- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:2360

Three Prominent Growth Companies With Significant Insider Ownership

Reviewed by Simply Wall St

As global markets experience broad-based gains, with U.S. indexes approaching record highs and smaller-cap stocks outperforming large-caps, investors are closely monitoring the Federal Reserve's interest rate policies amidst a robust labor market and rising home sales. In such an environment, growth companies with significant insider ownership can be particularly appealing as they often align management interests with those of shareholders, potentially enhancing long-term value creation.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 43% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| SKS Technologies Group (ASX:SKS) | 32.4% | 24.8% |

| Laopu Gold (SEHK:6181) | 36.4% | 34% |

| On Holding (NYSE:ONON) | 19.1% | 29.6% |

| Pharma Mar (BME:PHM) | 11.8% | 56.9% |

| Findi (ASX:FND) | 34.8% | 71.5% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 103.6% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.7% | 95% |

Here's a peek at a few of the choices from the screener.

Guangzhou Great Power Energy and Technology (SZSE:300438)

Simply Wall St Growth Rating: ★★★★☆☆

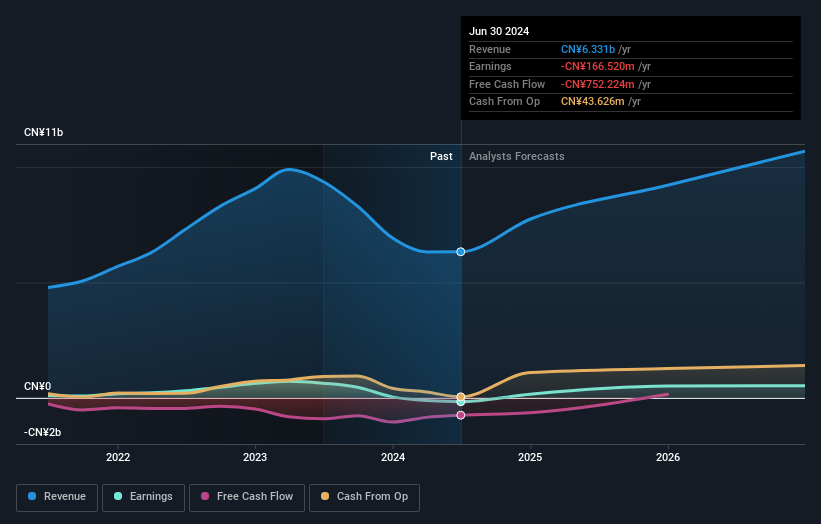

Overview: Guangzhou Great Power Energy and Technology Co., Ltd is engaged in the research, development, production, and sale of various batteries in China with a market cap of CN¥16.72 billion.

Operations: The company generates revenue of CN¥6.84 billion from its batteries and battery systems segment in China.

Insider Ownership: 34.5%

Revenue Growth Forecast: 18.7% p.a.

Guangzhou Great Power Energy and Technology has experienced a decline in net income from CNY 274.66 million to CNY 60.5 million over the past year, reflecting current challenges despite its growth potential. The company is expected to achieve profitability within three years, with forecasted annual profit growth of 81%, surpassing market averages. Revenue is projected to grow at 18.7% annually, outpacing the Chinese market's average, although return on equity remains low at an estimated 9.3%.

- Navigate through the intricacies of Guangzhou Great Power Energy and Technology with our comprehensive analyst estimates report here.

- Our comprehensive valuation report raises the possibility that Guangzhou Great Power Energy and Technology is priced higher than what may be justified by its financials.

Hon Hai Precision Industry (TWSE:2317)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hon Hai Precision Industry Co., Ltd. offers electronic OEM services and has a market cap of NT$2.82 trillion.

Operations: The company's revenue segments include NT$1.82 billion from the FIH Subgroup, NT$2.58 billion from the FII Subgroup, and NT$4.23 billion from Foxconn Population.

Insider Ownership: 12.6%

Revenue Growth Forecast: 18.2% p.a.

Hon Hai Precision Industry has demonstrated robust growth, with earnings increasing by 23.7% over the past year and expected to grow significantly in the coming years. Revenue is forecasted to rise at 18.2% annually, outpacing the Taiwan market's average growth rate. Despite this, its return on equity is projected to be relatively low at 12%. The company trades at a favorable price-to-earnings ratio compared to the local market and maintains a dividend yield of 2.59%, though not fully covered by free cash flow.

- Take a closer look at Hon Hai Precision Industry's potential here in our earnings growth report.

- Our valuation report unveils the possibility Hon Hai Precision Industry's shares may be trading at a discount.

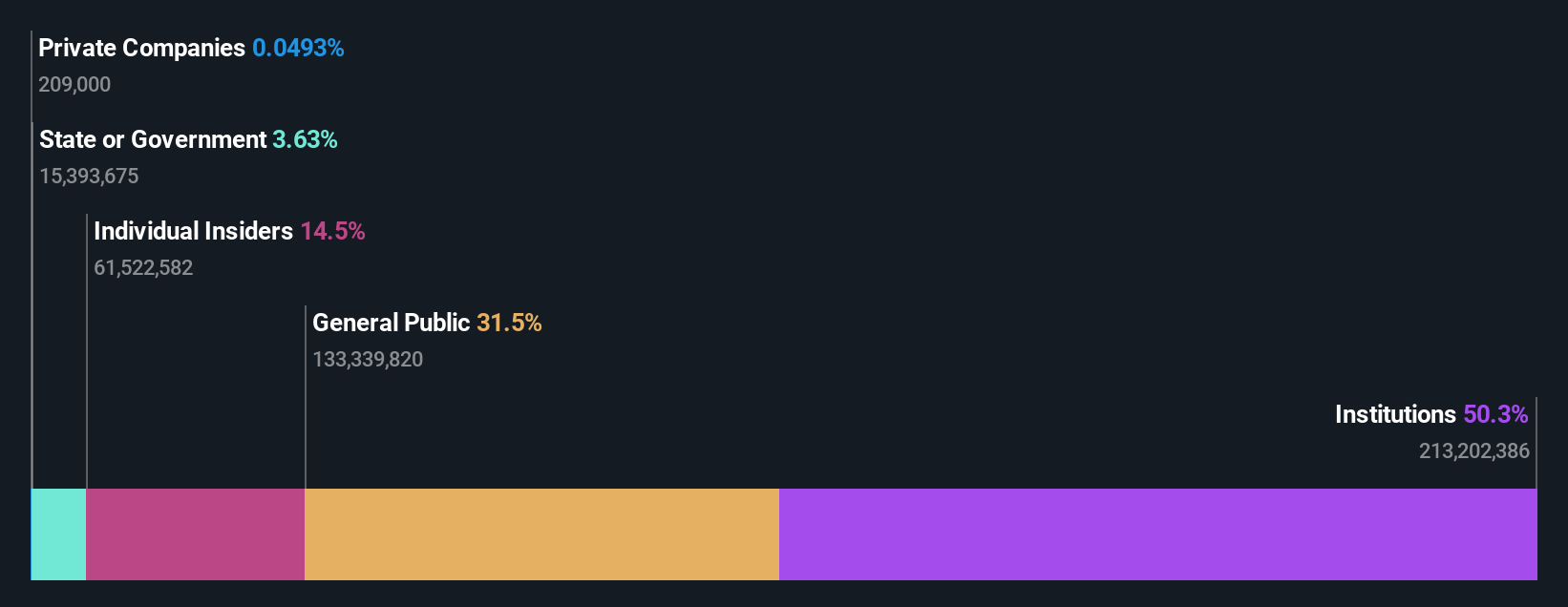

Chroma ATE (TWSE:2360)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Chroma ATE Inc. is involved in the design, assembly, manufacturing, sales, repair, and maintenance of software and hardware for computers and peripherals as well as various electronic testing equipment across Taiwan, China, the United States, and internationally; it has a market cap of NT$174.55 billion.

Operations: The company's revenue segments include NT$30.84 billion from the Measuring Instruments Business and NT$1.69 billion from Automated Transport Engineering.

Insider Ownership: 14.5%

Revenue Growth Forecast: 16.3% p.a.

Chroma ATE exhibits strong growth potential, with earnings forecasted to grow significantly at 24.9% annually, surpassing the Taiwan market's average. Recent earnings reports show a rise in revenue to TWD 15.57 billion for the first nine months of 2024, up from TWD 13.65 billion last year. Despite high share price volatility, it trades below its estimated fair value and showcases a robust return on equity projection of 28.3%.

- Click to explore a detailed breakdown of our findings in Chroma ATE's earnings growth report.

- Upon reviewing our latest valuation report, Chroma ATE's share price might be too optimistic.

Make It Happen

- Investigate our full lineup of 1529 Fast Growing Companies With High Insider Ownership right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2360

Chroma ATE

Designs, assembles, manufactures, sells, repairs, and maintains software/hardware for computers and peripherals, computerized automatic test systems, electronic test instruments, signal generators, power supplies, and telecom power supplies in Taiwan, China, the United States, and internationally.

Flawless balance sheet with high growth potential.