- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:6213

These 4 Measures Indicate That ITEQ (TPE:6213) Is Using Debt Reasonably Well

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that ITEQ Corporation (TPE:6213) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for ITEQ

What Is ITEQ's Net Debt?

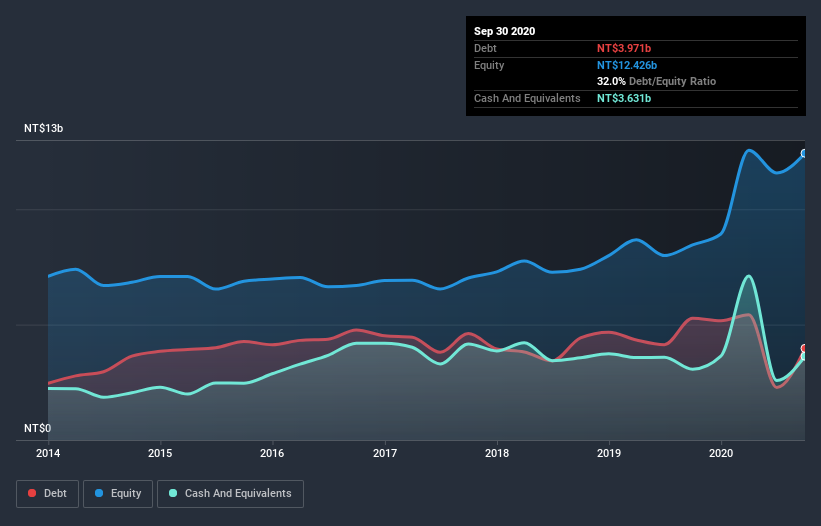

The image below, which you can click on for greater detail, shows that ITEQ had debt of NT$3.97b at the end of September 2020, a reduction from NT$5.28b over a year. However, it also had NT$3.63b in cash, and so its net debt is NT$340.4m.

How Healthy Is ITEQ's Balance Sheet?

According to the last reported balance sheet, ITEQ had liabilities of NT$11.2b due within 12 months, and liabilities of NT$2.30b due beyond 12 months. Offsetting this, it had NT$3.63b in cash and NT$12.3b in receivables that were due within 12 months. So it actually has NT$2.45b more liquid assets than total liabilities.

This surplus suggests that ITEQ has a conservative balance sheet, and could probably eliminate its debt without much difficulty. Carrying virtually no net debt, ITEQ has a very light debt load indeed.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

ITEQ has very little debt (net of cash), and boasts a debt to EBITDA ratio of 0.086 and EBIT of 52.3 times the interest expense. Indeed relative to its earnings its debt load seems light as a feather. Another good sign is that ITEQ has been able to increase its EBIT by 25% in twelve months, making it easier to pay down debt. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if ITEQ can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. Over the last three years, ITEQ reported free cash flow worth 6.8% of its EBIT, which is really quite low. That limp level of cash conversion undermines its ability to manage and pay down debt.

Our View

Happily, ITEQ's impressive interest cover implies it has the upper hand on its debt. But we must concede we find its conversion of EBIT to free cash flow has the opposite effect. Looking at the bigger picture, we think ITEQ's use of debt seems quite reasonable and we're not concerned about it. After all, sensible leverage can boost returns on equity. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with ITEQ (at least 1 which is a bit concerning) , and understanding them should be part of your investment process.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you’re looking to trade ITEQ, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:6213

ITEQ

Engages in the manufacture and sale of copper clad laminate materials used for fabrication of printed circuit boards in Taiwan, Asia, Europe, and internationally.

Excellent balance sheet with proven track record.