- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:1582

Returns On Capital - An Important Metric For Syncmold Enterprise (TPE:1582)

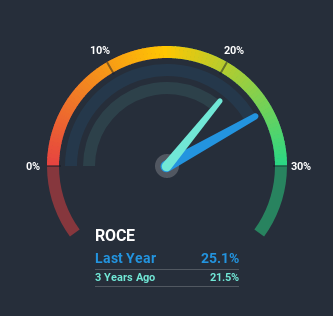

If we want to find a potential multi-bagger, often there are underlying trends that can provide clues. Amongst other things, we'll want to see two things; firstly, a growing return on capital employed (ROCE) and secondly, an expansion in the company's amount of capital employed. Ultimately, this demonstrates that it's a business that is reinvesting profits at increasing rates of return. So when we looked at the ROCE trend of Syncmold Enterprise (TPE:1582) we really liked what we saw.

Understanding Return On Capital Employed (ROCE)

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. The formula for this calculation on Syncmold Enterprise is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.25 = NT$1.6b ÷ (NT$10b - NT$4.1b) (Based on the trailing twelve months to September 2020).

So, Syncmold Enterprise has an ROCE of 25%. In absolute terms that's a great return and it's even better than the Electronic industry average of 11%.

Check out our latest analysis for Syncmold Enterprise

In the above chart we have measured Syncmold Enterprise's prior ROCE against its prior performance, but the future is arguably more important. If you're interested, you can view the analysts predictions in our free report on analyst forecasts for the company.

So How Is Syncmold Enterprise's ROCE Trending?

Syncmold Enterprise has not disappointed with their ROCE growth. The figures show that over the last five years, ROCE has grown 45% whilst employing roughly the same amount of capital. So our take on this is that the business has increased efficiencies to generate these higher returns, all the while not needing to make any additional investments. On that front, things are looking good so it's worth exploring what management has said about growth plans going forward.

Our Take On Syncmold Enterprise's ROCE

In summary, we're delighted to see that Syncmold Enterprise has been able to increase efficiencies and earn higher rates of return on the same amount of capital. And with a respectable 84% awarded to those who held the stock over the last five years, you could argue that these developments are starting to get the attention they deserve. With that being said, we still think the promising fundamentals mean the company deserves some further due diligence.

One more thing, we've spotted 1 warning sign facing Syncmold Enterprise that you might find interesting.

If you'd like to see other companies earning high returns, check out our free list of companies earning high returns with solid balance sheets here.

If you decide to trade Syncmold Enterprise, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:1582

Syncmold Enterprise

Engages in the processing, manufacturing, trading, technology authorization, import and export of various metal molds, plastic molds, and electronic parts in Taiwan.

Adequate balance sheet and slightly overvalued.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026