- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:3030

Undiscovered Gems In Asia Top Stocks To Watch In August 2025

Reviewed by Simply Wall St

As global markets respond to shifting economic policies and trade dynamics, the Asian market is showing resilience, with key indices like China's CSI 300 and Japan's Nikkei 225 experiencing gains amid strong corporate earnings and robust export data. In this environment, identifying promising small-cap stocks can be particularly rewarding for investors seeking growth opportunities; these undiscovered gems often thrive on innovation and adaptability in rapidly changing economic landscapes.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Chudenko | NA | 4.69% | 17.78% | ★★★★★★ |

| FALCO HOLDINGS | 5.07% | -0.61% | -1.29% | ★★★★★★ |

| Saison Technology | NA | 1.35% | -9.69% | ★★★★★★ |

| NARUMIYA INTERNATIONAL | 26.55% | 6.54% | 23.02% | ★★★★★★ |

| ISE Chemicals | 1.33% | 16.01% | 33.15% | ★★★★★★ |

| KurimotoLtd | 22.97% | 3.16% | 18.65% | ★★★★★☆ |

| CHANGE HoldingsInc | 65.87% | 30.07% | 16.98% | ★★★★★☆ |

| Ebara JitsugyoLtd | 3.93% | 5.24% | 6.40% | ★★★★★☆ |

| FCE | 7.92% | 26.91% | 26.05% | ★★★★★☆ |

| OUG Holdings | 68.97% | 2.94% | 34.51% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Precision Tsugami (China) (SEHK:1651)

Simply Wall St Value Rating: ★★★★★★

Overview: Precision Tsugami (China) Corporation Limited is an investment holding company that focuses on the manufacture and sale of computer numerical control machine tools in Mainland China and internationally, with a market capitalization of HK$9.50 billion.

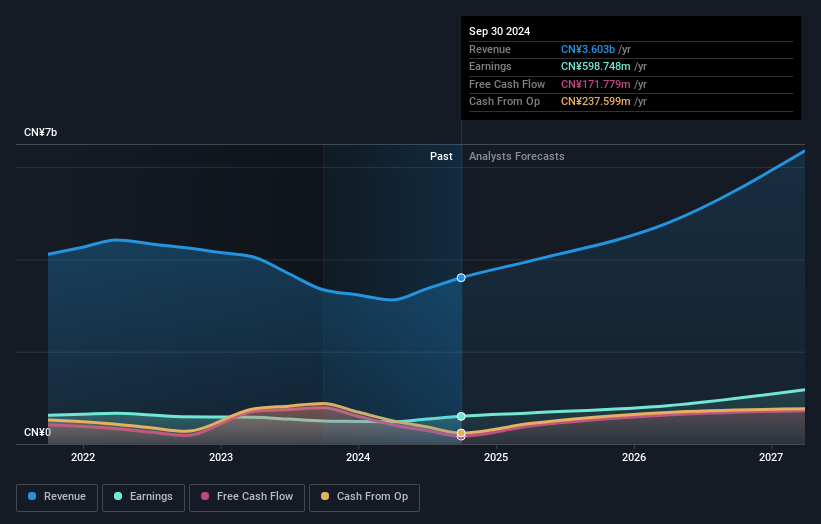

Operations: The company generates revenue primarily from the manufacture and sale of CNC high precision machine tools, amounting to CN¥4.26 billion.

Precision Tsugami (China) stands out with its recent performance, reporting sales of CNY 4.26 billion for the year ending March 2025, up from CNY 3.12 billion the previous year. Net income reached CNY 782 million compared to last year's CNY 480 million, reflecting a robust growth trajectory in the machinery sector where it outpaced industry averages by a significant margin. The company is debt-free and boasts high-quality earnings with strong non-cash components, offering a stable financial footing. Additionally, its basic earnings per share rose to CNY 2.08 from CNY 1.26, underscoring solid profitability improvements over the past year.

Co-Tech Development (TPEX:8358)

Simply Wall St Value Rating: ★★★★★★

Overview: Co-Tech Development Corporation, with a market cap of NT$33.07 billion, specializes in the production and sale of copper foil primarily for the printed circuit board industry in Taiwan and China.

Operations: Co-Tech's revenue is primarily derived from its copper foil segment, amounting to NT$7.23 billion. The company's financial performance is characterized by a net profit margin trend worth noting.

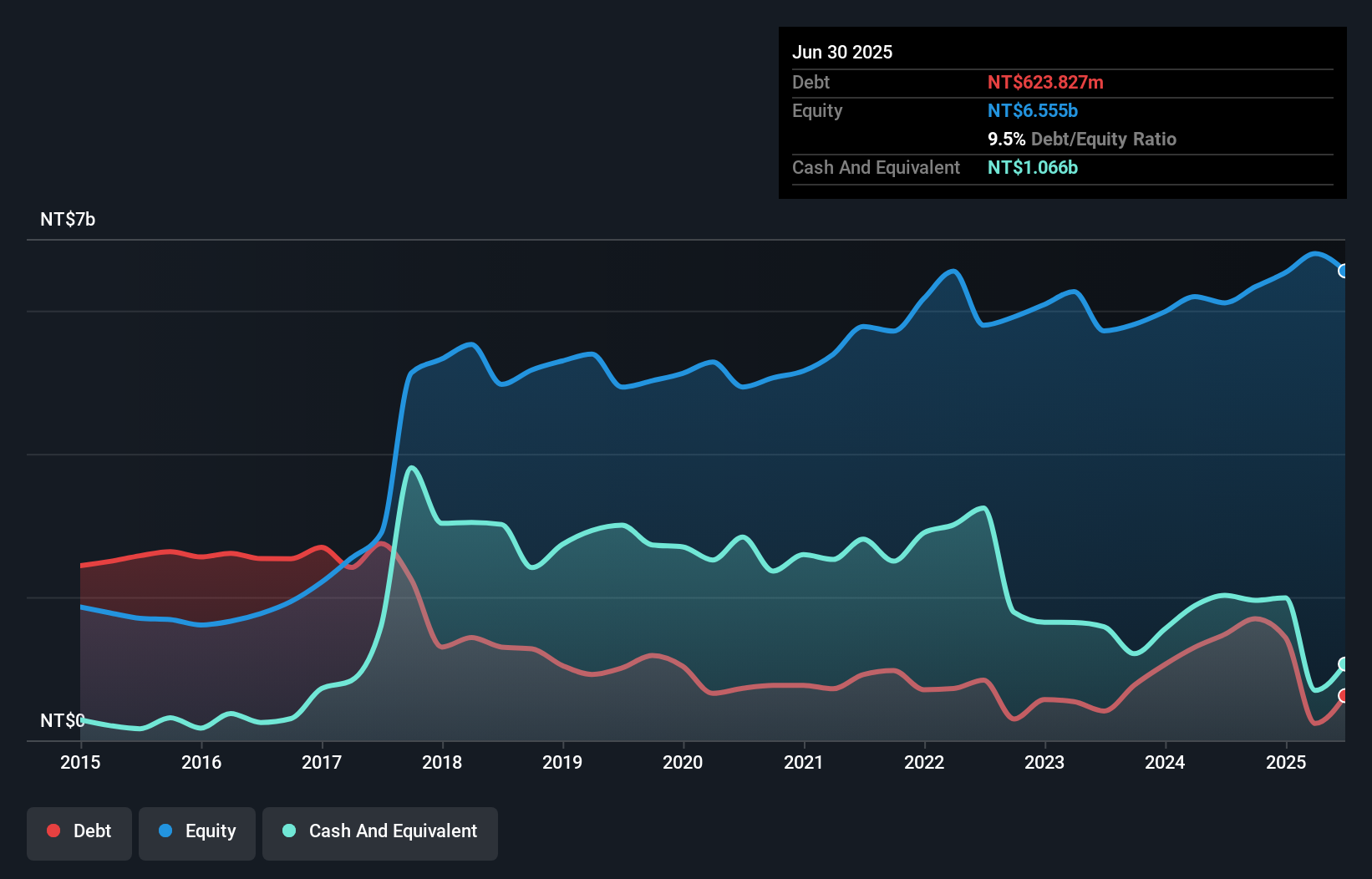

Co-Tech Development, a smaller player in the electronics sector, has shown robust earnings growth of 9.8% over the past year, surpassing the industry average of 8%. Despite this positive momentum, recent financial results indicate some challenges; net income for Q2 2025 was TWD 167.01 million compared to TWD 291.5 million in the previous year. On a brighter note, Co-Tech’s debt management appears effective with a reduced debt-to-equity ratio from 14.7% to 9.5% over five years and interest payments well-covered by EBIT at an impressive multiple of nearly 284x. Recent board changes suggest strategic shifts are underway to enhance governance and growth strategies.

- Dive into the specifics of Co-Tech Development here with our thorough health report.

Gain insights into Co-Tech Development's past trends and performance with our Past report.

Test Research (TWSE:3030)

Simply Wall St Value Rating: ★★★★★★

Overview: Test Research, Inc. and its subsidiaries operate in the design, assembly, manufacturing, sales, repair, and maintenance of automated inspection and testing equipment across Asia, America, Europe, and internationally with a market cap of NT$42.16 billion.

Operations: The company generates revenue primarily through the sales of automated inspection and testing equipment. Its cost structure involves expenses related to design, assembly, manufacturing, and maintenance operations across various regions. The net profit margin has shown a notable trend over recent periods, reflecting the company's operational efficiency within its industry.

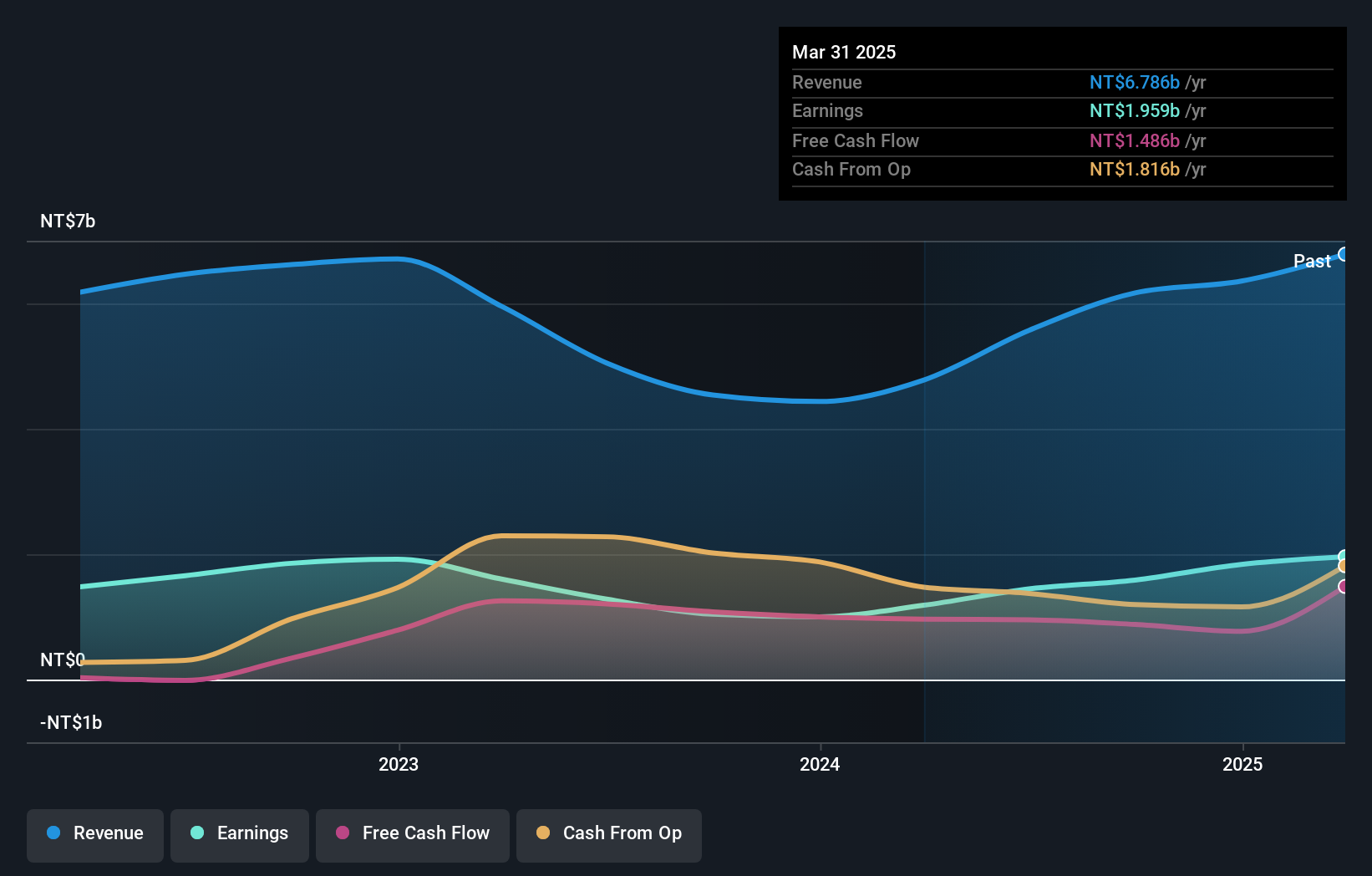

Test Research is making waves with its robust financial performance, showcasing a significant earnings growth of 39.3% over the past year, outpacing the Electronic industry average of 8%. The company reported second-quarter sales of TWD 2.38 billion, up from TWD 1.73 billion a year ago, while net income rose to TWD 521.47 million compared to TWD 466.13 million previously. With no debt on its books for five years and positive free cash flow, Test Research appears financially sound and well-positioned in the market landscape, bolstered by high-quality earnings and strategic dividend increases like the recent TWD 5 per share payout.

- Click here to discover the nuances of Test Research with our detailed analytical health report.

Evaluate Test Research's historical performance by accessing our past performance report.

Make It Happen

- Unlock our comprehensive list of 2518 Asian Undiscovered Gems With Strong Fundamentals by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Test Research might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:3030

Test Research

Designs, assembles, manufactures, sells, repairs, and maintains automated inspection and testing equipment in Asia, America, Europe, and internationally.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives