- Taiwan

- /

- Tech Hardware

- /

- TWSE:3011

Ji-Haw IndustrialLtd (TPE:3011) Has Debt But No Earnings; Should You Worry?

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that Ji-Haw Industrial Co.,Ltd. (TPE:3011) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

What Risk Does Debt Bring?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Ji-Haw IndustrialLtd

What Is Ji-Haw IndustrialLtd's Net Debt?

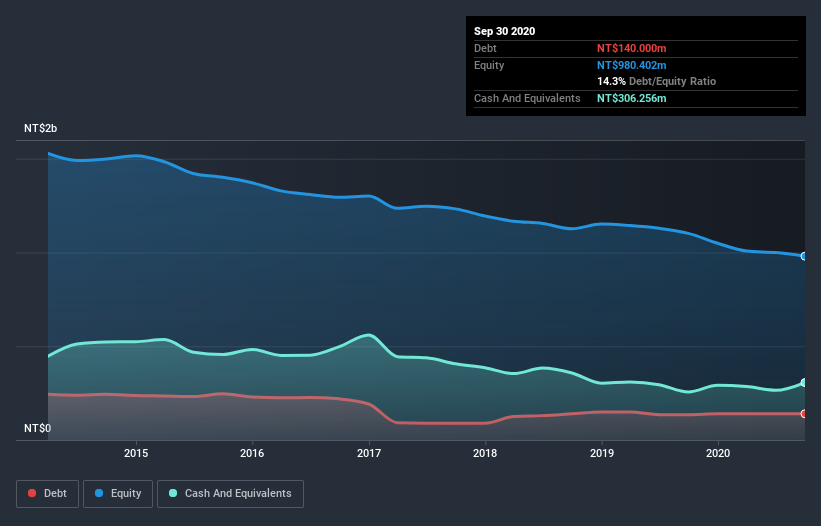

The chart below, which you can click on for greater detail, shows that Ji-Haw IndustrialLtd had NT$140.0m in debt in September 2020; about the same as the year before. However, its balance sheet shows it holds NT$306.3m in cash, so it actually has NT$166.3m net cash.

A Look At Ji-Haw IndustrialLtd's Liabilities

The latest balance sheet data shows that Ji-Haw IndustrialLtd had liabilities of NT$685.0m due within a year, and liabilities of NT$111.6m falling due after that. Offsetting this, it had NT$306.3m in cash and NT$513.3m in receivables that were due within 12 months. So it can boast NT$23.1m more liquid assets than total liabilities.

This short term liquidity is a sign that Ji-Haw IndustrialLtd could probably pay off its debt with ease, as its balance sheet is far from stretched. Succinctly put, Ji-Haw IndustrialLtd boasts net cash, so it's fair to say it does not have a heavy debt load! When analysing debt levels, the balance sheet is the obvious place to start. But it is Ji-Haw IndustrialLtd's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

In the last year Ji-Haw IndustrialLtd had a loss before interest and tax, and actually shrunk its revenue by 8.1%, to NT$1.3b. That's not what we would hope to see.

So How Risky Is Ji-Haw IndustrialLtd?

While Ji-Haw IndustrialLtd lost money on an earnings before interest and tax (EBIT) level, it actually generated positive free cash flow NT$36m. So although it is loss-making, it doesn't seem to have too much near-term balance sheet risk, keeping in mind the net cash. We'll feel more comfortable with the stock once EBIT is positive, given the lacklustre revenue growth. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. Case in point: We've spotted 1 warning sign for Ji-Haw IndustrialLtd you should be aware of.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

If you’re looking to trade Ji-Haw IndustrialLtd, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:3011

Ji-Haw IndustrialLtd

Manufactures and sells of precision electric ports and sockets, connectors, electric wires and cables, electronics components, and other industrial and commercial services in Taiwan, China, and Thailand.

Low risk with imperfect balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)