- Taiwan

- /

- Semiconductors

- /

- TWSE:2388

VIA Technologies, Inc.'s (TWSE:2388) Price Is Out Of Tune With Revenues

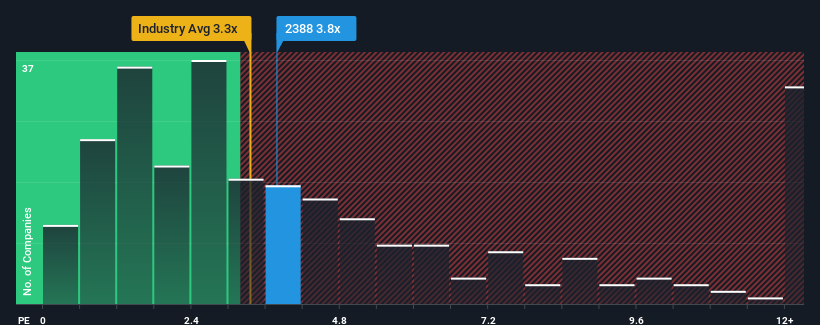

There wouldn't be many who think VIA Technologies, Inc.'s (TWSE:2388) price-to-sales (or "P/S") ratio of 3.8x is worth a mention when the median P/S for the Semiconductor industry in Taiwan is similar at about 3.3x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for VIA Technologies

What Does VIA Technologies' Recent Performance Look Like?

VIA Technologies certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. The P/S is probably moderate because investors think this strong revenue growth might not be enough to outperform the broader industry in the near future. If that doesn't eventuate, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on VIA Technologies' earnings, revenue and cash flow.How Is VIA Technologies' Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like VIA Technologies' is when the company's growth is tracking the industry closely.

If we review the last year of revenue growth, the company posted a terrific increase of 37%. The strong recent performance means it was also able to grow revenue by 114% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Comparing that to the industry, which is predicted to deliver 17,848% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

With this in mind, we find it intriguing that VIA Technologies' P/S is comparable to that of its industry peers. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. They may be setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

What We Can Learn From VIA Technologies' P/S?

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that VIA Technologies' average P/S is a bit surprising since its recent three-year growth is lower than the wider industry forecast. When we see weak revenue with slower than industry growth, we suspect the share price is at risk of declining, bringing the P/S back in line with expectations. Unless the recent medium-term conditions improve, it's hard to accept the current share price as fair value.

There are also other vital risk factors to consider and we've discovered 4 warning signs for VIA Technologies (1 makes us a bit uncomfortable!) that you should be aware of before investing here.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:2388

VIA Technologies

Engages in the programming, design, manufacture, and sale of semiconductors and PC chip sets in Taiwan, Hong Kong, and China.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives