- Taiwan

- /

- Communications

- /

- TWSE:2332

We're Not So Sure You Should Rely on D-Link's (TPE:2332) Statutory Earnings

Many investors consider it preferable to invest in profitable companies over unprofitable ones, because profitability suggests a business is sustainable. That said, the current statutory profit is not always a good guide to a company's underlying profitability. This article will consider whether D-Link's (TPE:2332) statutory profits are a good guide to its underlying earnings.

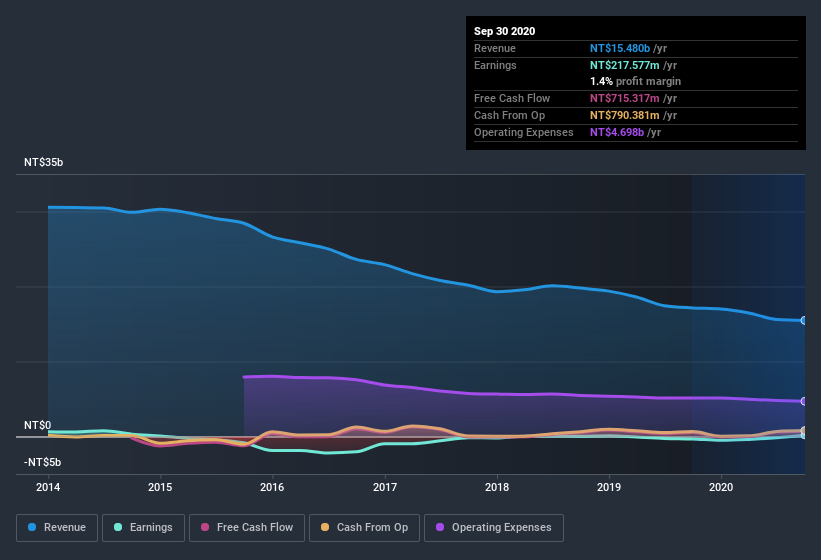

While D-Link was able to generate revenue of NT$15.5b in the last twelve months, we think its profit result of NT$217.6m was more important. The chart below shows that while revenue has fallen over the last three years, the company has moved from unprofitable to profitable.

Check out our latest analysis for D-Link

Importantly, statutory profits are not always the best tool for understanding a company's true earnings power, so it's well worth examining profits in a little more detail. This article will discuss how unusual items have impacted D-Link's most recent profit results. Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of D-Link.

How Do Unusual Items Influence Profit?

Importantly, our data indicates that D-Link's profit received a boost of NT$232m in unusual items, over the last year. We can't deny that higher profits generally leave us optimistic, but we'd prefer it if the profit were to be sustainable. When we crunched the numbers on thousands of publicly listed companies, we found that a boost from unusual items in a given year is often not repeated the next year. And, after all, that's exactly what the accounting terminology implies. We can see that D-Link's positive unusual items were quite significant relative to its profit in the year to September 2020. All else being equal, this would likely have the effect of making the statutory profit a poor guide to underlying earnings power.

Our Take On D-Link's Profit Performance

As we discussed above, we think the significant positive unusual item makes D-Link'searnings a poor guide to its underlying profitability. For this reason, we think that D-Link's statutory profits may be a bad guide to its underlying earnings power, and might give investors an overly positive impression of the company. The good news is that it earned a profit in the last twelve months, despite its previous loss. At the end of the day, it's essential to consider more than just the factors above, if you want to understand the company properly. In light of this, if you'd like to do more analysis on the company, it's vital to be informed of the risks involved. In terms of investment risks, we've identified 2 warning signs with D-Link, and understanding them should be part of your investment process.

Today we've zoomed in on a single data point to better understand the nature of D-Link's profit. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

If you’re looking to trade D-Link, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TWSE:2332

D-Link

Researches, develops, and sells local area computer network systems, wireless local area computer networks, and spare parts for integrated circuits in Taiwan, India, and internationally.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)