- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:2423

Global Dividend Stocks To Consider In August 2025

Reviewed by Simply Wall St

As global markets navigate a dynamic landscape marked by the Bank of England's rate cuts and record highs in U.S. indices, investors are keenly observing shifts in economic policy and trade developments. Amid these fluctuations, dividend stocks remain an attractive option for those seeking stable income streams, especially as central banks worldwide adjust interest rates to address labor market concerns and inflationary pressures.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 3.76% | ★★★★★★ |

| Torigoe (TSE:2009) | 4.68% | ★★★★★★ |

| Soliton Systems K.K (TSE:3040) | 3.80% | ★★★★★★ |

| NCD (TSE:4783) | 4.70% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.01% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.37% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.47% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.85% | ★★★★★★ |

| Daicel (TSE:4202) | 4.47% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.69% | ★★★★★★ |

Click here to see the full list of 1392 stocks from our Top Global Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

ASIX Electronics (TPEX:3169)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ASIX Electronics Corporation is an IC design company involved in the research, development, manufacture, and sale of chips across Taiwan, China, and internationally with a market cap of NT$5.72 billion.

Operations: ASIX Electronics Corporation generates revenue primarily from the research, development, production, and sale of integrated circuits, amounting to NT$900.06 million.

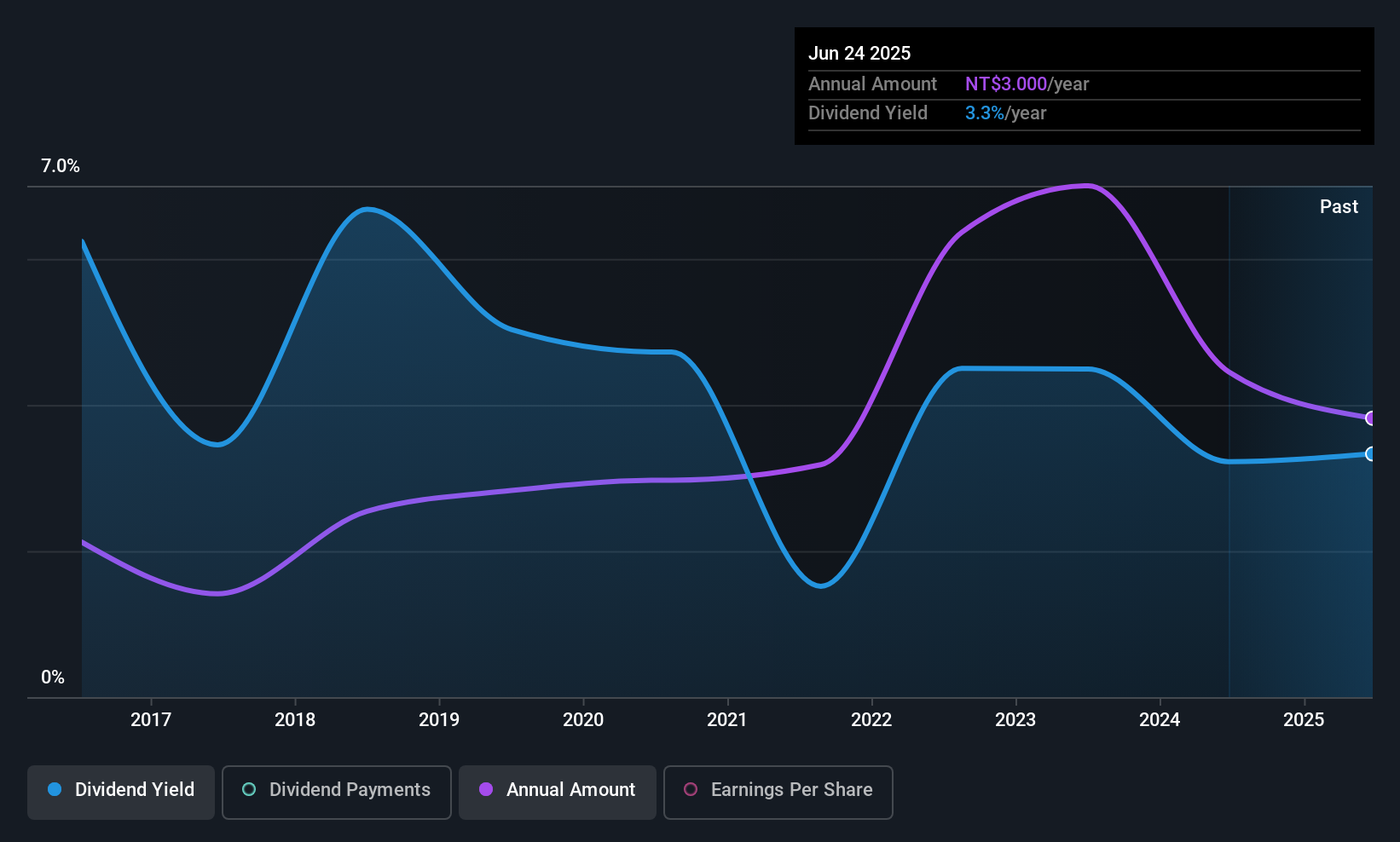

Dividend Yield: 3%

ASIX Electronics' dividend payments are covered by both earnings and cash flows, with a payout ratio of 87.4% and a cash payout ratio of 60%. However, the dividend yield is relatively low at 3.01% compared to the top quartile in Taiwan's market. The company has experienced volatility in its dividend history over the past decade, though there has been overall growth. Recent earnings showed a decline in quarterly net income, while six-month figures remained stable year-over-year.

- Click to explore a detailed breakdown of our findings in ASIX Electronics' dividend report.

- Our valuation report unveils the possibility ASIX Electronics' shares may be trading at a premium.

Asia Tech Image (TPEX:4974)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Asia Tech Image Inc. specializes in designing, developing, and manufacturing customized contact image sensor modules across Taiwan, China, and Myanmar with a market cap of NT$6.42 billion.

Operations: Asia Tech Image Inc.'s revenue primarily comes from its operations in designing and manufacturing customized contact image sensor modules.

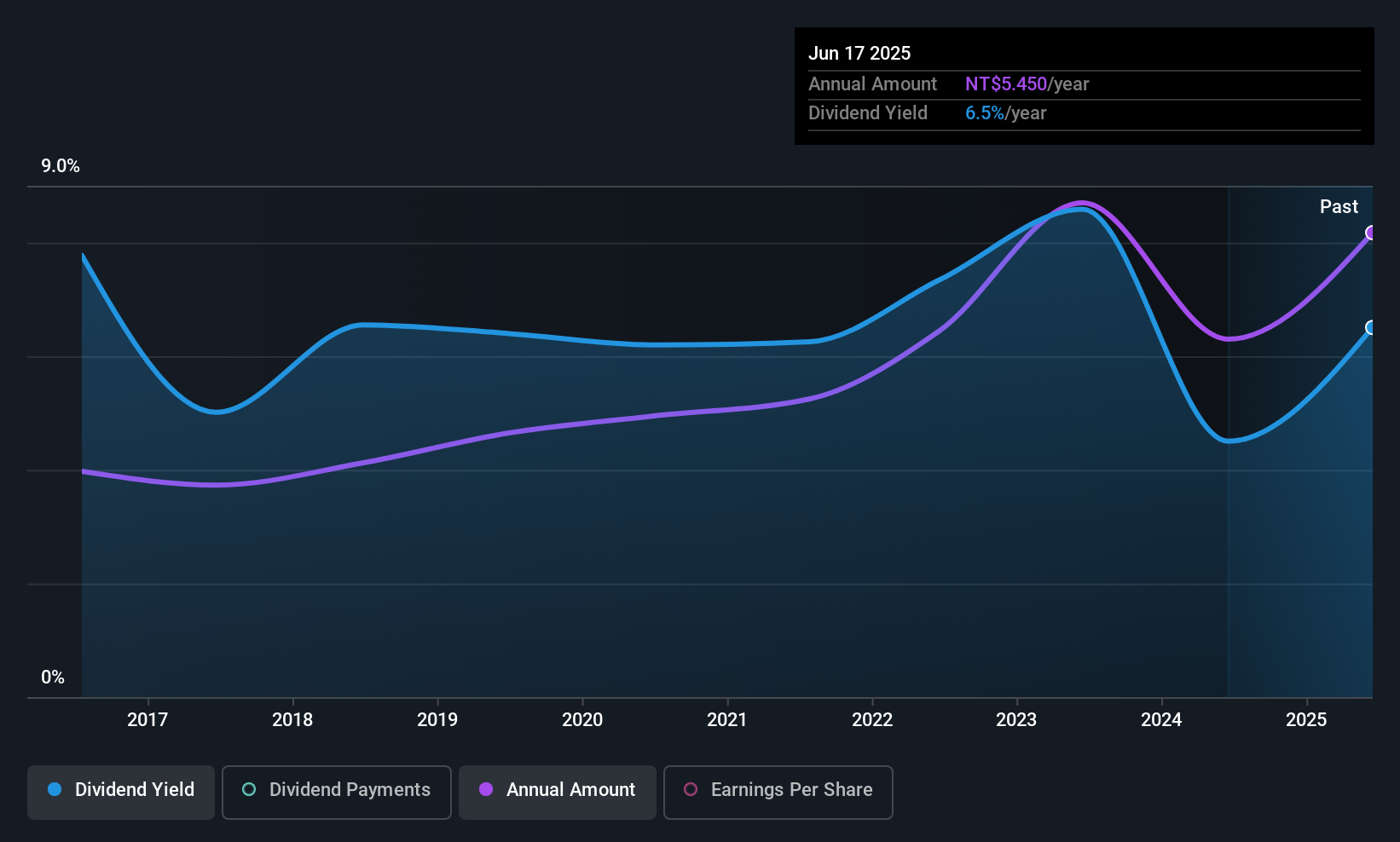

Dividend Yield: 5.8%

Asia Tech Image's dividend yield of 5.81% places it in the top quartile of Taiwan's market, but its high cash payout ratio of 92.6% indicates dividends are not well-covered by cash flows. Despite a history of volatility and unreliability over the past decade, dividends have increased over ten years. Recent earnings show a decline in quarterly net income to TWD 69.14 million from TWD 137.95 million last year, affecting dividend sustainability perceptions.

- Delve into the full analysis dividend report here for a deeper understanding of Asia Tech Image.

- According our valuation report, there's an indication that Asia Tech Image's share price might be on the expensive side.

Good Will Instrument (TWSE:2423)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Good Will Instrument Co., Ltd. manufactures and markets electrical test and measurement instruments for educational and industrial manufacturing markets, with a market cap of NT$7.35 billion.

Operations: Good Will Instrument Co., Ltd. generates revenue of NT$2.85 billion from its Electronic Test & Measurement Instruments segment.

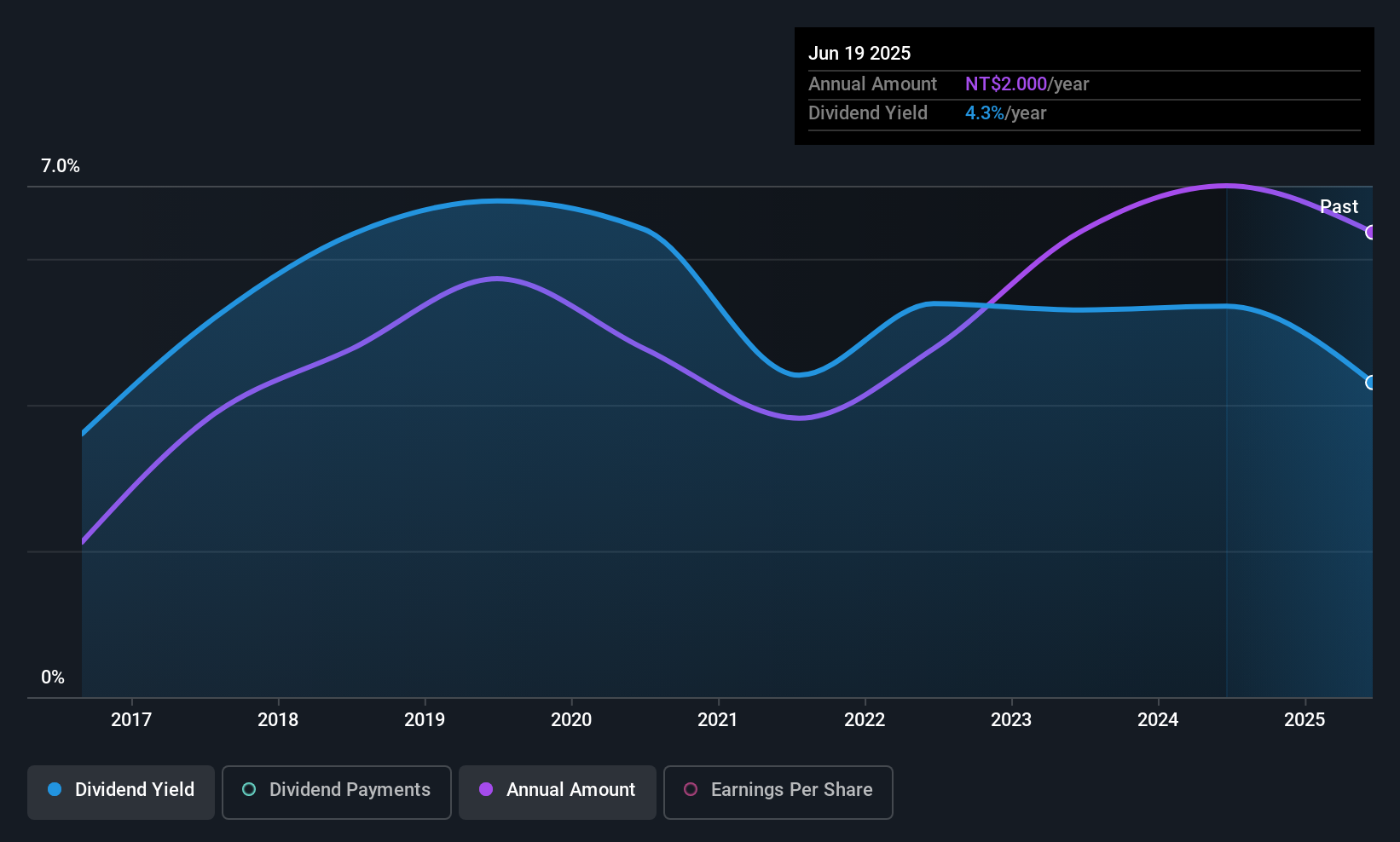

Dividend Yield: 3.8%

Good Will Instrument's dividend yield of 3.84% is below Taiwan's top quartile, yet dividends are well-covered by earnings (80.4% payout ratio) and cash flows (57.5% cash payout ratio). The company has consistently increased and stabilized dividends over the past decade. Recent earnings growth, with net income rising to TWD 77.54 million for Q2 2025, supports dividend sustainability despite a recent dividend decrease to TWD 2 per share announced in June 2025.

- Dive into the specifics of Good Will Instrument here with our thorough dividend report.

- The analysis detailed in our Good Will Instrument valuation report hints at an deflated share price compared to its estimated value.

Make It Happen

- Reveal the 1392 hidden gems among our Top Global Dividend Stocks screener with a single click here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2423

Good Will Instrument

Manufactures and markets electrical test and measurement instruments for educational and industrial manufacturing markets.

Flawless balance sheet with proven track record and pays a dividend.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026