- Taiwan

- /

- Tech Hardware

- /

- TWSE:3017

Asia Vital Components Co., Ltd.'s (TWSE:3017) Stock Retreats 30% But Earnings Haven't Escaped The Attention Of Investors

Asia Vital Components Co., Ltd. (TWSE:3017) shares have had a horrible month, losing 30% after a relatively good period beforehand. Still, a bad month hasn't completely ruined the past year with the stock gaining 53%, which is great even in a bull market.

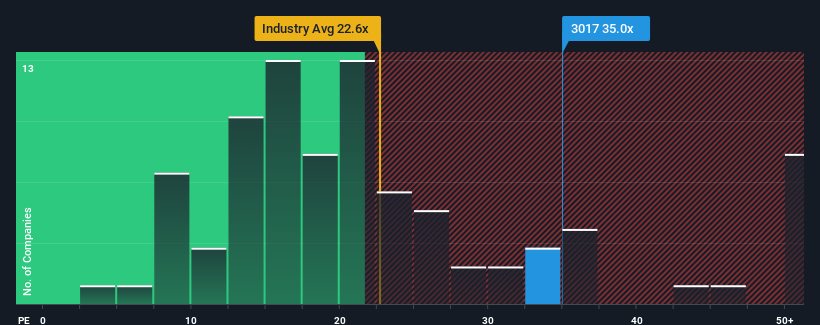

Although its price has dipped substantially, Asia Vital Components' price-to-earnings (or "P/E") ratio of 35x might still make it look like a strong sell right now compared to the market in Taiwan, where around half of the companies have P/E ratios below 22x and even P/E's below 15x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

Asia Vital Components certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. It seems that many are expecting the company to continue defying the broader market adversity, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Asia Vital Components

What Are Growth Metrics Telling Us About The High P/E?

In order to justify its P/E ratio, Asia Vital Components would need to produce outstanding growth well in excess of the market.

Retrospectively, the last year delivered an exceptional 22% gain to the company's bottom line. The strong recent performance means it was also able to grow EPS by 139% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

Turning to the outlook, the next three years should generate growth of 29% per annum as estimated by the ten analysts watching the company. That's shaping up to be materially higher than the 13% per year growth forecast for the broader market.

With this information, we can see why Asia Vital Components is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On Asia Vital Components' P/E

Even after such a strong price drop, Asia Vital Components' P/E still exceeds the rest of the market significantly. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Asia Vital Components maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

It is also worth noting that we have found 1 warning sign for Asia Vital Components that you need to take into consideration.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:3017

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives