- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:2360

February 2025's Discounted Stock Opportunities For Value Investors

Reviewed by Simply Wall St

As global markets navigate through tariff uncertainties and mixed economic indicators, investors are keenly watching for opportunities that arise from these volatile conditions. In such an environment, identifying undervalued stocks becomes crucial as they can offer potential value amidst broader market fluctuations and earnings surprises.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Shihlin Electric & Engineering (TWSE:1503) | NT$172.00 | NT$350.17 | 50.9% |

| National World (LSE:NWOR) | £0.225 | £0.45 | 49.9% |

| World Fitness Services (TWSE:2762) | NT$89.90 | NT$179.40 | 49.9% |

| Northwest Bancshares (NasdaqGS:NWBI) | US$13.17 | US$26.20 | 49.7% |

| Telefonaktiebolaget LM Ericsson (OM:ERIC B) | SEK83.24 | SEK165.67 | 49.8% |

| Decisive Dividend (TSXV:DE) | CA$6.05 | CA$12.03 | 49.7% |

| Hanwha Systems (KOSE:A272210) | ₩24700.00 | ₩50252.31 | 50.8% |

| Kinaxis (TSX:KXS) | CA$165.40 | CA$330.68 | 50% |

| PR TIMES (TSE:3922) | ¥2276.00 | ¥4432.70 | 48.7% |

| Ming Yuan Cloud Group Holdings (SEHK:909) | HK$3.56 | HK$7.11 | 49.9% |

Here's a peek at a few of the choices from the screener.

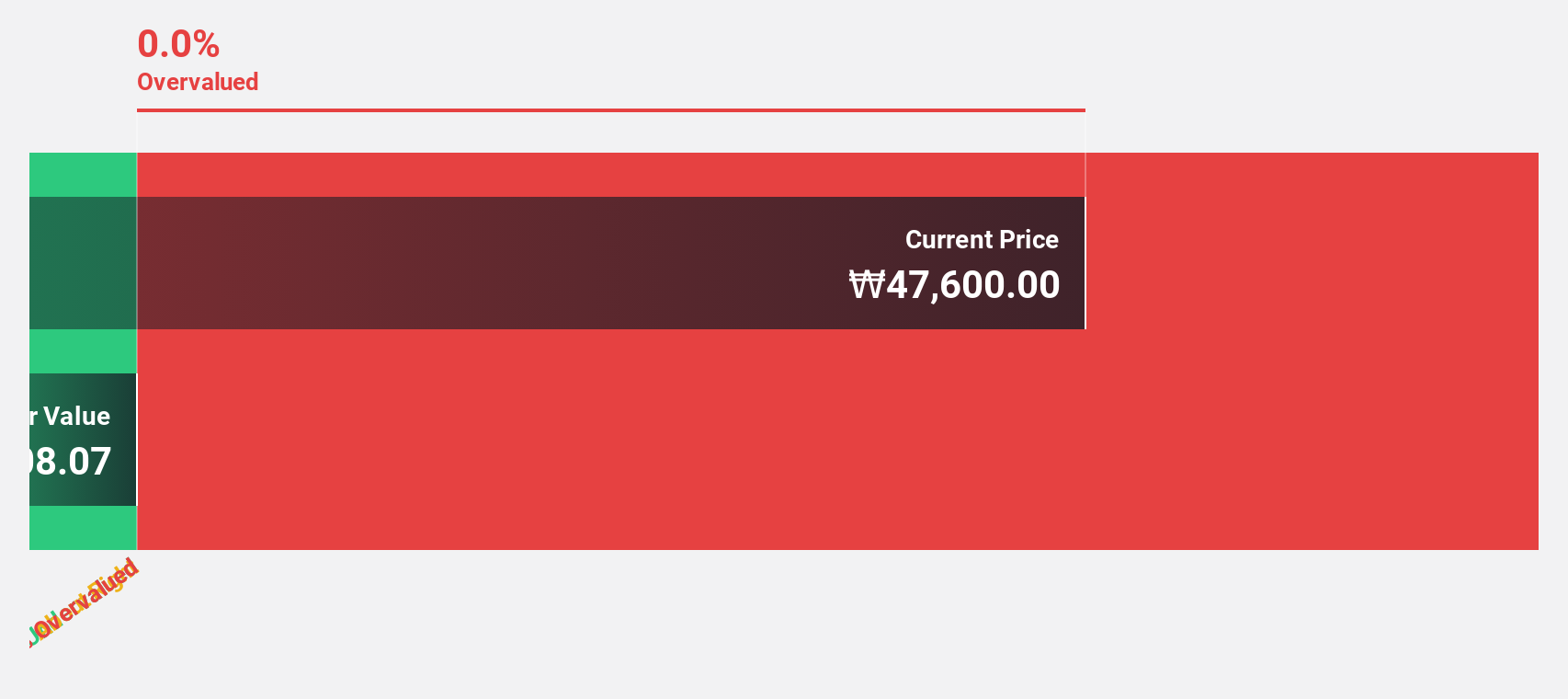

SK bioscienceLtd (KOSE:A302440)

Overview: SK bioscience Co., Ltd. focuses on the research, development, production, and distribution of vaccines and biopharmaceuticals both in Korea and internationally, with a market cap of approximately ₩3.78 trillion.

Operations: The company generates revenue from its pharmaceuticals segment, amounting to ₩201.30 billion.

Estimated Discount To Fair Value: 48.2%

SK bioscience Ltd. is trading at ₩49,050, significantly below its estimated fair value of ₩94,660.06, suggesting it might be undervalued based on cash flows. The company's revenue growth forecast of 17.9% per year surpasses the Korean market average and earnings are expected to grow substantially by 59.02% annually. Despite being unprofitable currently, profitability is anticipated within three years, supported by advancements in mRNA vaccine development and strategic partnerships with CEPI for pandemic preparedness initiatives.

- Our earnings growth report unveils the potential for significant increases in SK bioscienceLtd's future results.

- Get an in-depth perspective on SK bioscienceLtd's balance sheet by reading our health report here.

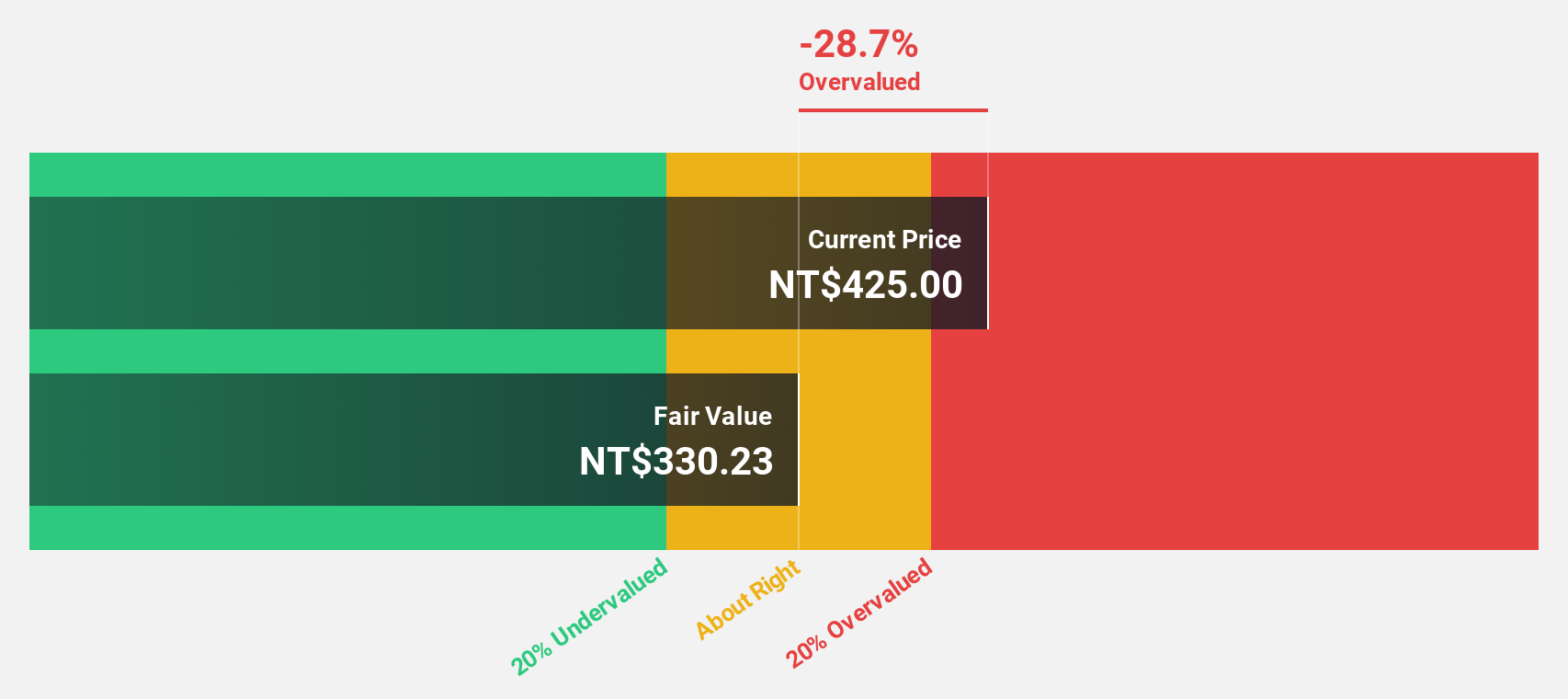

Chroma ATE (TWSE:2360)

Overview: Chroma ATE Inc. operates in the design, assembly, manufacturing, sales, repair, and maintenance of software/hardware for computers and peripherals as well as various electronic testing and power supply systems across Taiwan, China, the United States, and internationally with a market cap of NT$146.59 billion.

Operations: The company generates revenue primarily from its Measuring Instruments Business, which accounts for NT$30.84 billion, and Automated Transport Engineering, contributing NT$1.69 billion.

Estimated Discount To Fair Value: 33.8%

Chroma ATE, trading at NT$352.5, is valued 33.8% below its estimated fair value of NT$532.2, highlighting potential undervaluation based on cash flows. Expected revenue growth of 17.1% annually outpaces the Taiwanese market average, with earnings projected to rise significantly by 26.67% per year over the next three years. Despite high share price volatility recently and a dividend not well covered by free cash flows, analysts anticipate a stock price increase of 30.3%.

- Our growth report here indicates Chroma ATE may be poised for an improving outlook.

- Delve into the full analysis health report here for a deeper understanding of Chroma ATE.

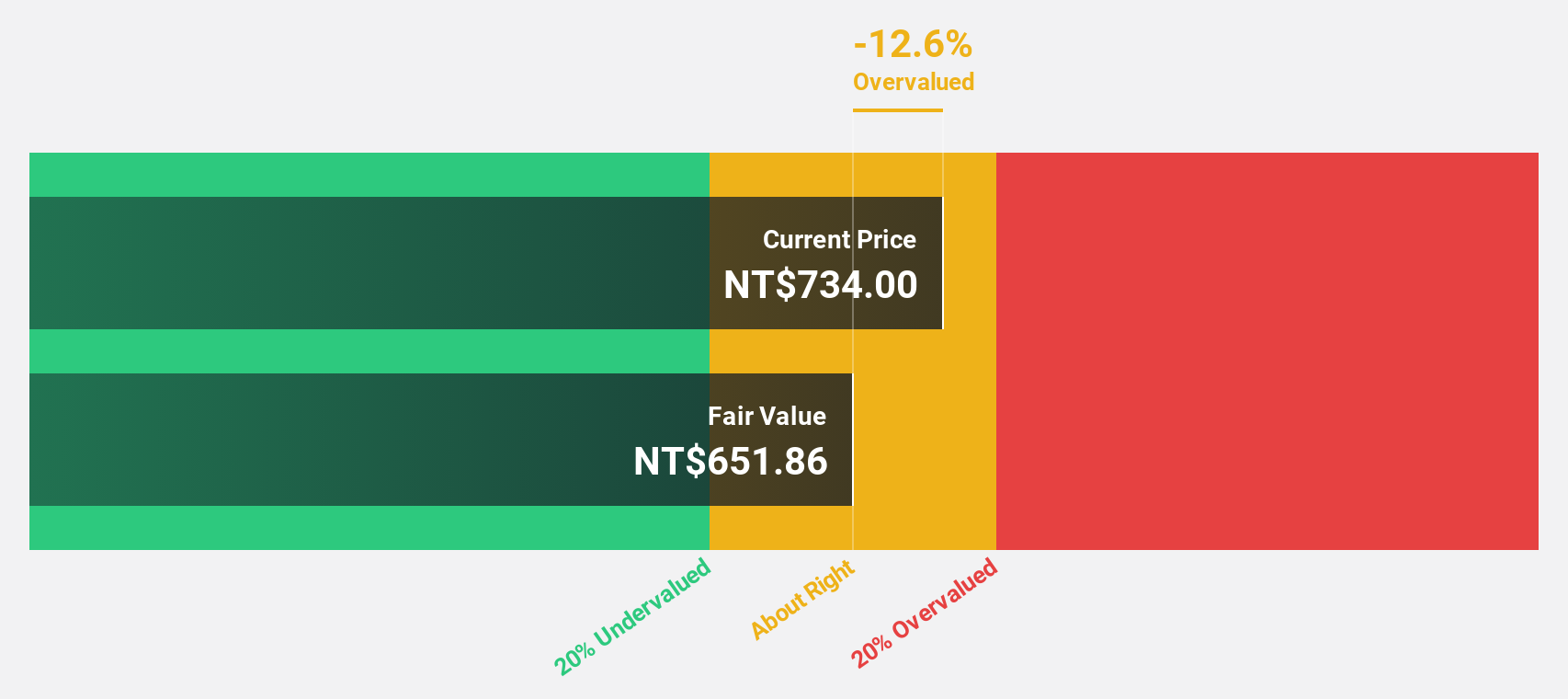

Asia Vital Components (TWSE:3017)

Overview: Asia Vital Components Co., Ltd. offers thermal solutions globally and has a market capitalization of NT$210.44 billion.

Operations: The company's revenue is primarily derived from its Overseas Operating Department, contributing NT$72.11 billion, and its Integrated Management Division, which accounts for NT$51.58 billion.

Estimated Discount To Fair Value: 41.7%

Asia Vital Components, trading at NT$539, is priced 41.7% below its estimated fair value of NT$924.9, indicating undervaluation based on cash flows. The company reported strong earnings growth of 59.2% over the past year and forecasts suggest earnings will grow by 30% annually, outpacing the Taiwanese market average. Despite recent share price volatility, analysts expect a potential stock price rise of 51%, supported by a high projected return on equity of 35.1%.

- In light of our recent growth report, it seems possible that Asia Vital Components' financial performance will exceed current levels.

- Take a closer look at Asia Vital Components' balance sheet health here in our report.

Summing It All Up

- Unlock more gems! Our Undervalued Stocks Based On Cash Flows screener has unearthed 912 more companies for you to explore.Click here to unveil our expertly curated list of 915 Undervalued Stocks Based On Cash Flows.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Chroma ATE, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2360

Chroma ATE

Designs, assembles, manufactures, sells, repairs, and maintains software/hardware for computers and peripherals, computerized automatic test systems, electronic test instruments, signal generators, power supplies, and telecom power supplies in Taiwan, China, the United States, and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives