- Taiwan

- /

- Tech Hardware

- /

- TWSE:3005

Three Top Dividend Stocks To Consider

Reviewed by Simply Wall St

As global markets show resilience, with U.S. stock indexes nearing record highs and European indices buoyed by positive economic developments, investors are increasingly focused on strategies that can provide steady returns amidst inflationary pressures and volatile interest rates. In this environment, dividend stocks stand out as a compelling option for those seeking income stability; these stocks typically offer regular payouts which can be particularly attractive when market conditions are uncertain.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 5.89% | ★★★★★★ |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.24% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.54% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.84% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.31% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.00% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 3.94% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.55% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.37% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.86% | ★★★★★★ |

Click here to see the full list of 1985 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

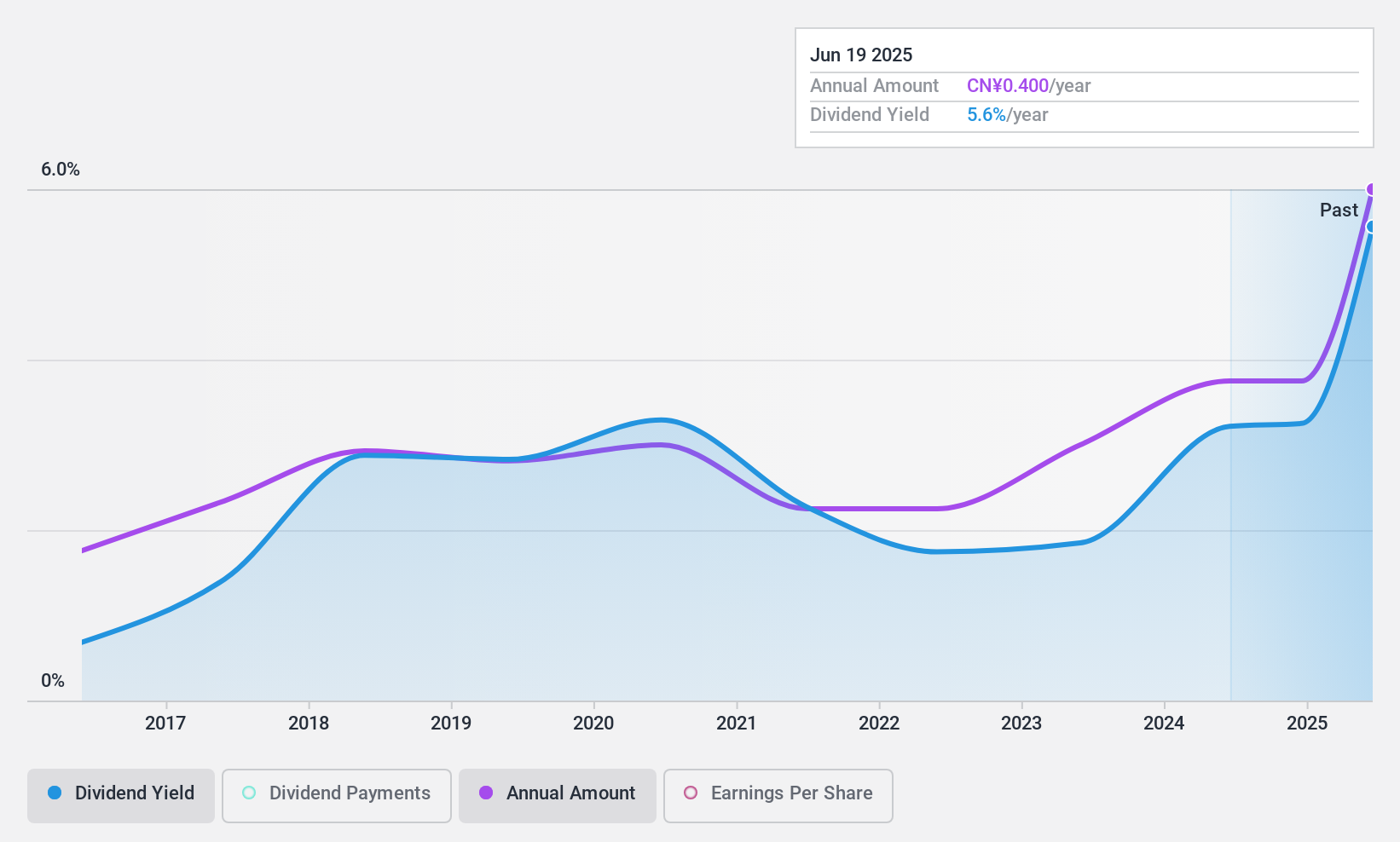

Xiamen R&T Plumbing TechnologyLtd (SZSE:002790)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Xiamen R&T Plumbing Technology Co., Ltd. is involved in the research and development, production, and sale of bathroom products and accessories globally, with a market cap of CN¥3.05 billion.

Operations: Xiamen R&T Plumbing Technology Co., Ltd. generates its revenue through the global production and sale of bathroom products and accessories.

Dividend Yield: 3.1%

Xiamen R&T Plumbing Technology Ltd. offers a dividend yield of 3.11%, ranking it in the top 25% of dividend payers in China, with dividends covered by earnings and cash flows. However, its nine-year dividend history is marked by volatility and occasional drops exceeding 20%. The company's recent earnings report showed increased sales to CNY 2.36 billion but a decline in net income to CNY 188.39 million, indicating potential challenges ahead for consistent dividend growth.

- Click here to discover the nuances of Xiamen R&T Plumbing TechnologyLtd with our detailed analytical dividend report.

- Upon reviewing our latest valuation report, Xiamen R&T Plumbing TechnologyLtd's share price might be too pessimistic.

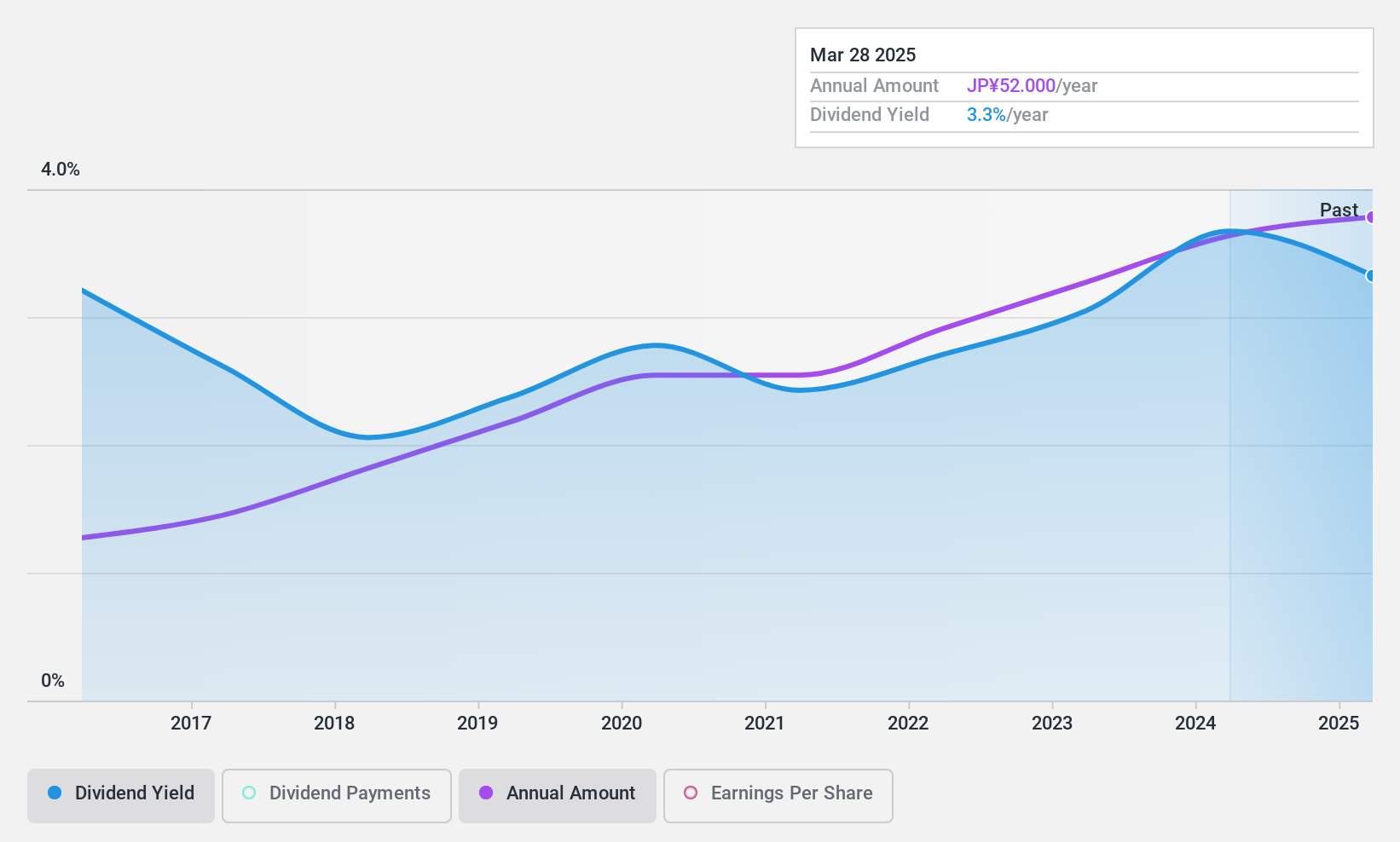

Pro-Ship (TSE:3763)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Pro-Ship Incorporated develops, sells, consults on, and customizes solution packages for asset and sales management in Japan with a market cap of ¥19.26 billion.

Operations: Pro-Ship Incorporated generates revenue through its development, sale, consulting, and customization of solution packages focused on asset and sales management within Japan.

Dividend Yield: 3.3%

Pro-Ship's dividends have been stable and reliable over the past decade, with a payout ratio of 43.9% and cash payout ratio of 39.5%, indicating strong coverage by earnings and cash flows. The dividend yield stands at 3.27%, slightly below Japan's top quartile dividend payers. Recent product developments in compliance with new accounting standards could enhance long-term corporate value, but immediate impact on fiscal year results is limited, maintaining current dividend stability without special expenses incurred for the launch.

- Dive into the specifics of Pro-Ship here with our thorough dividend report.

- Our valuation report here indicates Pro-Ship may be undervalued.

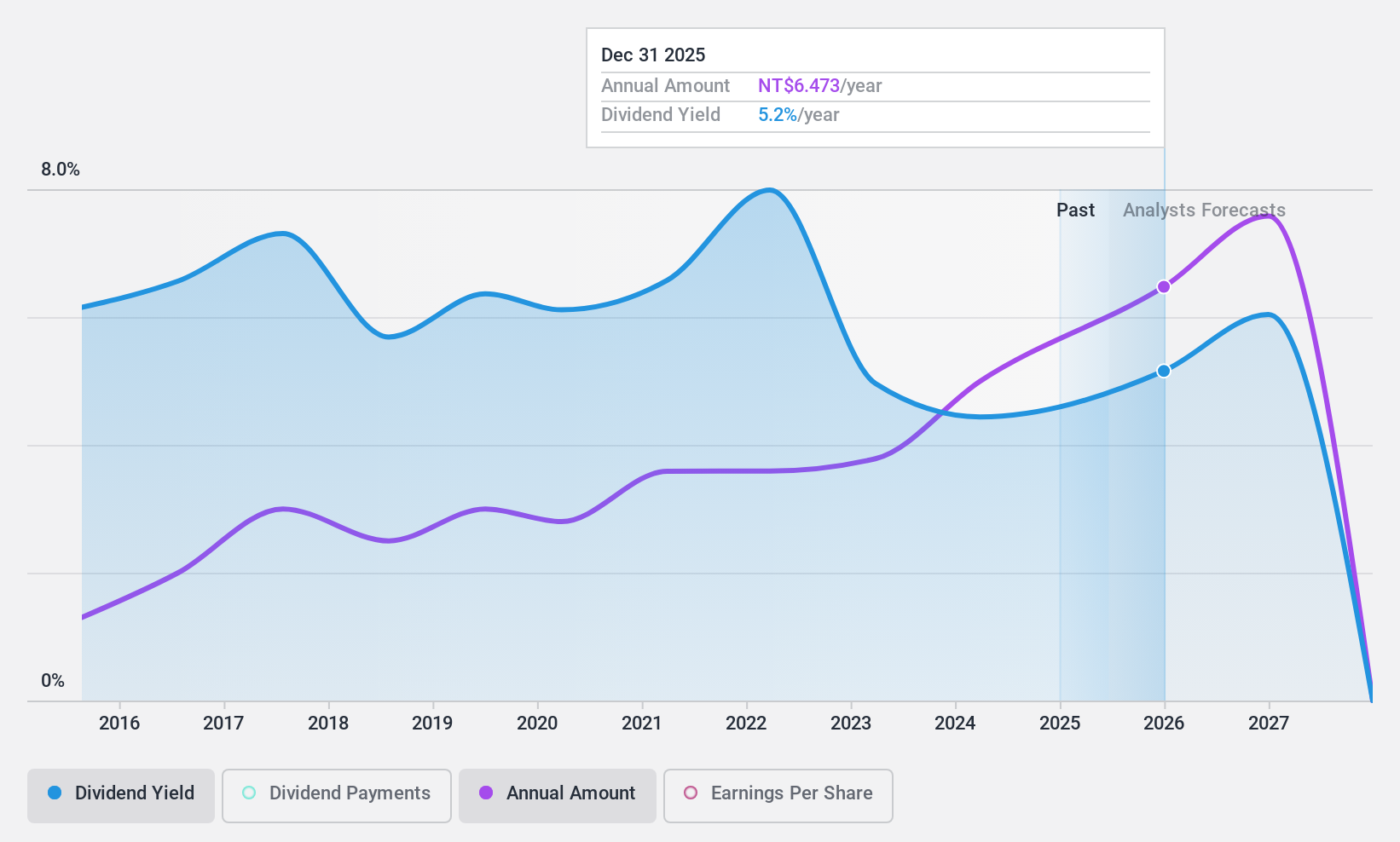

Getac Holdings (TWSE:3005)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Getac Holdings Corporation, along with its subsidiaries, engages in the research, development, manufacturing, and sale of notebook computers and related products across China, the United States, Europe, and other international markets with a market cap of NT$74.18 billion.

Operations: Getac Holdings Corporation generates revenue from its various segments, including NT$13.61 billion from Machine Parts, NT$18.43 billion from Electronic Parts, and NT$3.43 billion from Aerospace Fasteners.

Dividend Yield: 3.9%

Getac Holdings' dividend payments have been volatile over the past decade, despite a reasonable payout ratio of 71.8% and cash payout ratio of 71.2%, ensuring coverage by earnings and cash flows. The dividend yield is relatively low compared to top-tier payers in Taiwan. Recent executive changes and strategic partnerships, like the one with MAHLE Aftermarket, highlight Getac's focus on rugged hardware solutions, potentially supporting long-term revenue growth amidst fluctuating monthly revenues.

- Delve into the full analysis dividend report here for a deeper understanding of Getac Holdings.

- Upon reviewing our latest valuation report, Getac Holdings' share price might be too optimistic.

Make It Happen

- Reveal the 1985 hidden gems among our Top Dividend Stocks screener with a single click here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:3005

Getac Holdings

Researches, develops, manufactures, and sells notebook computers and related products in China, the United States, Europe, and internationally.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives