- China

- /

- Renewable Energy

- /

- SHSE:601619

Asian Dividend Stocks: Jiaze Renewables And Two Other Top Picks

Reviewed by Simply Wall St

As global markets react to central bank policies and economic data, investors are increasingly looking towards Asia for opportunities, particularly in dividend stocks that can offer a steady income stream amid fluctuating interest rates and economic uncertainties. In this context, Jiaze Renewables and two other notable companies stand out as potential candidates for those seeking reliable dividend yields in the region's dynamic market environment.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 3.75% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 5.68% | ★★★★★★ |

| NCD (TSE:4783) | 4.17% | ★★★★★★ |

| Kyoritsu Electric (TSE:6874) | 3.77% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.00% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.28% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.50% | ★★★★★★ |

| Changjiang Publishing & MediaLtd (SHSE:600757) | 4.48% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.88% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.41% | ★★★★★★ |

Click here to see the full list of 1027 stocks from our Top Asian Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

Jiaze Renewables (SHSE:601619)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Jiaze Renewables Corporation Limited, with a market cap of CN¥13.49 billion, is involved in the development, construction, sale, operation, and maintenance of new energy power stations in China.

Operations: Jiaze Renewables Corporation Limited generates revenue through its activities in developing, constructing, selling, operating, and maintaining new energy power stations within China.

Dividend Yield: 3.5%

Jiaze Renewables offers a dividend yield in the top 25% of the Chinese market, supported by a low cash payout ratio of 29.9%, indicating strong coverage by cash flows. However, its dividend history is less stable, with volatility over its seven-year payment period. Recent financials show improved earnings, with net income reaching CNY 594.75 million for the first nine months of 2025. Despite shareholder dilution from recent share issuance, dividends remain covered by earnings at a payout ratio of 59%.

- Navigate through the intricacies of Jiaze Renewables with our comprehensive dividend report here.

- Our comprehensive valuation report raises the possibility that Jiaze Renewables is priced lower than what may be justified by its financials.

Nippon SeisenLtd (TSE:5659)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nippon Seisen Co., Ltd. is engaged in the manufacturing and sale of stainless steel wires both in Japan and internationally, with a market cap of ¥36.82 billion.

Operations: Nippon Seisen Co., Ltd.'s revenue segments are ¥41.14 billion from Japan, ¥5.50 billion from Thailand, and ¥1.53 billion from China and South Korea.

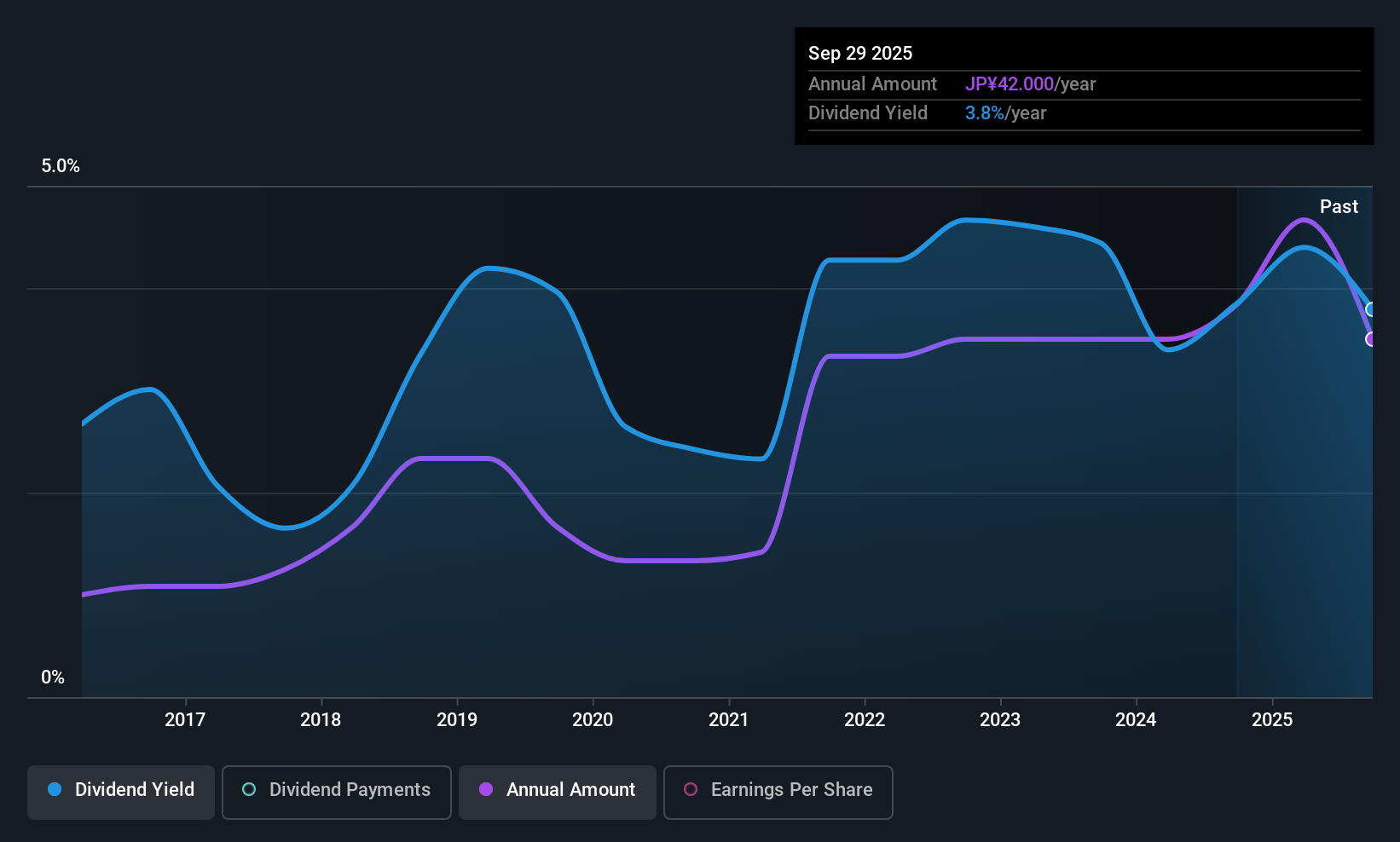

Dividend Yield: 3.5%

Nippon Seisen Ltd. has a reasonable payout ratio of 53.1%, indicating dividends are covered by earnings, and a cash payout ratio of 58.4% suggests coverage by cash flows as well. However, its dividend track record is unstable and unreliable, with significant volatility over the past decade. Recent news highlights a reduction in dividends to ¥16 per share from ¥28 the previous year, reflecting ongoing challenges in maintaining consistent payouts for investors seeking stable income streams in Asia.

- Click here to discover the nuances of Nippon SeisenLtd with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that Nippon SeisenLtd is priced higher than what may be justified by its financials.

Emerging Display Technologies (TWSE:3038)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Emerging Display Technologies Corp. specializes in producing and selling capacitive touch panels and liquid crystal displays (LCD) across Taiwan, Europe, the United States, and internationally, with a market cap of NT$3.32 billion.

Operations: Emerging Display Technologies Corp. generates revenue from its Taiwan Division (NT$3.04 billion), Americas Division (NT$1.63 billion), and Mainland China Division (NT$276.54 million).

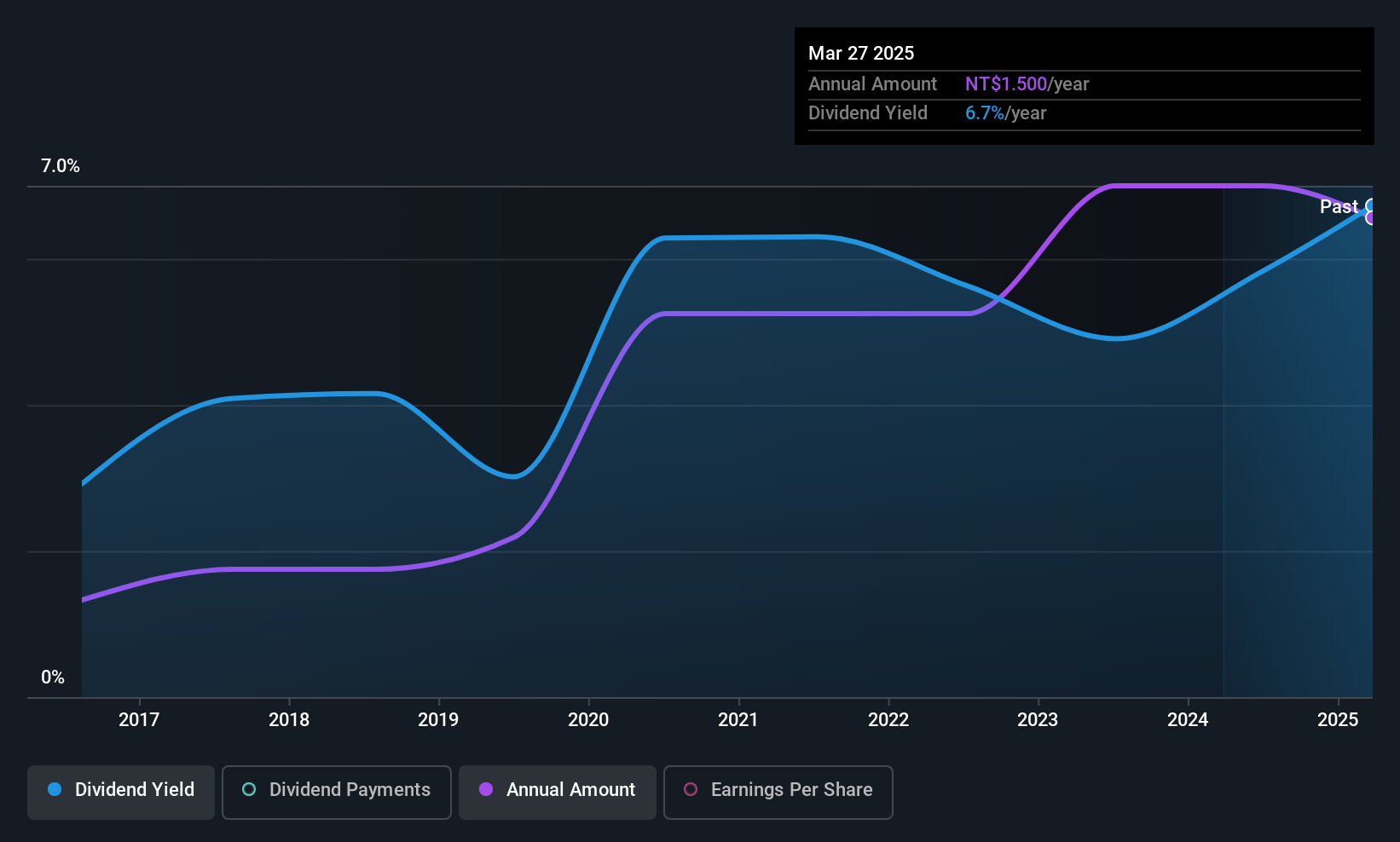

Dividend Yield: 6.7%

Emerging Display Technologies offers a dividend yield of 6.71%, placing it in the top 25% of Taiwan's market, though its high payout ratio of 127.7% indicates dividends aren't well covered by earnings. However, with a cash payout ratio of 72%, dividends are supported by cash flows and have been stable over the past decade. Recent earnings show improved net income but declining sales, highlighting potential challenges in sustaining current dividend levels.

- Take a closer look at Emerging Display Technologies' potential here in our dividend report.

- The valuation report we've compiled suggests that Emerging Display Technologies' current price could be inflated.

Next Steps

- Delve into our full catalog of 1027 Top Asian Dividend Stocks here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:601619

Jiaze Renewables

Engages in the development, construction, sale, operation, and maintenance of new energy power stations in China.

Excellent balance sheet, good value and pays a dividend.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)