- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:6672

Ventec International GroupLtd (TPE:6672) Could Easily Take On More Debt

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that Ventec International Group Co.,Ltd. (TPE:6672) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for Ventec International GroupLtd

What Is Ventec International GroupLtd's Net Debt?

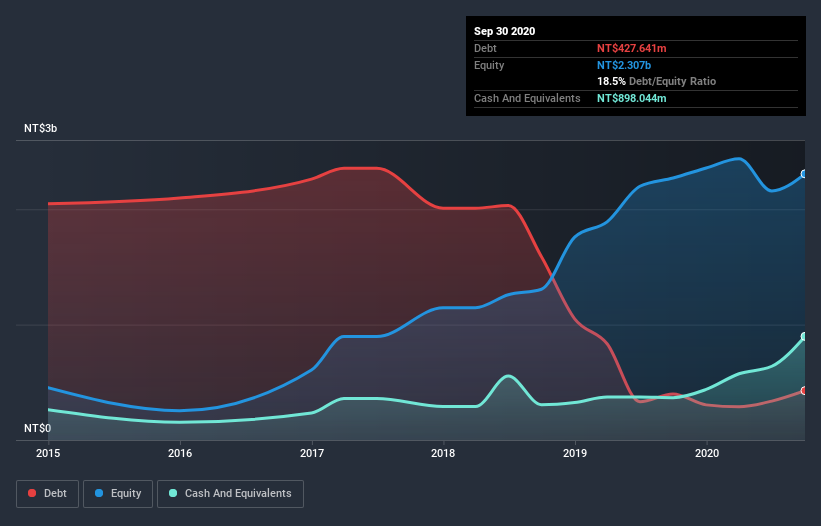

As you can see below, at the end of September 2020, Ventec International GroupLtd had NT$427.6m of debt, up from NT$399.7m a year ago. Click the image for more detail. However, it does have NT$898.0m in cash offsetting this, leading to net cash of NT$470.4m.

How Healthy Is Ventec International GroupLtd's Balance Sheet?

The latest balance sheet data shows that Ventec International GroupLtd had liabilities of NT$1.59b due within a year, and liabilities of NT$383.4m falling due after that. Offsetting these obligations, it had cash of NT$898.0m as well as receivables valued at NT$1.33b due within 12 months. So it can boast NT$260.9m more liquid assets than total liabilities.

This short term liquidity is a sign that Ventec International GroupLtd could probably pay off its debt with ease, as its balance sheet is far from stretched. Succinctly put, Ventec International GroupLtd boasts net cash, so it's fair to say it does not have a heavy debt load!

The good news is that Ventec International GroupLtd has increased its EBIT by 4.7% over twelve months, which should ease any concerns about debt repayment. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Ventec International GroupLtd can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. While Ventec International GroupLtd has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Over the last three years, Ventec International GroupLtd recorded free cash flow worth a fulsome 99% of its EBIT, which is stronger than we'd usually expect. That puts it in a very strong position to pay down debt.

Summing up

While we empathize with investors who find debt concerning, you should keep in mind that Ventec International GroupLtd has net cash of NT$470.4m, as well as more liquid assets than liabilities. The cherry on top was that in converted 99% of that EBIT to free cash flow, bringing in NT$569m. So is Ventec International GroupLtd's debt a risk? It doesn't seem so to us. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. For instance, we've identified 1 warning sign for Ventec International GroupLtd that you should be aware of.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you’re looking to trade Ventec International GroupLtd, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TWSE:6672

Ventec International GroupLtd

Engages in the research and development, production, and sale of copper clad laminates, aluminium-backed laminate, and prepreg bonding.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026