- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:2486

Is I-Chiun Precision Industry (TPE:2486) Using Debt In A Risky Way?

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about. So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies I-Chiun Precision Industry Co., Ltd. (TPE:2486) makes use of debt. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for I-Chiun Precision Industry

What Is I-Chiun Precision Industry's Debt?

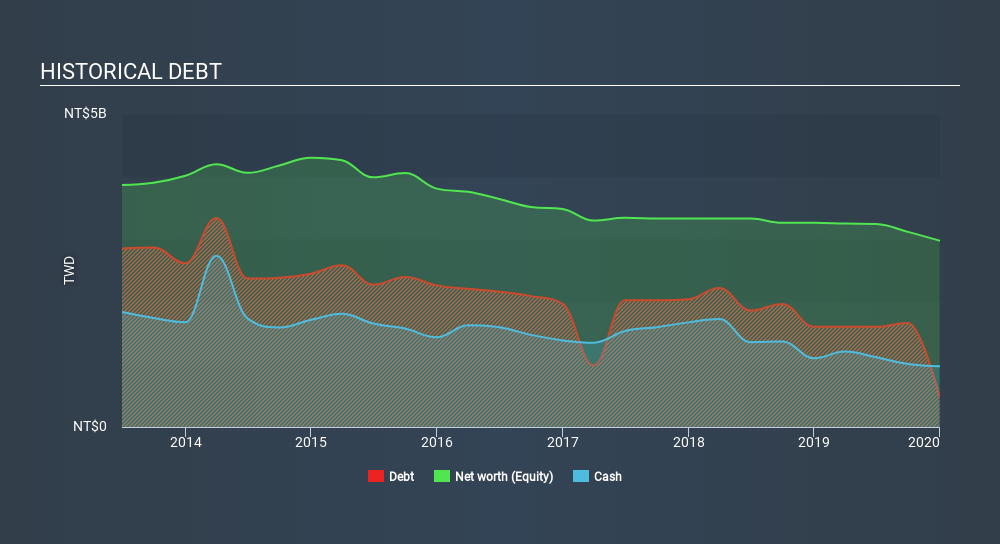

The image below, which you can click on for greater detail, shows that I-Chiun Precision Industry had debt of NT$480.0m at the end of December 2019, a reduction from NT$1.60b over a year. However, its balance sheet shows it holds NT$969.5m in cash, so it actually has NT$489.5m net cash.

How Healthy Is I-Chiun Precision Industry's Balance Sheet?

We can see from the most recent balance sheet that I-Chiun Precision Industry had liabilities of NT$2.49b falling due within a year, and liabilities of NT$374.8m due beyond that. Offsetting these obligations, it had cash of NT$969.5m as well as receivables valued at NT$1.49b due within 12 months. So its liabilities total NT$411.8m more than the combination of its cash and short-term receivables.

This deficit isn't so bad because I-Chiun Precision Industry is worth NT$1.15b, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. But it's clear that we should definitely closely examine whether it can manage its debt without dilution. Despite its noteworthy liabilities, I-Chiun Precision Industry boasts net cash, so it's fair to say it does not have a heavy debt load! When analysing debt levels, the balance sheet is the obvious place to start. But it is I-Chiun Precision Industry's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

In the last year I-Chiun Precision Industry had negative earnings before interest and tax, and actually shrunk its revenue by 8.1%, to NT$3.7b. We would much prefer see growth.

So How Risky Is I-Chiun Precision Industry?

By their very nature companies that are losing money are more risky than those with a long history of profitability. And the fact is that over the last twelve months I-Chiun Precision Industry lost money at the earnings before interest and tax (EBIT) line. Indeed, in that time it burnt through NT$264m of cash and made a loss of NT$178m. But the saving grace is the NT$489.5m on the balance sheet. That kitty means the company can keep spending for growth for at least two years, at current rates. Overall, we'd say the stock is a bit risky, and we're usually very cautious until we see positive free cash flow. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. Consider for instance, the ever-present spectre of investment risk. We've identified 4 warning signs with I-Chiun Precision Industry (at least 1 which can't be ignored) , and understanding them should be part of your investment process.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About TWSE:2486

I-Chiun Precision Industry

Manufactures and sells optoelectronic lead frames, miniature electrical products, small motors and 3C products in Taiwan, China, and internationally.

Slight with imperfect balance sheet.

Market Insights

Community Narratives