. Despite this, dividends are covered by both earnings and cash flows with payout ratios around 71%. Recent revenue growth and a proposed TWD 430 million dividend for Q3 2024 affirm commitment to shareholders. The stock trades below estimated fair value, suggesting potential upside relative to peers and industry standards.

- Click here to discover the nuances of Getac Holdings with our detailed analytical dividend report.

- In light of our recent valuation report, it seems possible that Getac Holdings is trading behind its estimated value.

Turning Ideas Into Actions

- Get an in-depth perspective on all 1973 Top Dividend Stocks by using our screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:3005

Getac Holdings

Researches, develops, manufactures, and sells notebook computers and related products in China, the United States, Europe, and internationally.

Flawless balance sheet established dividend payer.