- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:6271

Tong Hsing Electronic Industries, Ltd.'s (TPE:6271) Stock Been Rising But Financials Look Weak: Should Shareholders Be Worried?

Tong Hsing Electronic Industries' (TPE:6271) stock up by 6.5% over the past three months. However, its weak financial performance indicators makes us a bit doubtful if that trend could continue. Particularly, we will be paying attention to Tong Hsing Electronic Industries' ROE today.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. In simpler terms, it measures the profitability of a company in relation to shareholder's equity.

View our latest analysis for Tong Hsing Electronic Industries

How Is ROE Calculated?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Tong Hsing Electronic Industries is:

5.8% = NT$1.2b ÷ NT$21b (Based on the trailing twelve months to September 2020).

The 'return' is the profit over the last twelve months. So, this means that for every NT$1 of its shareholder's investments, the company generates a profit of NT$0.06.

What Is The Relationship Between ROE And Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

A Side By Side comparison of Tong Hsing Electronic Industries' Earnings Growth And 5.8% ROE

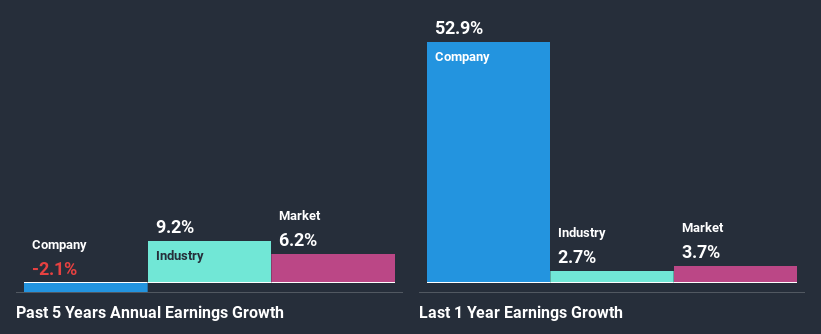

At first glance, Tong Hsing Electronic Industries' ROE doesn't look very promising. We then compared the company's ROE to the broader industry and were disappointed to see that the ROE is lower than the industry average of 9.9%. Given the circumstances, the significant decline in net income by 2.1% seen by Tong Hsing Electronic Industries over the last five years is not surprising. However, there could also be other factors causing the earnings to decline. For instance, the company has a very high payout ratio, or is faced with competitive pressures.

However, when we compared Tong Hsing Electronic Industries' growth with the industry we found that while the company's earnings have been shrinking, the industry has seen an earnings growth of 9.2% in the same period. This is quite worrisome.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. What is 6271 worth today? The intrinsic value infographic in our free research report helps visualize whether 6271 is currently mispriced by the market.

Is Tong Hsing Electronic Industries Making Efficient Use Of Its Profits?

Tong Hsing Electronic Industries' declining earnings is not surprising given how the company is spending most of its profits in paying dividends, judging by its three-year median payout ratio of 97% (or a retention ratio of 2.7%). The business is only left with a small pool of capital to reinvest - A vicious cycle that doesn't benefit the company in the long-run.

In addition, Tong Hsing Electronic Industries has been paying dividends over a period of at least ten years suggesting that keeping up dividend payments is way more important to the management even if it comes at the cost of business growth. Existing analyst estimates suggest that the company's future payout ratio is expected to drop to 69% over the next three years. The fact that the company's ROE is expected to rise to 12% over the same period is explained by the drop in the payout ratio.

Conclusion

Overall, we would be extremely cautious before making any decision on Tong Hsing Electronic Industries. Particularly, its ROE is a huge disappointment, not to mention its lack of proper reinvestment into the business. As a result its earnings growth has also been quite disappointing. With that said, we studied the latest analyst forecasts and found that while the company has shrunk its earnings in the past, analysts expect its earnings to grow in the future. To know more about the latest analysts predictions for the company, check out this visualization of analyst forecasts for the company.

If you’re looking to trade Tong Hsing Electronic Industries, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Tong Hsing Electronic Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TWSE:6271

Tong Hsing Electronic Industries

Engages in the development and production of thick film substrates and customized semiconductor micro-module packaging.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion