- Taiwan

- /

- Electronic Equipment and Components

- /

- TPEX:8069

Global Market's Hidden Value: Three Stocks Estimated Below Fair Value

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by mixed index performances and trade negotiations, investors are keenly observing the potential impacts of economic policies and interest rate decisions. Amidst this environment, identifying stocks that are trading below their intrinsic value can offer opportunities for those looking to capitalize on market inefficiencies. Recognizing undervalued stocks often involves assessing companies with strong fundamentals that may be temporarily overlooked due to broader market trends or economic uncertainties.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| PixArt Imaging (TPEX:3227) | NT$221.00 | NT$440.13 | 49.8% |

| Shenzhen KSTAR Science and Technology (SZSE:002518) | CN¥22.87 | CN¥44.96 | 49.1% |

| CoinShares International (OM:CS) | SEK79.90 | SEK158.59 | 49.6% |

| Alfio Bardolla Training Group (BIT:ABTG) | €1.91 | €3.72 | 48.7% |

| Shenzhen Yinghe Technology (SZSE:300457) | CN¥17.72 | CN¥34.61 | 48.8% |

| ONE CAREER (TSE:4377) | ¥2218.00 | ¥4396.53 | 49.6% |

| Lectra (ENXTPA:LSS) | €24.10 | €47.39 | 49.1% |

| Zhuhai CosMX Battery (SHSE:688772) | CN¥14.10 | CN¥28.03 | 49.7% |

| HanJung Natural Connectivity System.co.Ltd (KOSDAQ:A107640) | ₩28000.00 | ₩55868.52 | 49.9% |

| illimity Bank (BIT:ILTY) | €3.666 | €7.26 | 49.5% |

Let's dive into some prime choices out of the screener.

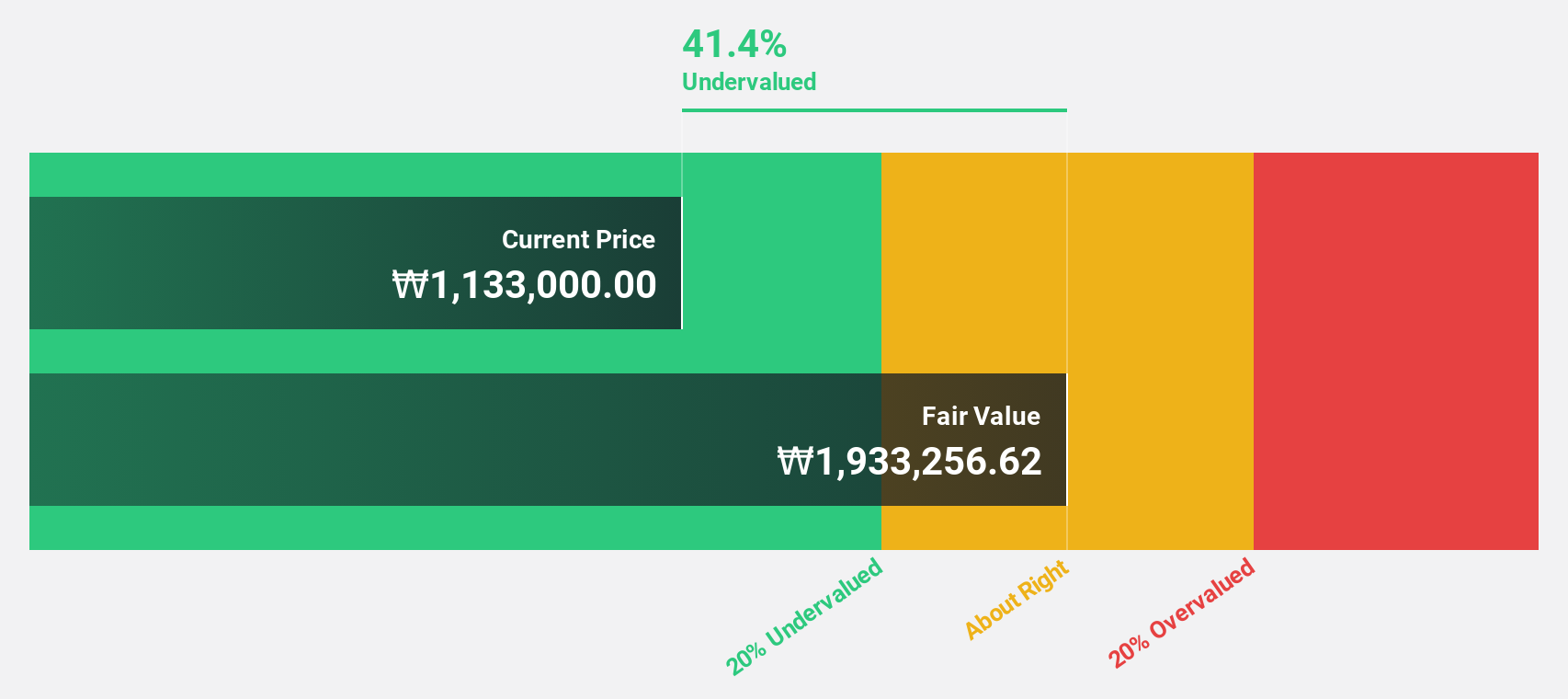

Samyang Foods (KOSE:A003230)

Overview: Samyang Foods Co., Ltd. operates in the food industry both in South Korea and internationally, with a market cap of approximately ₩7.39 billion.

Operations: Samyang Foods generates its revenue from the food business, serving both domestic and international markets.

Estimated Discount To Fair Value: 34.1%

Samyang Foods is trading at ₩1.18 million, significantly below its estimated fair value of ₩1.78 million, indicating it may be undervalued based on cash flows. The company's earnings are forecast to grow at 21.8% annually, outpacing the Korean market's 20.6%. Revenue growth is also strong at 20.1% per year, surpassing the market's 7.8%. Despite high non-cash earnings, its return on equity is projected to reach a robust 29.9% in three years.

- According our earnings growth report, there's an indication that Samyang Foods might be ready to expand.

- Click here to discover the nuances of Samyang Foods with our detailed financial health report.

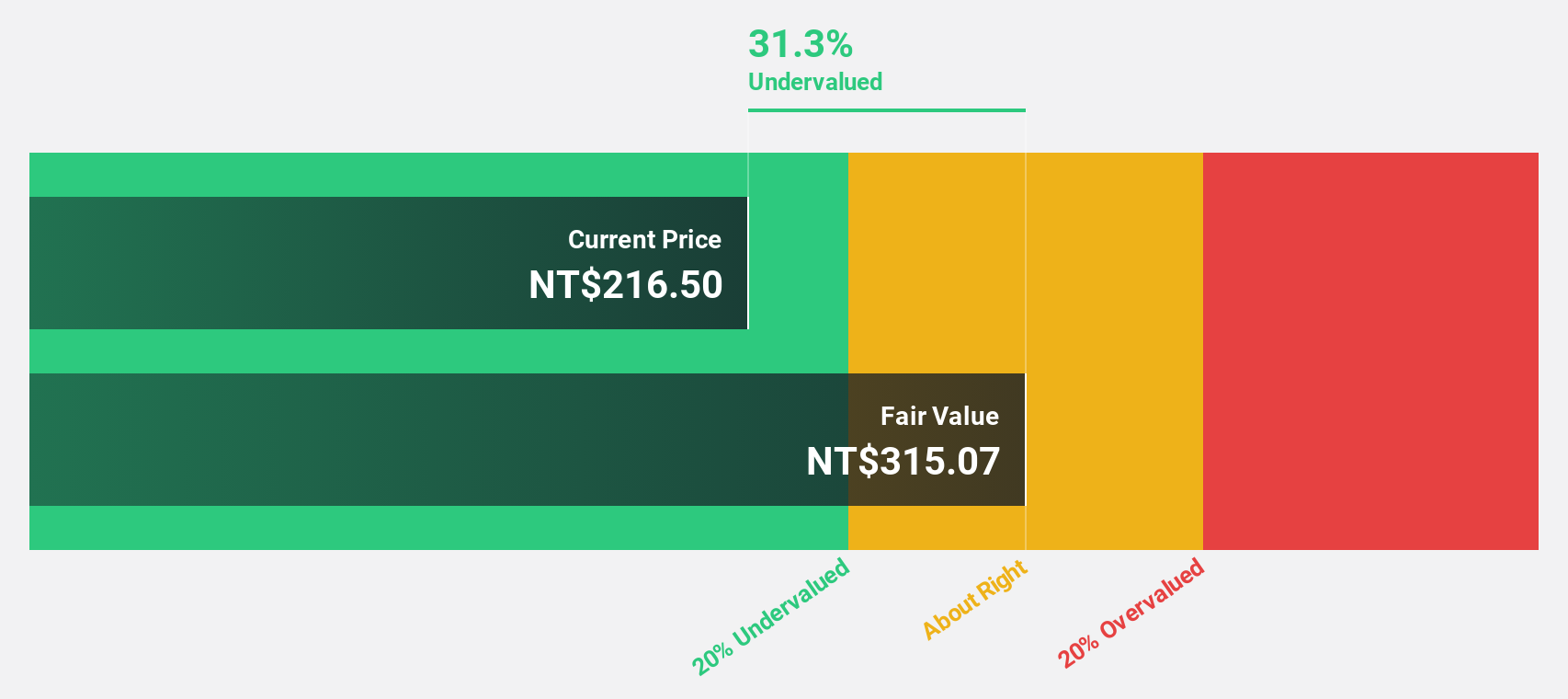

E Ink Holdings (TPEX:8069)

Overview: E Ink Holdings Inc. is involved in the research, development, manufacturing, and sale of electronic paper display panels globally, with a market cap of NT$264.66 billion.

Operations: The company's revenue primarily comes from its Electronic Components & Parts segment, which generated NT$34.58 billion.

Estimated Discount To Fair Value: 46.3%

E Ink Holdings, trading at NT$224, is significantly below its estimated fair value of NT$416.98, highlighting potential undervaluation based on cash flows. The company's earnings are projected to grow substantially at 30.3% annually, surpassing the Taiwan market's 13.3%. Recent first-quarter results showed a strong performance with sales increasing to TWD 8.06 billion from TWD 5.64 billion a year ago and net income rising to TWD 2.20 billion from TWD 1.32 billion.

- Insights from our recent growth report point to a promising forecast for E Ink Holdings' business outlook.

- Click to explore a detailed breakdown of our findings in E Ink Holdings' balance sheet health report.

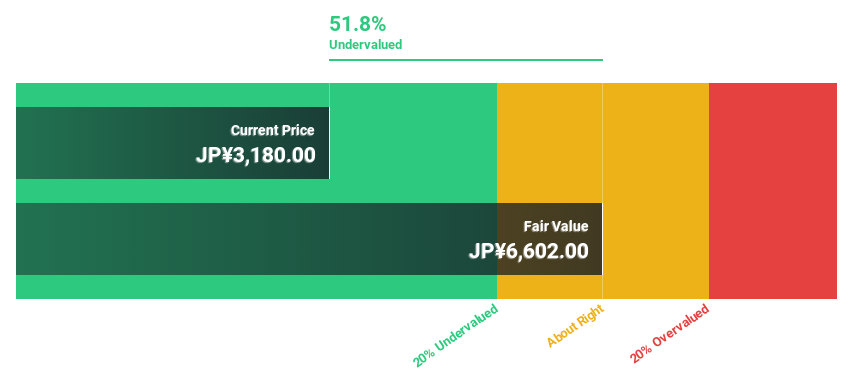

TechnoPro Holdings (TSE:6028)

Overview: TechnoPro Holdings, Inc. operates as a temporary staffing and contract work company both in Japan and internationally, with a market cap of ¥353.10 billion.

Operations: The company's revenue is primarily derived from its R&D Outsourcing Business at ¥183.09 billion, followed by Construction Management Outsourcing at ¥24.97 billion, Overseas Businesses at ¥24.76 billion, and Domestic Other Business contributing ¥4.80 billion.

Estimated Discount To Fair Value: 42%

TechnoPro Holdings, priced at ¥4089, is notably undervalued relative to its estimated fair value of ¥7047.83. The company's earnings are forecasted to grow at 13.6% annually, outpacing the JP market's 7.6%. Revenue growth is also expected at 8.4% per year, exceeding the market average of 4%. Despite an unstable dividend history, TechnoPro's future return on equity is projected to be high at 21.5%, indicating strong potential for value appreciation based on cash flows.

- The growth report we've compiled suggests that TechnoPro Holdings' future prospects could be on the up.

- Dive into the specifics of TechnoPro Holdings here with our thorough financial health report.

Next Steps

- Reveal the 486 hidden gems among our Undervalued Global Stocks Based On Cash Flows screener with a single click here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade E Ink Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if E Ink Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:8069

E Ink Holdings

Researches, develops, manufactures, and sells electronic paper display panels worldwide.

Exceptional growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives