- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:3037

High Growth Tech Stocks to Watch in February 2025

Reviewed by Simply Wall St

As global markets navigate uncertainties stemming from tariff announcements and mixed economic indicators, the S&P 500 Index has shown resilience despite a slight decline, while manufacturing activity in the U.S. sees a tentative recovery. In this environment, identifying high growth tech stocks involves looking for companies that not only demonstrate robust earnings performance but also have the agility to adapt to evolving trade policies and economic conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Medley | 20.95% | 27.32% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 135.02% | ★★★★★★ |

| Elliptic Laboratories | 61.01% | 121.13% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1216 stocks from our High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Victory Giant Technology (HuiZhou)Co.Ltd (SZSE:300476)

Simply Wall St Growth Rating: ★★★★★☆

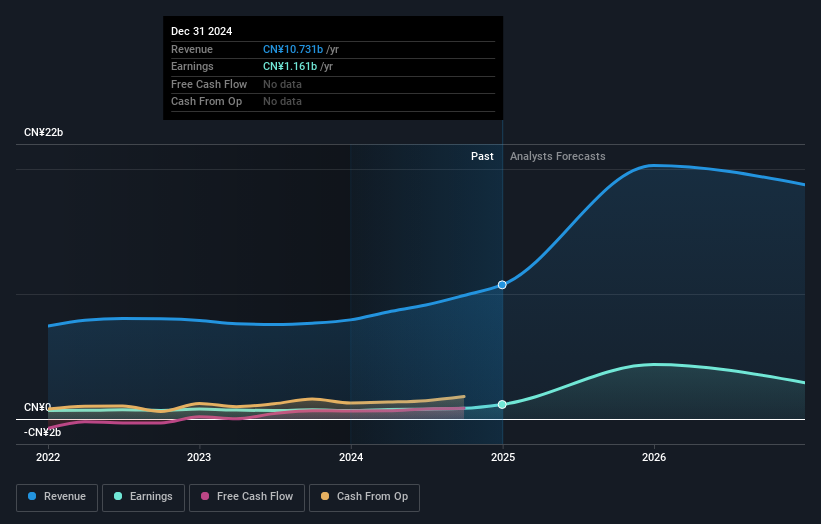

Overview: Victory Giant Technology (HuiZhou) Co., Ltd. operates in the printed circuit board manufacturing industry and has a market capitalization of CN¥43.75 billion.

Operations: Victory Giant Technology generates revenue primarily from its printed circuit board (PCB) manufacturing segment, which accounts for CN¥9.41 billion. The company's revenue model highlights a focus on PCB production within the electronics industry.

Victory Giant Technology (HuiZhou)Co.,Ltd. has demonstrated robust financial performance, with earnings growth of 15.4% over the past year, significantly surpassing the electronic industry's average of 3%. This trend is supported by an aggressive R&D investment strategy that not only fuels innovation but also aligns with anticipated revenue growth of 23.6% per year, outpacing the broader Chinese market forecast of 13.6%. Recently, the company has actively engaged shareholders and reinforced its market position through strategic share buybacks totaling CNY 28.32 million. These actions reflect a proactive approach in steering towards sustained growth and market responsiveness, especially considering its volatile share price in recent months and a forward-looking Return on Equity forecast at a modest 18.4%.

- Navigate through the intricacies of Victory Giant Technology (HuiZhou)Co.Ltd with our comprehensive health report here.

Learn about Victory Giant Technology (HuiZhou)Co.Ltd's historical performance.

WT Microelectronics (TWSE:3036)

Simply Wall St Growth Rating: ★★★★☆☆

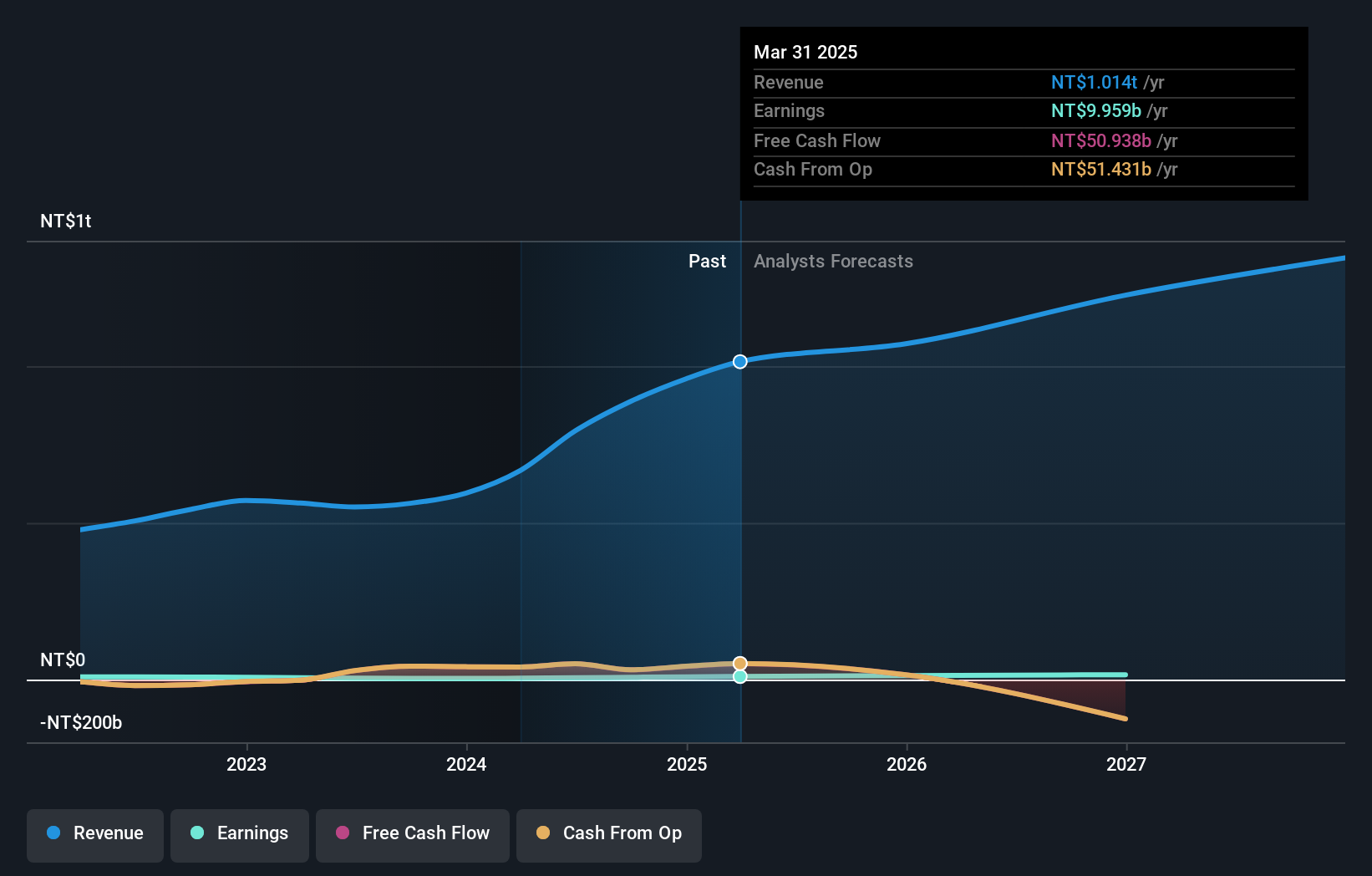

Overview: WT Microelectronics Co., Ltd. develops and sells electronic and communication components across Taiwan, China, and internationally with a market capitalization of NT$117.78 billion.

Operations: WT Microelectronics Co., Ltd. operates in the electronic and communication components sector with a focus on Taiwan, China, and international markets. The company generates revenue primarily through the sale of these components, leveraging its extensive network and market presence.

WT Microelectronics has showcased a dynamic growth trajectory, with its earnings surging by 91.1% over the past year, outstripping the electronics industry's average growth rate of 6.6%. This impressive performance is underpinned by a forward-looking R&D commitment, which is evident from the company's substantial investment in innovation—this aligns closely with their projected annual revenue increase of 15.3%. Furthermore, recent sales announcements have highlighted significant monthly and annual gains; December sales alone jumped by 63% year-over-year to TWD 95.8 billion, culminating in an annual total of TWD 959.4 billion—a robust increase of about 61% from the previous year. These figures not only demonstrate WT Microelectronics' capacity to generate revenue but also underscore its potential for sustained financial growth amidst competitive market conditions.

- Click here and access our complete health analysis report to understand the dynamics of WT Microelectronics.

Evaluate WT Microelectronics' historical performance by accessing our past performance report.

Unimicron Technology (TWSE:3037)

Simply Wall St Growth Rating: ★★★★★☆

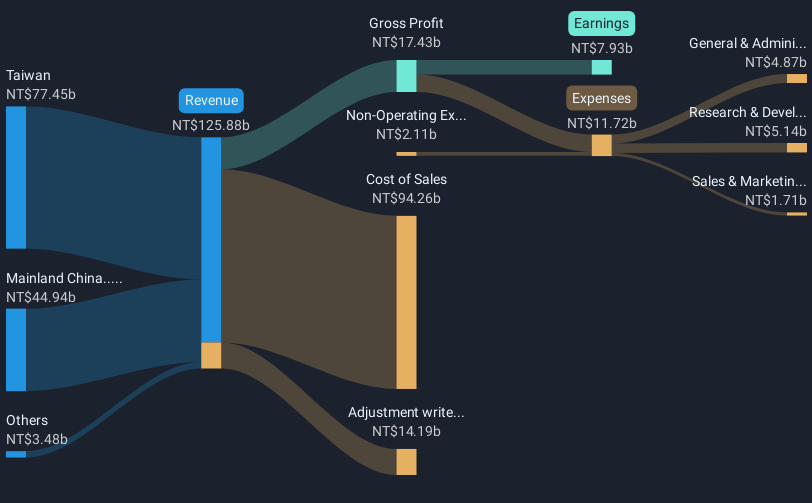

Overview: Unimicron Technology Corp. is involved in the development, manufacturing, processing, and sale of printed circuit boards and electronic products globally, with a market cap of NT$188.80 billion.

Operations: Unimicron Technology Corp. generates revenue primarily from its operations in Taiwan and Mainland China, with figures reaching NT$77.45 billion and NT$44.94 billion, respectively. The company focuses on printed circuit boards, electrical equipment, electronic products, and testing systems for integrated circuits on a global scale.

Unimicron Technology's strategic focus on research and development is evident from its significant R&D expenditure, which aligns with its robust annual revenue growth of 19.6%. This commitment to innovation is crucial in the tech sector, where staying ahead technologically can directly influence market share and profitability. Despite a challenging year with a net profit margin decrease to 7.1% from 14.3%, the company's earnings are projected to surge by an impressive 62.3% annually, outpacing the Taiwanese market average growth of 17.8%. Recent executive changes and a series of high-profile conference presentations underscore Unimicron’s proactive approach in leadership and industry engagement, positioning it well for future technological advancements and market expansion.

- Get an in-depth perspective on Unimicron Technology's performance by reading our health report here.

Key Takeaways

- Embark on your investment journey to our 1216 High Growth Tech and AI Stocks selection here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Unimicron Technology, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:3037

Unimicron Technology

Engages in the development, manufacturing, processing, and sale of printed circuit boards, electrical equipment, electronic products, and testing and burn-in systems for integrated circuit products worldwide.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives