The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, Chenbro Micom Co., Ltd. (TPE:8210) does carry debt. But is this debt a concern to shareholders?

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for Chenbro Micom

How Much Debt Does Chenbro Micom Carry?

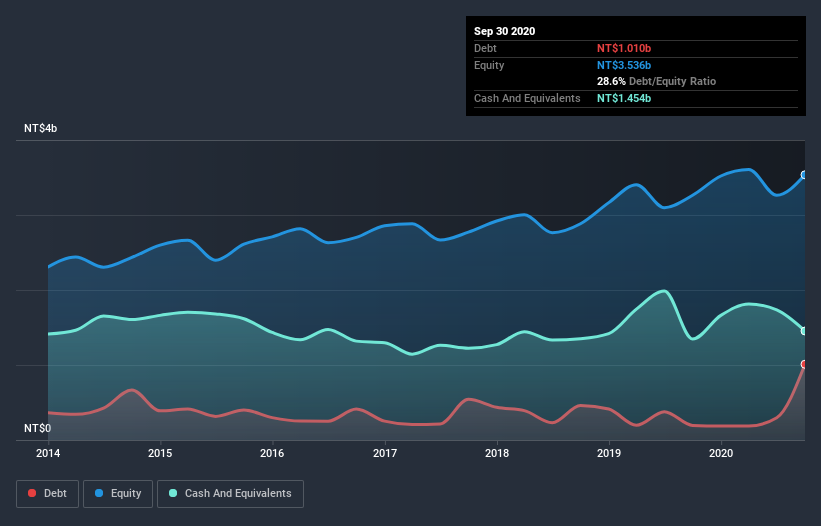

As you can see below, at the end of September 2020, Chenbro Micom had NT$1.01b of debt, up from NT$194.6m a year ago. Click the image for more detail. However, its balance sheet shows it holds NT$1.45b in cash, so it actually has NT$443.7m net cash.

How Healthy Is Chenbro Micom's Balance Sheet?

The latest balance sheet data shows that Chenbro Micom had liabilities of NT$4.00b due within a year, and liabilities of NT$302.6m falling due after that. Offsetting these obligations, it had cash of NT$1.45b as well as receivables valued at NT$1.85b due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by NT$997.4m.

Given Chenbro Micom has a market capitalization of NT$9.93b, it's hard to believe these liabilities pose much threat. Having said that, it's clear that we should continue to monitor its balance sheet, lest it change for the worse. Despite its noteworthy liabilities, Chenbro Micom boasts net cash, so it's fair to say it does not have a heavy debt load!

On the other hand, Chenbro Micom saw its EBIT drop by 3.4% in the last twelve months. That sort of decline, if sustained, will obviously make debt harder to handle. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Chenbro Micom can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. While Chenbro Micom has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. During the last three years, Chenbro Micom produced sturdy free cash flow equating to 51% of its EBIT, about what we'd expect. This cold hard cash means it can reduce its debt when it wants to.

Summing up

Although Chenbro Micom's balance sheet isn't particularly strong, due to the total liabilities, it is clearly positive to see that it has net cash of NT$443.7m. So we don't have any problem with Chenbro Micom's use of debt. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. Be aware that Chenbro Micom is showing 1 warning sign in our investment analysis , you should know about...

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you’re looking to trade Chenbro Micom, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:8210

Chenbro Micom

Engages in the research and development, design, manufacture, processing, and trading of computer peripherals and system of expendables in the United States, China, Taiwan, Singapore, and internationally.

Outstanding track record with excellent balance sheet and pays a dividend.