- China

- /

- Electrical

- /

- SZSE:001283

Insider-Owned Growth Companies To Watch In February 2025

Reviewed by Simply Wall St

As global markets navigate the complexities of tariff uncertainties and mixed economic signals, investors are paying close attention to companies that demonstrate resilience and potential for growth. In this context, growth companies with high insider ownership stand out as they often reflect strong internal confidence and alignment with shareholder interests, making them intriguing options in today's market landscape.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 17.3% | 22.8% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 26.2% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Propel Holdings (TSX:PRL) | 36.5% | 38.9% |

| Medley (TSE:4480) | 34.1% | 27.3% |

| On Holding (NYSE:ONON) | 19.1% | 29.7% |

| Pharma Mar (BME:PHM) | 11.9% | 44.7% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 121.1% |

| Plenti Group (ASX:PLT) | 12.7% | 120.1% |

| Findi (ASX:FND) | 35.8% | 101% |

Here we highlight a subset of our preferred stocks from the screener.

ESR Group (SEHK:1821)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: ESR Group Limited operates in logistics real estate development, leasing, and management across multiple regions including Hong Kong, China, Japan, South Korea, Australia, New Zealand, Southeast Asia, India, and Europe with a market cap of HK$51.20 billion.

Operations: The company's revenue segments include Fund Management at $627.98 million and New Economy Development at $113.33 million, with an Investment segment loss of -$106.44 million.

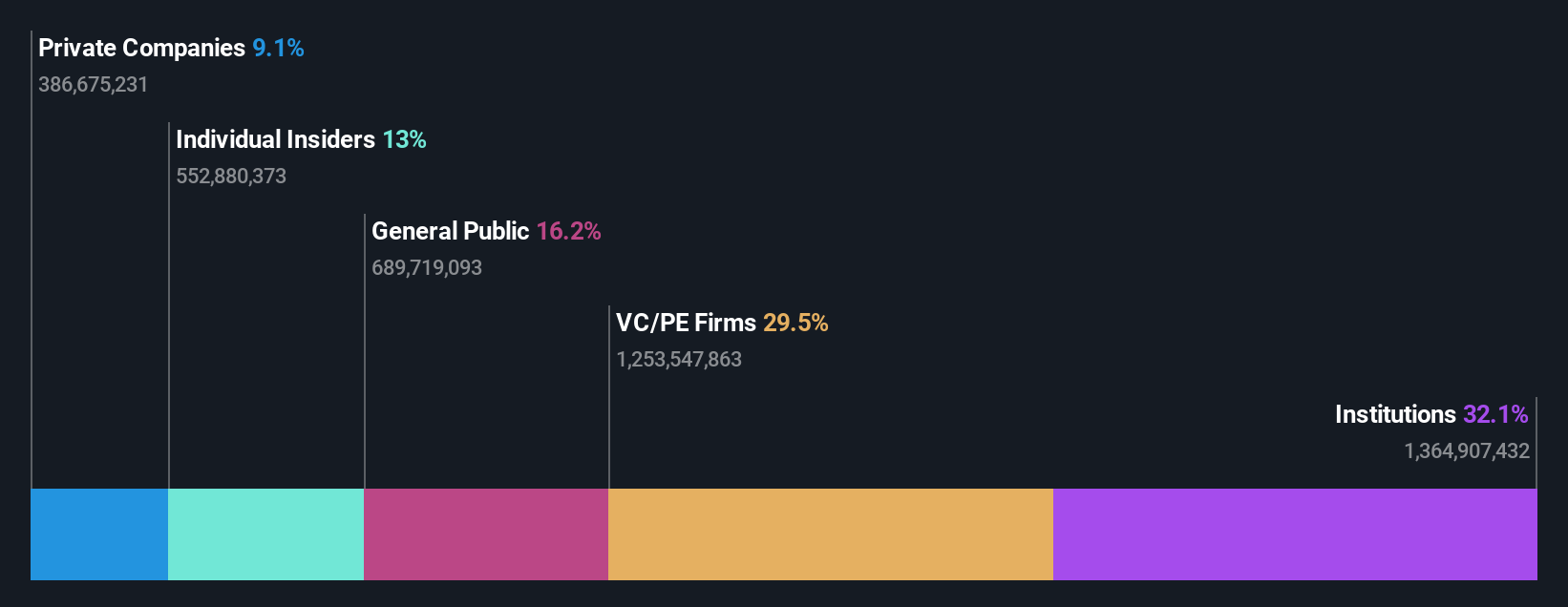

Insider Ownership: 13%

ESR Group is navigating significant changes with a proposed acquisition by major investors, including Warburg Pincus and Starwood Capital, aiming to acquire the remaining 60.09% stake. The company is trading below its estimated fair value but faces challenges with interest payments not well covered by earnings. Despite this, ESR's revenue growth forecast surpasses the Hong Kong market average, and it is expected to become profitable within three years, indicating potential for growth amidst insider ownership dynamics.

- Take a closer look at ESR Group's potential here in our earnings growth report.

- Our valuation report here indicates ESR Group may be overvalued.

Shenzhen Highpower Technology (SZSE:001283)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shenzhen Highpower Technology Co., Ltd. focuses on the research, design, development, manufacture, and sale of lithium-ion and nickel-metal hydride batteries in China with a market cap of CN¥5.03 billion.

Operations: Shenzhen Highpower Technology Co., Ltd. generates revenue through the production and sale of lithium-ion and nickel-metal hydride batteries within China.

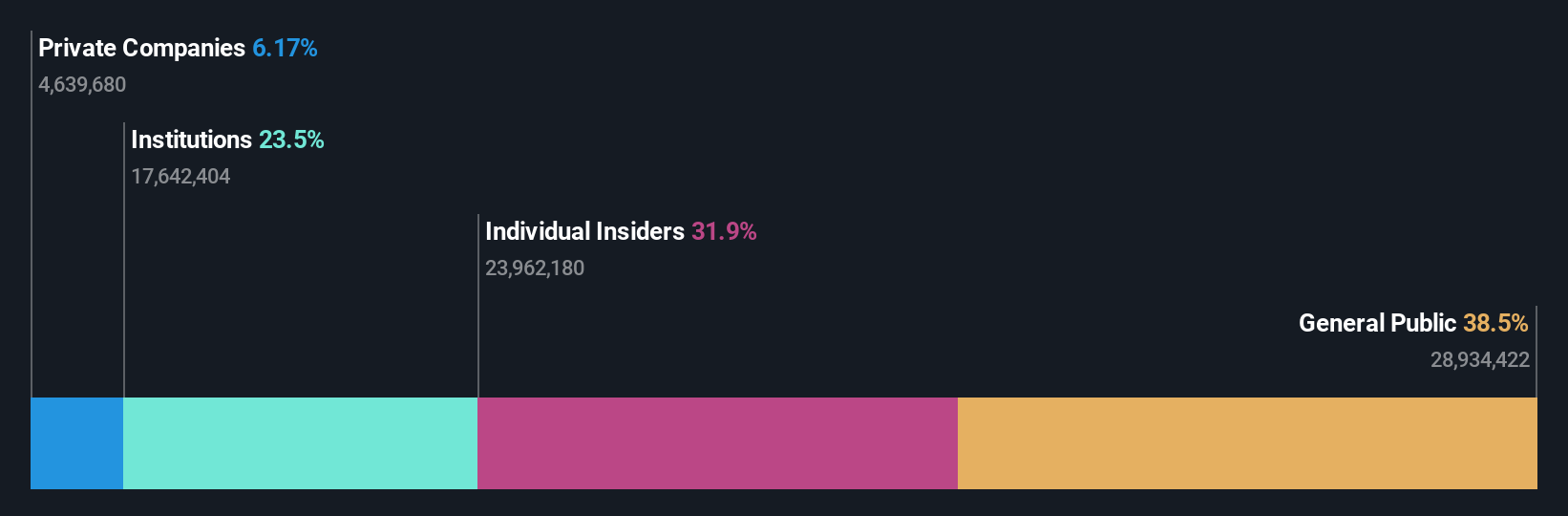

Insider Ownership: 30.2%

Shenzhen Highpower Technology is experiencing robust earnings growth, forecasted at 75.72% annually, outpacing the Chinese market average. Despite this, revenue growth is expected to be slower than 20% per year. Recent share buybacks of CNY 96.21 million reflect strong insider confidence but interest payments are not well covered by earnings, posing a financial risk. The dividend yield of 0.73% lacks coverage by free cash flows, indicating potential sustainability concerns amidst high insider ownership dynamics.

- Click here to discover the nuances of Shenzhen Highpower Technology with our detailed analytical future growth report.

- The valuation report we've compiled suggests that Shenzhen Highpower Technology's current price could be inflated.

Quanta Computer (TWSE:2382)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Quanta Computer Inc. is a global manufacturer and seller of notebook computers, with operations spanning Asia, the Americas, Europe, and other international markets, and has a market cap of NT$971.34 billion.

Operations: The company's revenue from the Electronics Sector is NT$2.78 billion.

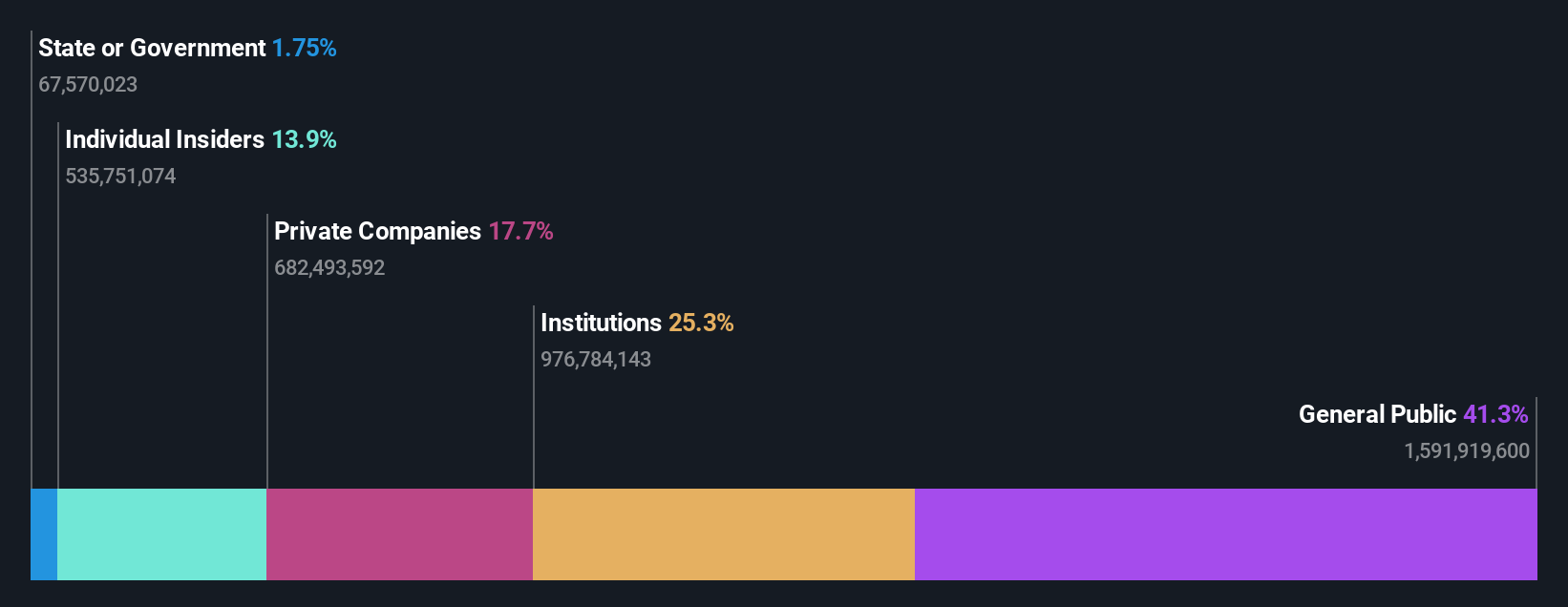

Insider Ownership: 13.7%

Quanta Computer shows strong growth potential, with earnings rising 41% over the past year and revenue expected to grow at 36.2% annually, surpassing market averages. Analysts anticipate a 44.4% price increase, highlighting its good relative value compared to peers. Recent private placements raised TWD 482 million, indicating strategic financial maneuvers. However, its dividend yield of 3.57% isn't well covered by free cash flows, suggesting some sustainability concerns despite high-quality earnings and insider ownership dynamics.

- Click to explore a detailed breakdown of our findings in Quanta Computer's earnings growth report.

- Upon reviewing our latest valuation report, Quanta Computer's share price might be too pessimistic.

Key Takeaways

- Unlock our comprehensive list of 1439 Fast Growing Companies With High Insider Ownership by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:001283

Shenzhen Highpower Technology

Engages in the research, design, development, manufacture, and sale of lithium-ion and nickel-metal hydride batteries in China.

Reasonable growth potential with proven track record.

Market Insights

Community Narratives