- Taiwan

- /

- Tech Hardware

- /

- TWSE:2362

Would Shareholders Who Purchased Clevo's (TPE:2362) Stock Year Be Happy With The Share price Today?

Passive investing in an index fund is a good way to ensure your own returns roughly match the overall market. Active investors aim to buy stocks that vastly outperform the market - but in the process, they risk under-performance. For example, the Clevo Co. (TPE:2362) share price is down 21% in the last year. That falls noticeably short of the market return of around 24%. The silver lining (for longer term investors) is that the stock is still 7.5% higher than it was three years ago.

See our latest analysis for Clevo

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

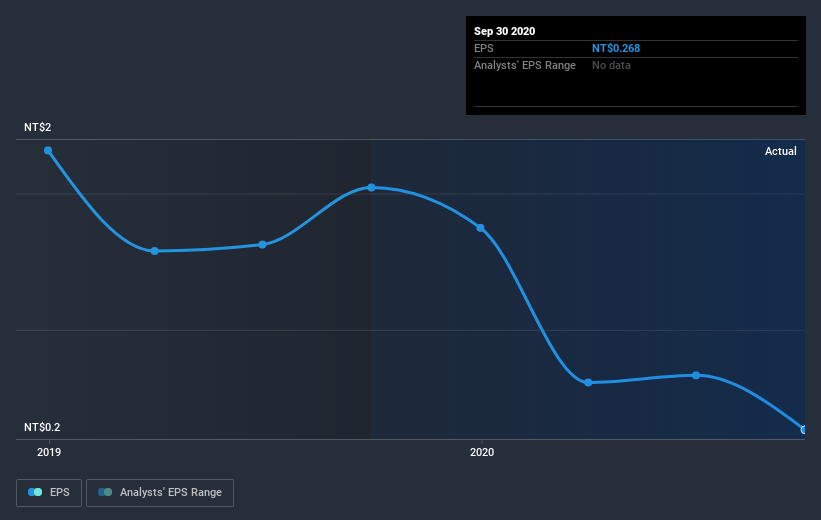

Unfortunately Clevo reported an EPS drop of 87% for the last year. The share price fall of 21% isn't as bad as the reduction in earnings per share. So despite the weak per-share profits, some investors are probably relieved the situation wasn't more difficult. Indeed, with a P/E ratio of 112.46 there is obviously some real optimism that earnings will bounce back.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

A Different Perspective

Clevo shareholders are down 20% for the year (even including dividends), but the market itself is up 24%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Longer term investors wouldn't be so upset, since they would have made 1.6%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. It's always interesting to track share price performance over the longer term. But to understand Clevo better, we need to consider many other factors. For instance, we've identified 4 warning signs for Clevo (2 are a bit unpleasant) that you should be aware of.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on TW exchanges.

If you decide to trade Clevo, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TWSE:2362

Clevo

Primarily engages in the design, manufacture, and sale of visual display units, computers, and peripheral devices in Taiwan, China, the Asia-Pacific, Europe, and the Americas.

Acceptable track record with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026