- China

- /

- Electronic Equipment and Components

- /

- SHSE:688768

High Growth Tech Stocks to Watch in March 2025

Reviewed by Simply Wall St

As global markets navigate through a period of economic uncertainty, with U.S. consumer confidence taking a notable hit and growth stocks underperforming amid regulatory concerns, investors are closely watching the tech sector's response to these challenges. In this environment, identifying high-growth tech stocks involves looking for companies that demonstrate resilience in the face of market volatility and have strong fundamentals to weather potential economic headwinds.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| eWeLLLtd | 24.94% | 24.24% | ★★★★★★ |

| Pharma Mar | 22.65% | 39.77% | ★★★★★★ |

| CD Projekt | 27.11% | 39.37% | ★★★★★★ |

| Ascelia Pharma | 46.09% | 66.93% | ★★★★★★ |

| Yggdrazil Group | 52.42% | 134.19% | ★★★★★★ |

| Elliptic Laboratories | 49.89% | 89.90% | ★★★★★★ |

| Mental Health TechnologiesLtd | 21.91% | 92.81% | ★★★★★★ |

| JNTC | 24.99% | 104.40% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Let's uncover some gems from our specialized screener.

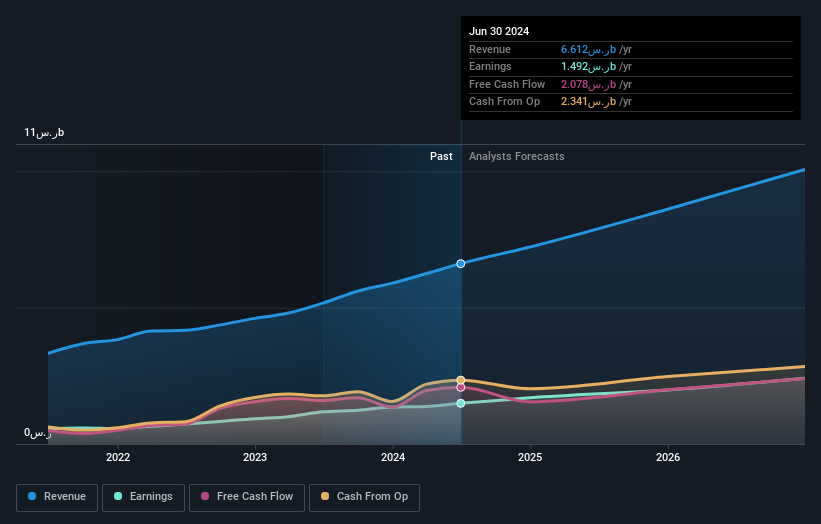

Elm (SASE:7203)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Elm Company offers ready-made and customized digital solutions in Saudi Arabia, with a market capitalization of SAR86.24 billion.

Operations: Elm generates revenue primarily from three segments: Digital Business, Professional Services, and Business Process Outsourcing. The Digital Business segment is the largest contributor with SAR5.04 billion, followed by Business Process Outsourcing at SAR1.78 billion, and Professional Services at SAR143.22 million.

Elm's strategic focus on R&D has significantly bolstered its market position, with a notable 33.4% growth in earnings last year, surpassing the IT industry's average of 27.2%. This investment in innovation is reflected in their R&D expenses which consistently align with industry trends to foster development and competitiveness. With revenues projected to grow at 15.1% annually, slightly below the high-growth benchmark of 20%, Elm still outpaces the broader SA market's near-stagnant growth rate of 0.03%. The firm’s robust forecasted return on equity at an impressive 34.5% highlights its efficient use of shareholder funds, promising for future endeavors as evidenced by recent presentations at major conferences and their latest earnings call which underscored strategic initiatives driving this growth trajectory.

- Take a closer look at Elm's potential here in our health report.

Examine Elm's past performance report to understand how it has performed in the past.

Anhui Ronds Science & Technology (SHSE:688768)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Anhui Ronds Science & Technology Incorporated Company specializes in offering machinery condition monitoring solutions for predictive maintenance in China, with a market capitalization of CN¥4.17 billion.

Operations: Anhui Ronds Science & Technology focuses on providing machinery condition monitoring solutions for predictive maintenance in China. The company's revenue is primarily driven by its specialized technology offerings in this sector.

Anhui Ronds Science & Technology has demonstrated robust growth, with a 22% annual increase in revenue and a notable 20.7% rise in earnings. This performance is underpinned by significant R&D investment, aligning with their strategic focus on innovation to stay competitive in the high-tech sector. Their recent financial results revealed an impressive jump from CNY 498.04 million to CNY 583.73 million in sales, alongside earnings that surged from CNY 62.7 million to CNY 107.47 million year-over-year, reflecting strong operational execution and market demand for their offerings.

- Click here to discover the nuances of Anhui Ronds Science & Technology with our detailed analytical health report.

Understand Anhui Ronds Science & Technology's track record by examining our Past report.

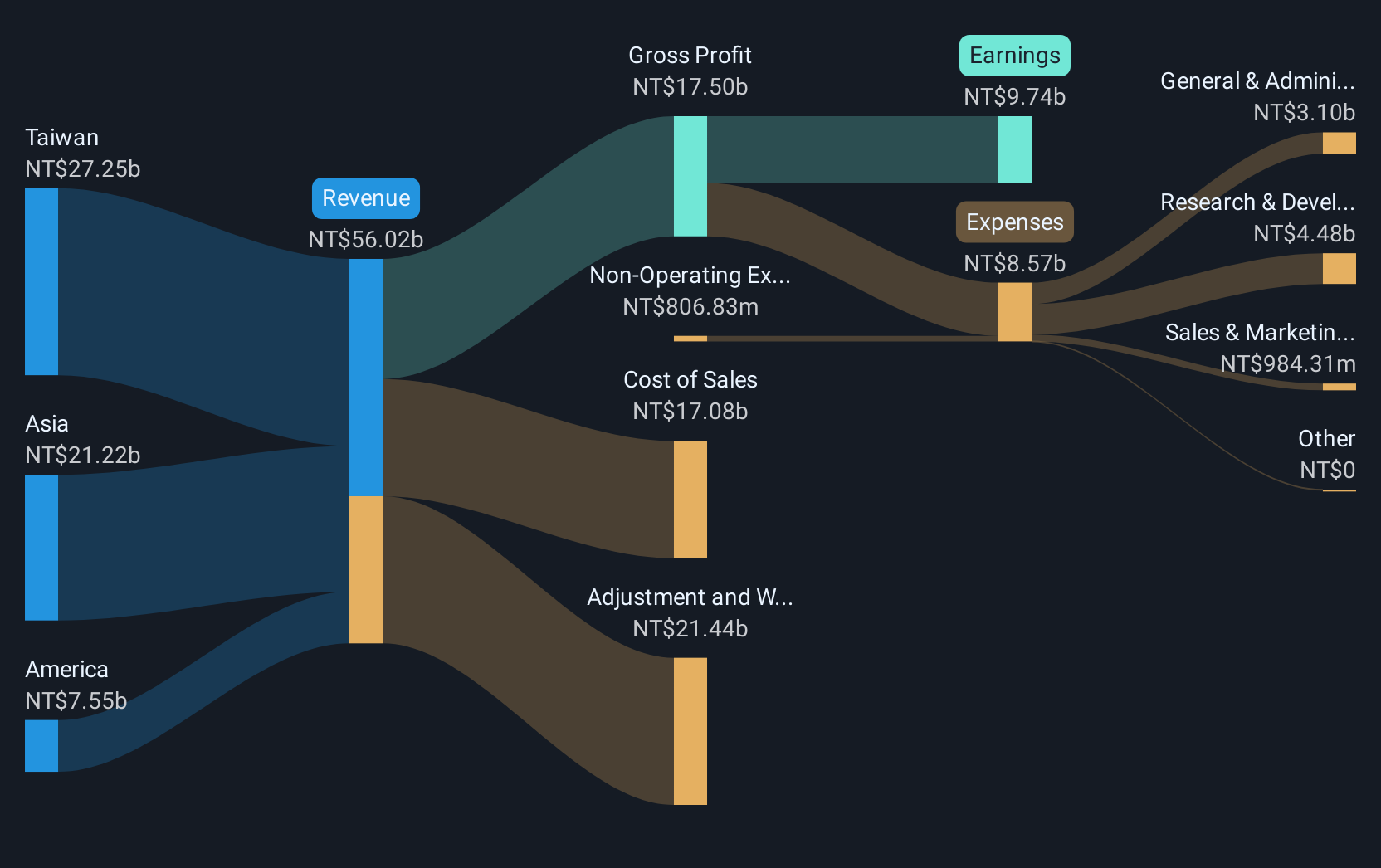

E Ink Holdings (TPEX:8069)

Simply Wall St Growth Rating: ★★★★★★

Overview: E Ink Holdings Inc. specializes in the research, development, manufacturing, and sale of electronic paper display panels globally, with a market cap of NT$315.70 billion.

Operations: The company generates revenue primarily through the sale of electronic components and parts, amounting to NT$32.16 billion. The focus on electronic paper display panels positions it within a niche market segment globally.

E Ink Holdings has shown impressive growth with a 24.6% increase in annual revenue and a robust 29.9% rise in earnings, outpacing the broader Taiwanese market's growth rates of 11.6% and 17.4%, respectively. This performance is bolstered by strategic R&D investments, which have grown to TWD 1.2 billion, accounting for nearly 3.7% of their total revenue, reflecting the company's commitment to innovation in ePaper technology used across various industries including consumer electronics and digital signage. Recent collaborations, like with Cream Guitars for color-changing guitars showcased at NAMM 2025, highlight E Ink's pioneering role in integrating digital technology into traditional industries, enhancing product customization while maintaining energy efficiency—a key competitive edge as industries increasingly prioritize sustainability.

- Unlock comprehensive insights into our analysis of E Ink Holdings stock in this health report.

Review our historical performance report to gain insights into E Ink Holdings''s past performance.

Where To Now?

- Click this link to deep-dive into the 804 companies within our Global High Growth Tech and AI Stocks screener.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688768

Anhui Ronds Science & Technology

Provides solutions for machinery condition monitoring in the predictive maintenance field in China.

Solid track record with reasonable growth potential.

Market Insights

Community Narratives