- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:3037

High Growth Tech Stocks to Watch in January 2025

Reviewed by Simply Wall St

As global markets navigate mixed signals, with the S&P 500 and Nasdaq Composite closing out a strong year despite recent slumps and economic indicators like the Chicago PMI showing contraction, investors are keenly observing how these dynamics impact high-growth sectors. In such an environment, identifying promising tech stocks involves looking for companies that demonstrate resilience and adaptability to market fluctuations while maintaining robust innovation pipelines.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| AVITA Medical | 33.76% | 52.47% | ★★★★★★ |

| Medley | 20.97% | 27.22% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.47% | 56.38% | ★★★★★★ |

| TG Therapeutics | 30.33% | 44.07% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Travere Therapeutics | 28.68% | 62.50% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1255 stocks from our High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Cal-Comp Electronics (Thailand) (SET:CCET)

Simply Wall St Growth Rating: ★★★★☆☆

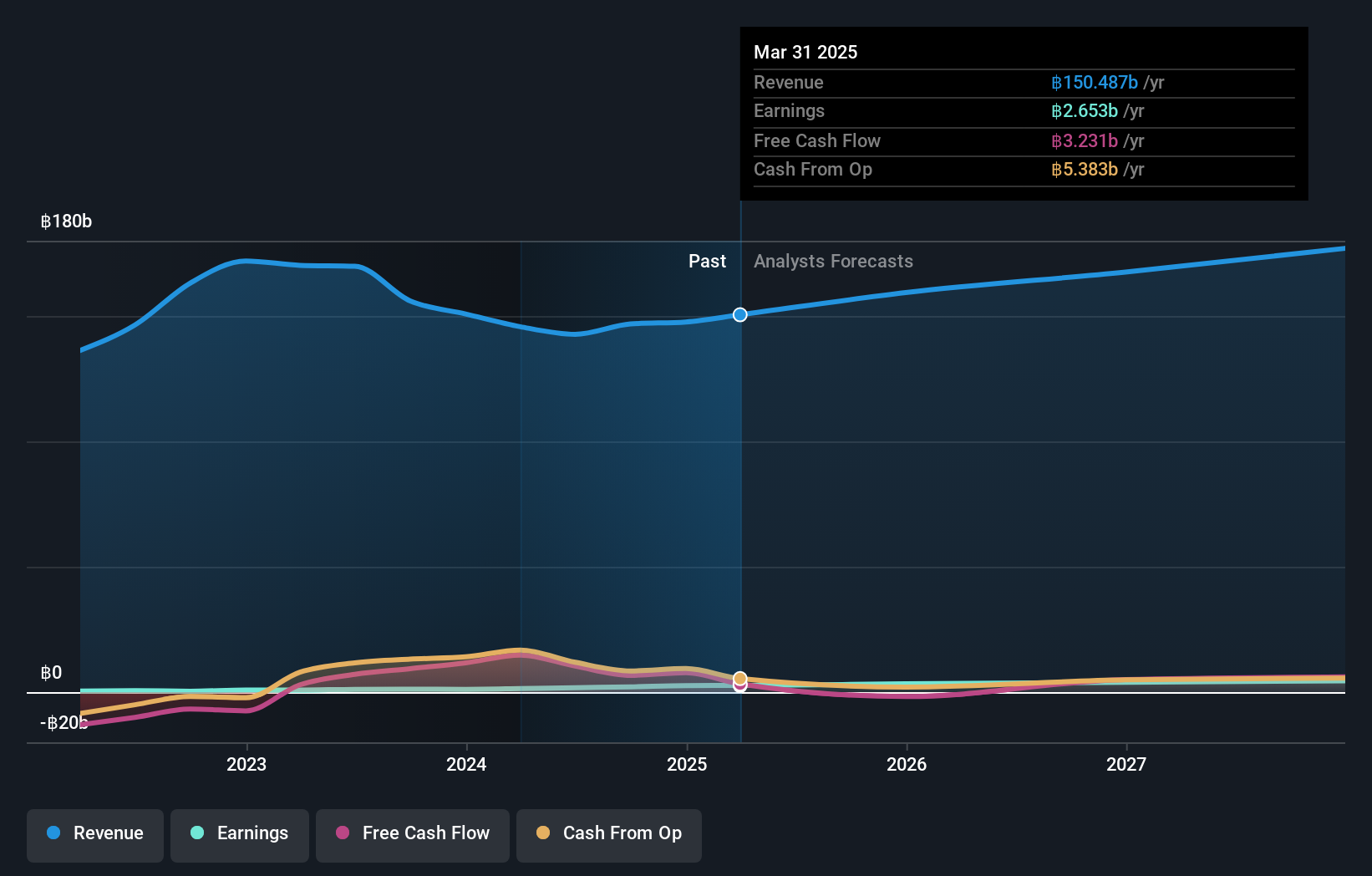

Overview: Cal-Comp Electronics (Thailand) Public Company Limited, along with its subsidiaries, is engaged in the global manufacturing of electronic products and has a market capitalization of approximately THB98.23 billion.

Operations: Cal-Comp Electronics (Thailand) focuses on manufacturing electronic products, generating significant revenue from computer peripherals and telecommunication products, with THB158.81 billion and THB20.78 billion respectively. The company also derives income from service activities amounting to THB1.56 billion.

Cal-Comp Electronics (Thailand) has demonstrated robust financial performance with a significant 80.3% earnings growth over the past year, outpacing the electronic industry's average of 7.1%. This growth trajectory is supported by a forecasted annual earnings increase of 29.2%, indicating potential sustained upward momentum. Despite facing challenges such as high levels of debt and volatile share prices, CCET's strategic inclusion in the SET 50 Index underscores its market recognition. The company also benefits from substantial one-off gains, which have notably influenced its recent financial outcomes, suggesting an adeptness at capitalizing on unique opportunities within its operational framework.

Meiko Electronics (TSE:6787)

Simply Wall St Growth Rating: ★★★★☆☆

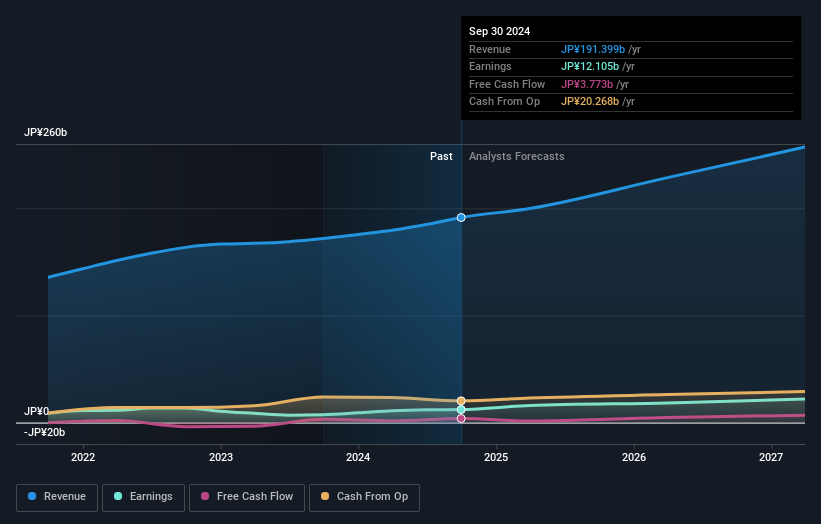

Overview: Meiko Electronics Co., Ltd. designs, manufactures, and sells printed circuit boards (PCBs) and auxiliary electronics across various regions including Japan, China, Vietnam, the rest of Asia, North America, Europe, and internationally with a market cap of ¥221.42 billion.

Operations: The primary revenue stream for Meiko Electronics Co., Ltd. is its electronic-related business, generating ¥191.26 billion. The company operates in a global market, focusing on the production and sale of printed circuit boards and auxiliary electronics across multiple regions.

Meiko Electronics has shown remarkable adaptability in a competitive market, as evidenced by its recent dividend adjustments and upward revision of financial forecasts for FY 2024. The company's ability to increase dividends from JPY 27.00 to JPY 40.00 per share highlights its robust financial health and commitment to shareholder returns. Moreover, the revised earnings guidance—with net sales now expected at JPY 197 billion and a significant jump in operating income to JPY 19 billion—reflects an optimistic outlook supported by strategic operational efficiencies. This performance is underpinned by a solid revenue growth rate of 12.2% annually, surpassing the Japanese market average of 4.2%, and an impressive earnings growth forecast of 21.9% per year, indicating potential for sustained profitability amidst industry challenges such as high debt levels.

- Get an in-depth perspective on Meiko Electronics' performance by reading our health report here.

Gain insights into Meiko Electronics' past trends and performance with our Past report.

Unimicron Technology (TWSE:3037)

Simply Wall St Growth Rating: ★★★★★☆

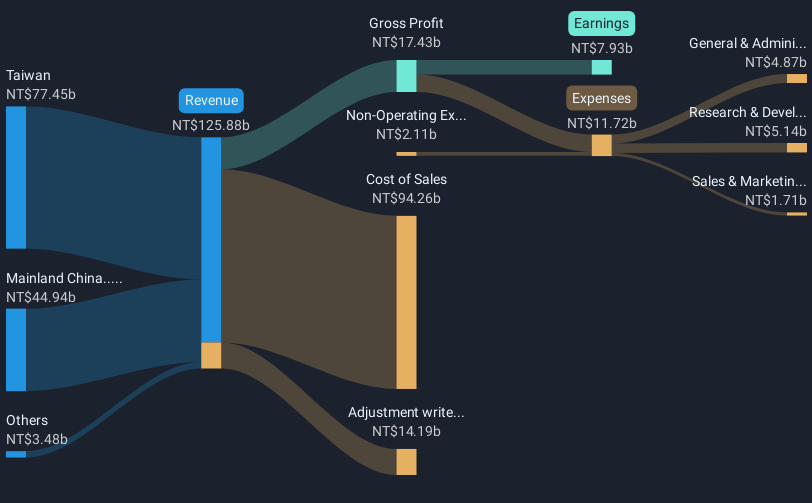

Overview: Unimicron Technology Corp. focuses on the development, manufacturing, processing, and sale of printed circuit boards and electronic products globally, with a market cap of NT$221.72 billion.

Operations: The company generates revenue primarily from Taiwan (NT$77.45 billion) and Mainland China (NT$44.94 billion), focusing on printed circuit boards, electrical equipment, electronic products, and integrated circuit testing systems.

Unimicron Technology, amid executive reshuffles and a robust schedule of investor forums, also announced a significant fixed-income offering of TWD 15 billion. This move could bolster its financial structure as it navigates through a challenging phase marked by a notable dip in net income from TWD 2.59 billion to TWD 997 million in Q3 year-over-year. Despite these hurdles, the company's revenue trajectory remains promising with an annual growth rate of 19.6%, outpacing the broader Taiwanese market's expansion of 12.4%. This resilience is critical as Unimicron continues to invest in innovation and operational efficiencies to maintain its competitive edge in the tech sector.

- Click here to discover the nuances of Unimicron Technology with our detailed analytical health report.

Evaluate Unimicron Technology's historical performance by accessing our past performance report.

Where To Now?

- Gain an insight into the universe of 1255 High Growth Tech and AI Stocks by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:3037

Unimicron Technology

Engages in the development, manufacturing, processing, and sale of printed circuit boards, electrical equipment, electronic products, and testing and burn-in systems for integrated circuit products worldwide.

Flawless balance sheet with high growth potential.