As global markets navigate through heightened trade tensions and fluctuating consumer sentiment, U.S. stocks have experienced notable volatility, with indices like the Nasdaq Composite surging over 12% in a single day amid tariff-related developments. In this environment of uncertainty, identifying high growth tech stocks requires a keen focus on companies with robust innovation capabilities and resilience to external economic pressures, making them potential standouts amidst broader market fluctuations.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 20.81% | 26.05% | ★★★★★★ |

| Shanghai Huace Navigation Technology | 26.94% | 24.43% | ★★★★★★ |

| Pharma Mar | 24.24% | 40.82% | ★★★★★★ |

| eWeLLLtd | 24.66% | 25.31% | ★★★★★★ |

| Seojin SystemLtd | 31.68% | 39.34% | ★★★★★★ |

| CD Projekt | 33.78% | 37.39% | ★★★★★★ |

| Arabian Contracting Services | 21.29% | 30.65% | ★★★★★★ |

| Elliptic Laboratories | 49.76% | 88.21% | ★★★★★★ |

| Ascelia Pharma | 46.09% | 66.93% | ★★★★★★ |

| JNTC | 34.26% | 86.00% | ★★★★★★ |

Below we spotlight a couple of our favorites from our exclusive screener.

E Ink Holdings (TPEX:8069)

Simply Wall St Growth Rating: ★★★★★★

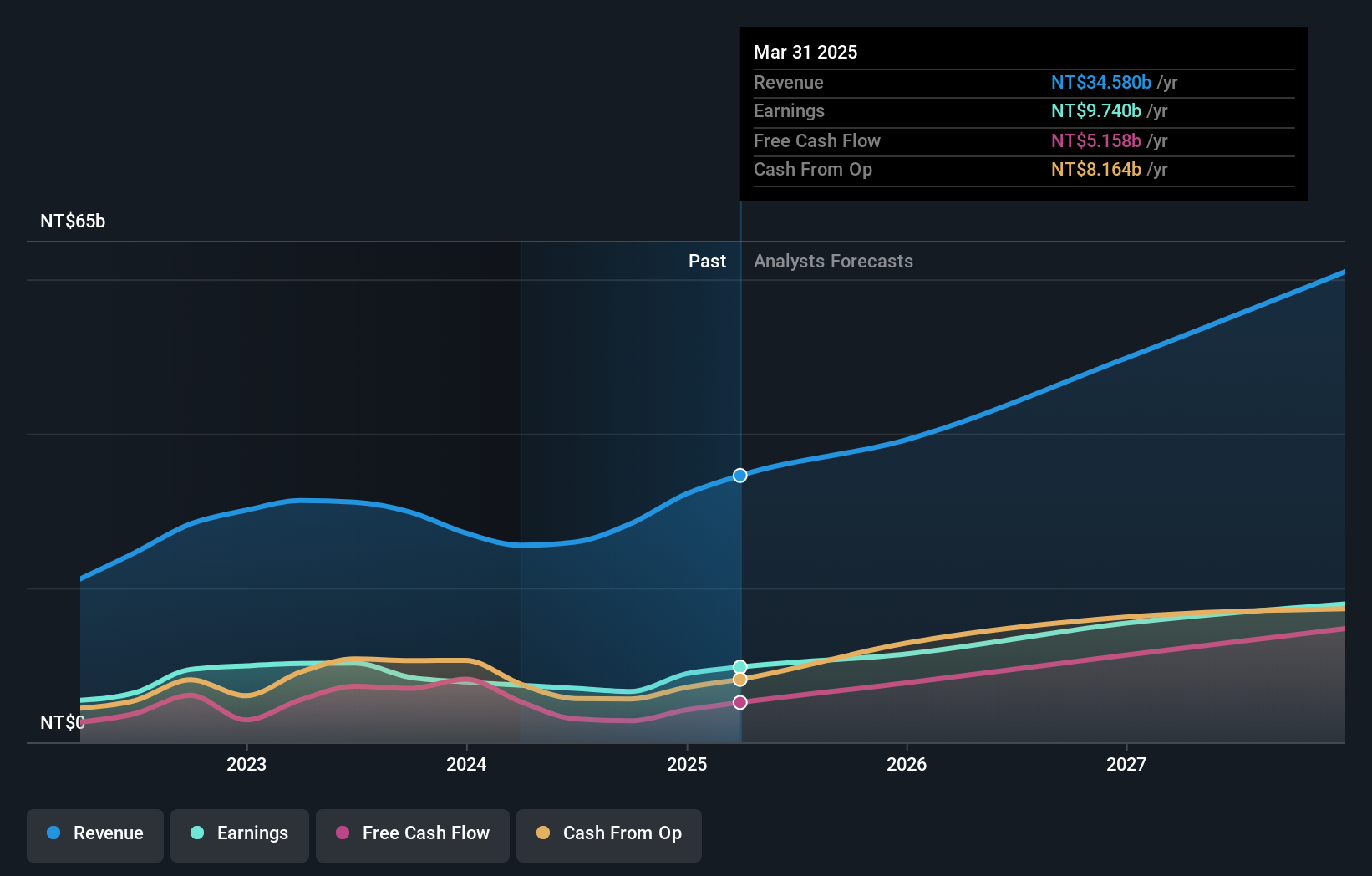

Overview: E Ink Holdings Inc. is a global leader in the research, development, manufacturing, and sale of electronic paper display panels with a market capitalization of NT$271.58 billion.

Operations: E Ink Holdings generates revenue primarily from the sale of electronic components and parts, amounting to NT$32.16 billion. The company's focus on electronic paper display panels positions it as a significant player in this niche market globally.

E Ink Holdings, a leader in ePaper technology, continues to innovate with its recent product launches like the E Ink Spectra™ 6 and E Ink Marquee, which are pivotal in transforming digital signage and advertising industries. These products not only offer vibrant colors and energy efficiency but also operate across extreme temperatures, making them suitable for diverse environments. The company's commitment to sustainability is evident as nearly all of its product sales revenue is considered green by FTSE Russell standards. With a strategic joint venture set to enhance large-sized EPD module production capabilities, E Ink is poised to meet increasing demand while adhering to low-carbon, eco-friendly principles that align with global ESG trends. This approach not only secures its market position but also drives future growth prospects in the high-growth tech sector.

- Click to explore a detailed breakdown of our findings in E Ink Holdings' health report.

Understand E Ink Holdings' track record by examining our Past report.

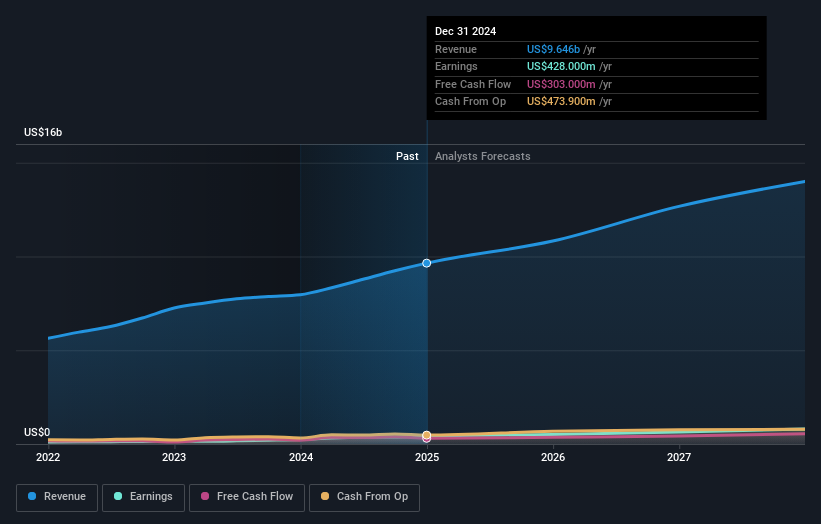

Celestica (TSX:CLS)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Celestica Inc. offers supply chain solutions across North America, Europe, and Asia with a market capitalization of CA$12.75 billion.

Operations: Celestica Inc. generates revenue through two primary segments: Advanced Technology Solutions (ATS) and Connectivity & Cloud Solutions (CCS), with the latter contributing $6.49 billion. The company's operations span North America, Europe, and Asia, focusing on providing comprehensive supply chain solutions.

Celestica has demonstrated robust financial performance, with a notable 75.1% earnings growth over the past year, significantly outpacing the electronic industry's -4.6%. This growth is underpinned by strategic investments in R&D, which have not only fueled innovations but also positioned the company well above market expectations with projected annual revenue and earnings growth rates of 12.7% and 20.7%, respectively. The firm's recent shelf registration suggests a readiness to fund further expansion or innovation, aligning with its aggressive growth strategy in high-tech sectors. Moreover, Celestica's commitment to shareholder returns is evident from its recent completion of a share buyback program worth $129.58 million, underscoring confidence in its financial health and future prospects.

- Unlock comprehensive insights into our analysis of Celestica stock in this health report.

Examine Celestica's past performance report to understand how it has performed in the past.

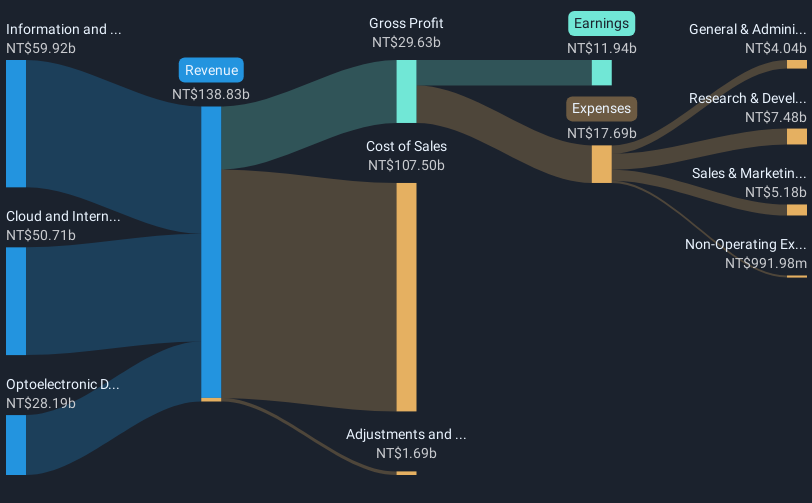

Lite-On Technology (TWSE:2301)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lite-On Technology Corporation, with a market cap of approximately NT$200.58 billion, is involved in the research, design, development, manufacture, and sale of modules and system solutions through its subsidiaries.

Operations: Lite-On Technology generates revenue primarily from its Information and Consumer Electronics Sector, which accounts for NT$59.92 billion, followed by the Cloud and Internet of Things department at NT$50.71 billion. The Optoelectronic Department contributes NT$28.19 billion to the company's revenue stream.

Lite-On Technology's strategic maneuvers, including a significant share repurchase program for TWD 62.13 billion, underscore its robust financial confidence and commitment to shareholder value. With an annualized revenue growth of 11.1% and earnings expansion at 20.7%, the company is outpacing the broader Taiwanese market averages of 9.9% and 14.8%, respectively. This performance is bolstered by its participation in high-profile tech conferences and substantial contracts like the Quang Ninh Phase 1 project, signaling strong operational capabilities and industry trust in its technological solutions.

- Click here to discover the nuances of Lite-On Technology with our detailed analytical health report.

Key Takeaways

- Click here to access our complete index of 759 Global High Growth Tech and AI Stocks.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Celestica, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CLS

Celestica

Provides supply chain solutions in North America, Europe, and Asia.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives