As global markets react to the recent U.S. election results, with major indices like the S&P 500 reaching record highs on hopes of economic growth and tax reforms, investors are keenly observing how these developments might impact their portfolios. In this climate of shifting policies and economic indicators, dividend stocks present an attractive option for those looking to balance potential growth with steady income.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.63% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.90% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.81% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.45% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.81% | ★★★★★★ |

| Kwong Lung Enterprise (TPEX:8916) | 6.32% | ★★★★★★ |

| James Latham (AIM:LTHM) | 6.15% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.47% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.43% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.93% | ★★★★★★ |

Click here to see the full list of 1937 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

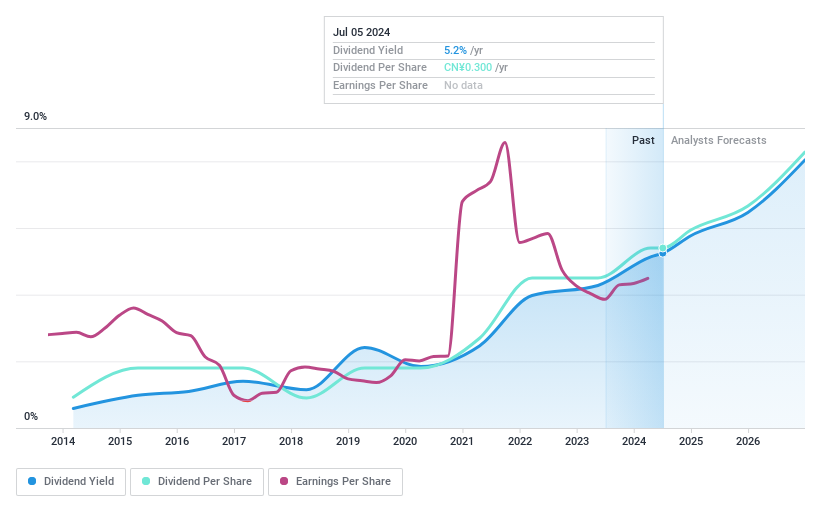

Shandong Sunway Chemical Group (SZSE:002469)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Shandong Sunway Chemical Group Co., Ltd. offers engineering services in the petrochemical and coal chemical industries in China, with a market cap of CN¥3.71 billion.

Operations: Shandong Sunway Chemical Group Co., Ltd. generates revenue through its provision of engineering services within the petrochemical and coal chemical sectors in China.

Dividend Yield: 3.4%

Shandong Sunway Chemical Group's dividend yield of 3.4% ranks in the top 25% within the Chinese market, yet its dividends have been unreliable and volatile over the past decade. Despite a low cash payout ratio of 21.6%, indicating coverage by cash flows, earnings do not cover dividends due to a high payout ratio of 114.3%. Recent financials show declining revenue and net income for the first nine months of 2024, raising concerns about dividend sustainability.

- Click here to discover the nuances of Shandong Sunway Chemical Group with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that Shandong Sunway Chemical Group is priced lower than what may be justified by its financials.

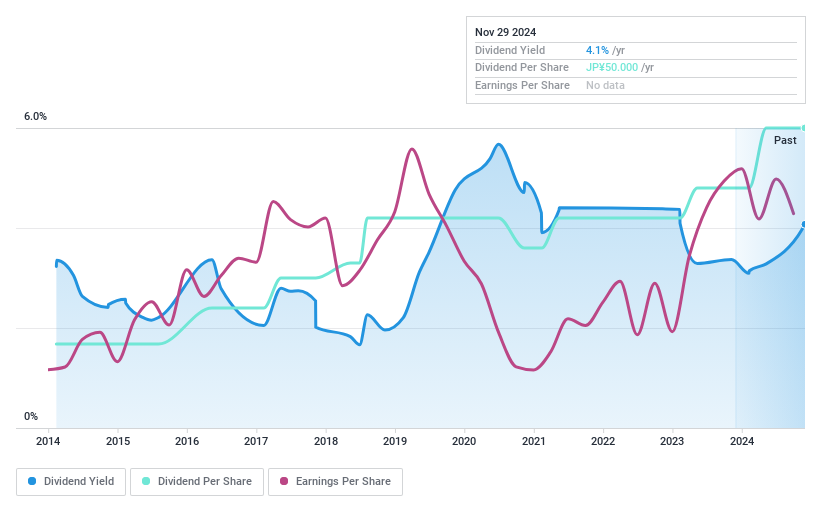

Sansei Technologies (TSE:6357)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sansei Technologies, Inc. is involved in the planning, design, manufacturing, installation, repair, and maintenance of amusement rides, stage equipment, elevators, and other specialized equipment both in Japan and internationally with a market cap of ¥25.84 billion.

Operations: Sansei Technologies generates revenue from its segments as follows: Amusement Machinery ¥33.14 billion, Stage Equipment ¥16.10 billion, and Elevator ¥6.53 billion.

Dividend Yield: 3.5%

Sansei Technologies' dividend payments have increased over the past decade, supported by a low payout ratio of 30.1%, indicating strong coverage by earnings and cash flows (cash payout ratio at 10.9%). However, the dividend yield of 3.52% is below Japan's top quartile payers, and its historical volatility raises concerns about reliability. Despite trading significantly below estimated fair value, investors should consider the unstable dividend track record when evaluating long-term income potential.

- Take a closer look at Sansei Technologies' potential here in our dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Sansei Technologies shares in the market.

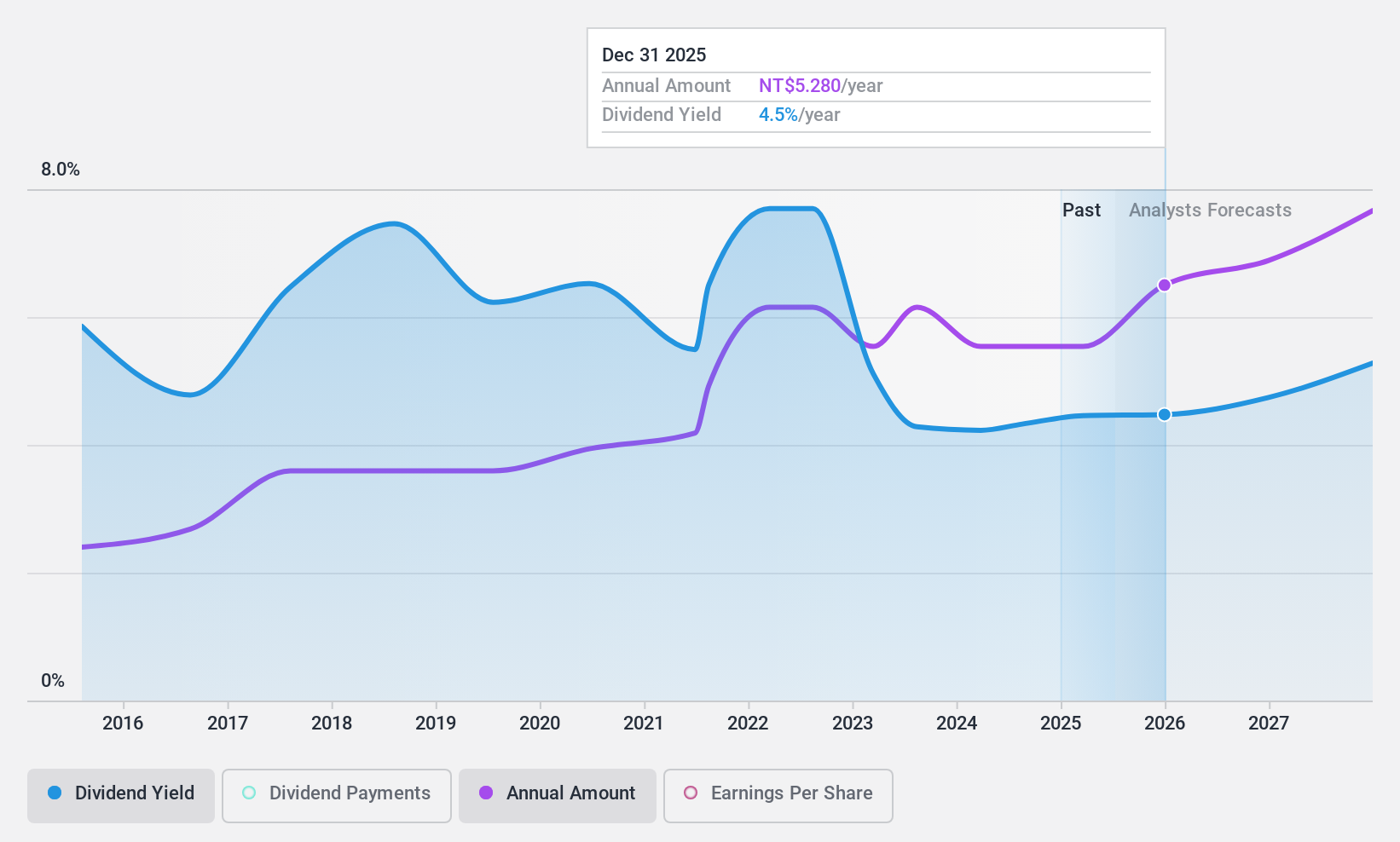

Lite-On Technology (TWSE:2301)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Lite-On Technology Corporation, along with its subsidiaries, focuses on the research, design, development, manufacture, and sale of modules and system solutions, with a market cap of NT$241.53 billion.

Operations: Lite-On Technology Corporation's revenue primarily comes from its Information and Consumer Electronics Segment, generating NT$60.96 billion, followed by the Cloud and IoT Segment at NT$47.74 billion, and the Optoelectronic Department contributing NT$28.58 billion.

Dividend Yield: 4.1%

Lite-On Technology's dividend is covered by earnings and cash flows, with payout ratios of 83.5% and 83.6%, respectively, though its historical volatility raises reliability concerns. Recent earnings showed a decline in net income to TWD 3.39 billion for Q3 2024 from TWD 4.56 billion a year ago, impacting its ability to sustain dividends consistently. Trading at good value compared to peers, the dividend yield of 4.13% remains below Taiwan's top quartile payers' average of 4.42%.

- Dive into the specifics of Lite-On Technology here with our thorough dividend report.

- In light of our recent valuation report, it seems possible that Lite-On Technology is trading behind its estimated value.

Next Steps

- Click through to start exploring the rest of the 1934 Top Dividend Stocks now.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6357

Sansei Technologies

Plans, designs, manufactures, installs, repairs, and maintains amusement rides, stage equipment, elevators, and other designed equipment in Japan and internationally.

Flawless balance sheet established dividend payer.