- China

- /

- Electronic Equipment and Components

- /

- SZSE:300065

Three Promising Asian Stocks with Strong Potential

Reviewed by Simply Wall St

As global markets navigate the complexities of trade policies and economic indicators, Asian markets present unique opportunities for investors seeking growth in a dynamic environment. With smaller-cap indexes showing resilience despite broader market fluctuations, identifying stocks with strong fundamentals and growth potential becomes crucial.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wuxi Double Elephant Micro Fibre MaterialLtd | 6.32% | 9.86% | 52.64% | ★★★★★★ |

| Hangzhou Fortune Gas Cryogenic Group | 0.01% | 22.78% | 17.11% | ★★★★★★ |

| Kyoritsu Electric | 6.30% | 4.83% | 15.38% | ★★★★★★ |

| Advanced International Multitech | 35.32% | 3.62% | 1.11% | ★★★★★★ |

| Shangri-La Hotel | NA | 23.33% | 39.56% | ★★★★★★ |

| Miwon Chemicals | 0.12% | 10.40% | 16.52% | ★★★★★★ |

| Otec | 7.14% | 4.39% | 6.95% | ★★★★★☆ |

| Kangping Technology (Suzhou) | 23.90% | 1.60% | 16.23% | ★★★★★☆ |

| Jinlihua Electric | 48.71% | 7.36% | 31.30% | ★★★★★☆ |

| Guangdong Tloong Technology GroupLtd | 39.59% | -7.11% | -21.90% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

BaTeLab (SEHK:2149)

Simply Wall St Value Rating: ★★★★☆☆

Overview: BaTeLab Co., Ltd. focuses on the research, development, and sale of analog integrated circuit patterned wafers for packaging and testing solutions in China, with a market capitalization of HK$4.04 billion.

Operations: BaTeLab generates revenue primarily from the sale of analog IC patterned wafers and electronic components, amounting to CN¥578.81 million. The company's financial performance is influenced by its ability to manage costs associated with research, development, and production within this segment.

BaTeLab, a nimble player in the semiconductor space, has outpaced its industry with a remarkable 52.6% earnings growth over the past year. Despite not being free cash flow positive, it trades at an attractive value compared to peers and boasts more cash than total debt. Recent moves include a follow-on equity offering of HKD 120 million and changes in company bylaws, signaling strategic shifts. The share price has been volatile lately; however, earnings are forecasted to grow by 25.5% annually, suggesting potential for future expansion amidst industry challenges.

- Get an in-depth perspective on BaTeLab's performance by reading our health report here.

Assess BaTeLab's past performance with our detailed historical performance reports.

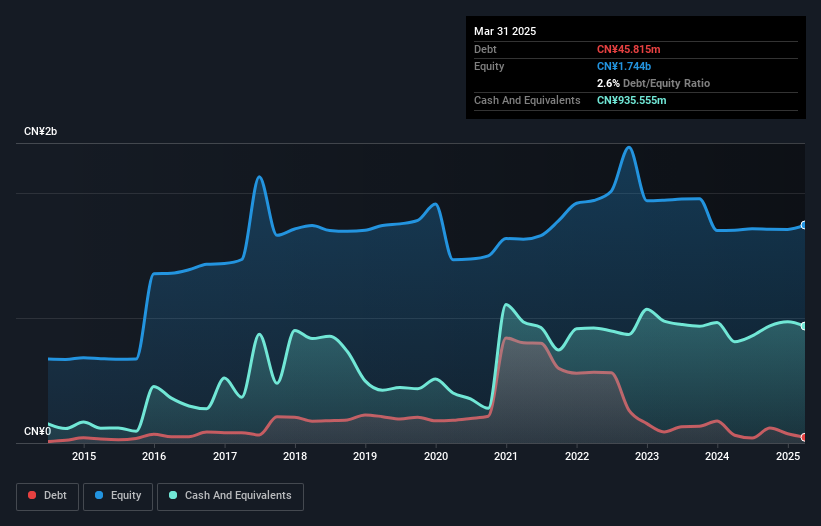

Beijing Highlander Digital Technology (SZSE:300065)

Simply Wall St Value Rating: ★★★★★★

Overview: Beijing Highlander Digital Technology Co., Ltd. operates in the technology sector with a focus on digital solutions and has a market capitalization of CN¥13.44 billion.

Operations: The company generates revenue primarily from its digital technology solutions. It has a market capitalization of CN¥13.44 billion.

Beijing Highlander Digital Technology has shown a remarkable turnaround, transitioning from a net loss of CNY 116.36 million last year to a net income of CNY 8.21 million for the full year ending December 2024. This improvement is reflected in their basic earnings per share, which shifted from a loss of CNY 0.1609 to an earnings figure of CNY 0.0114 per share. The first quarter of 2025 continued this positive trend with sales reaching CNY 346.45 million compared to just CNY 46.88 million in the same period last year, illustrating significant revenue growth and operational efficiency gains within this small but promising entity in Asia's tech landscape.

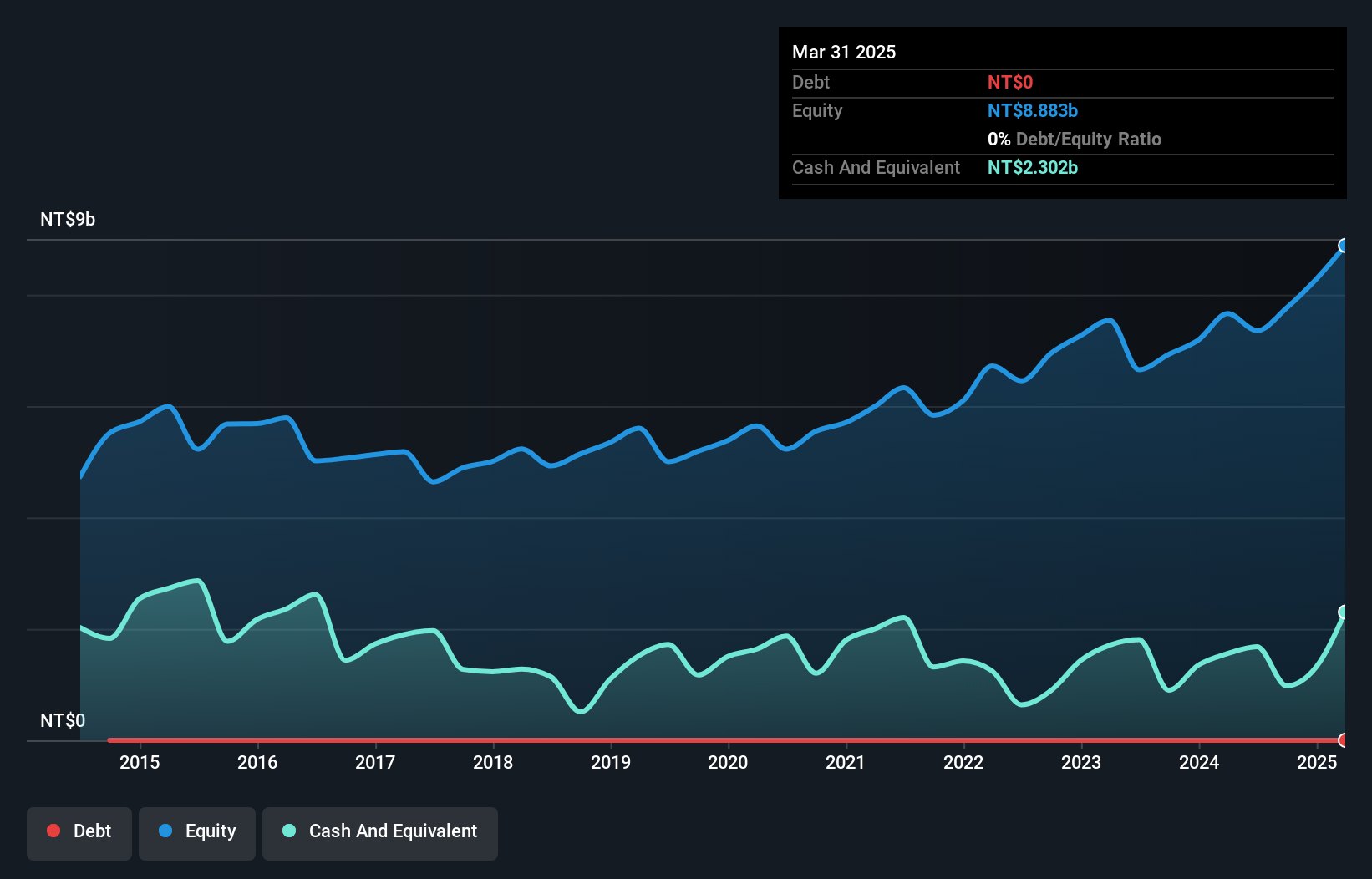

Test Research (TWSE:3030)

Simply Wall St Value Rating: ★★★★★★

Overview: Test Research, Inc. operates in the design, assembly, manufacture, sale, and maintenance of automated inspection and testing equipment across Asia, the United States, Europe, and other international markets with a market cap of NT$31.06 billion.

Operations: Test Research generates revenue primarily from the design, assembly, manufacture, sale, and maintenance of automated testing equipment, amounting to NT$6.79 billion. The company's financial performance is marked by a focus on these core activities across its international markets.

Test Research, a nimble player in the electronics sector, reported impressive earnings growth of 65.3% over the past year, outpacing the industry average of 14.2%. With no debt on its books for five years and a price-to-earnings ratio of 15.9x, it offers good value compared to the broader Taiwan market at 18.3x. The company recently announced a cash dividend payout totaling TWD 1,181 million (TWD 5 per share), reflecting strong financial health and profitability. Despite recent share price volatility, Test Research's high-quality earnings and free cash flow positivity signal robust operational performance.

Taking Advantage

- Unlock more gems! Our Asian Undiscovered Gems With Strong Fundamentals screener has unearthed 2604 more companies for you to explore.Click here to unveil our expertly curated list of 2607 Asian Undiscovered Gems With Strong Fundamentals.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Beijing Highlander Digital Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300065

Beijing Highlander Digital Technology

Beijing Highlander Digital Technology Co., Ltd.

Flawless balance sheet with acceptable track record.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion