As we enter January 2025, global markets are navigating a landscape marked by fluctuating consumer confidence and mixed economic indicators, with major U.S. stock indexes experiencing moderate gains amidst a holiday-shortened trading week. In this environment, identifying high-growth tech stocks requires careful consideration of factors such as innovation potential and market adaptability, particularly as the technology-heavy Nasdaq Composite continues to show resilience despite recent volatility.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Medley | 22.38% | 31.67% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Travere Therapeutics | 28.68% | 62.50% | ★★★★★★ |

Click here to see the full list of 1261 stocks from our High Growth Tech and AI Stocks screener.

Let's explore several standout options from the results in the screener.

argenx (ENXTBR:ARGX)

Simply Wall St Growth Rating: ★★★★★★

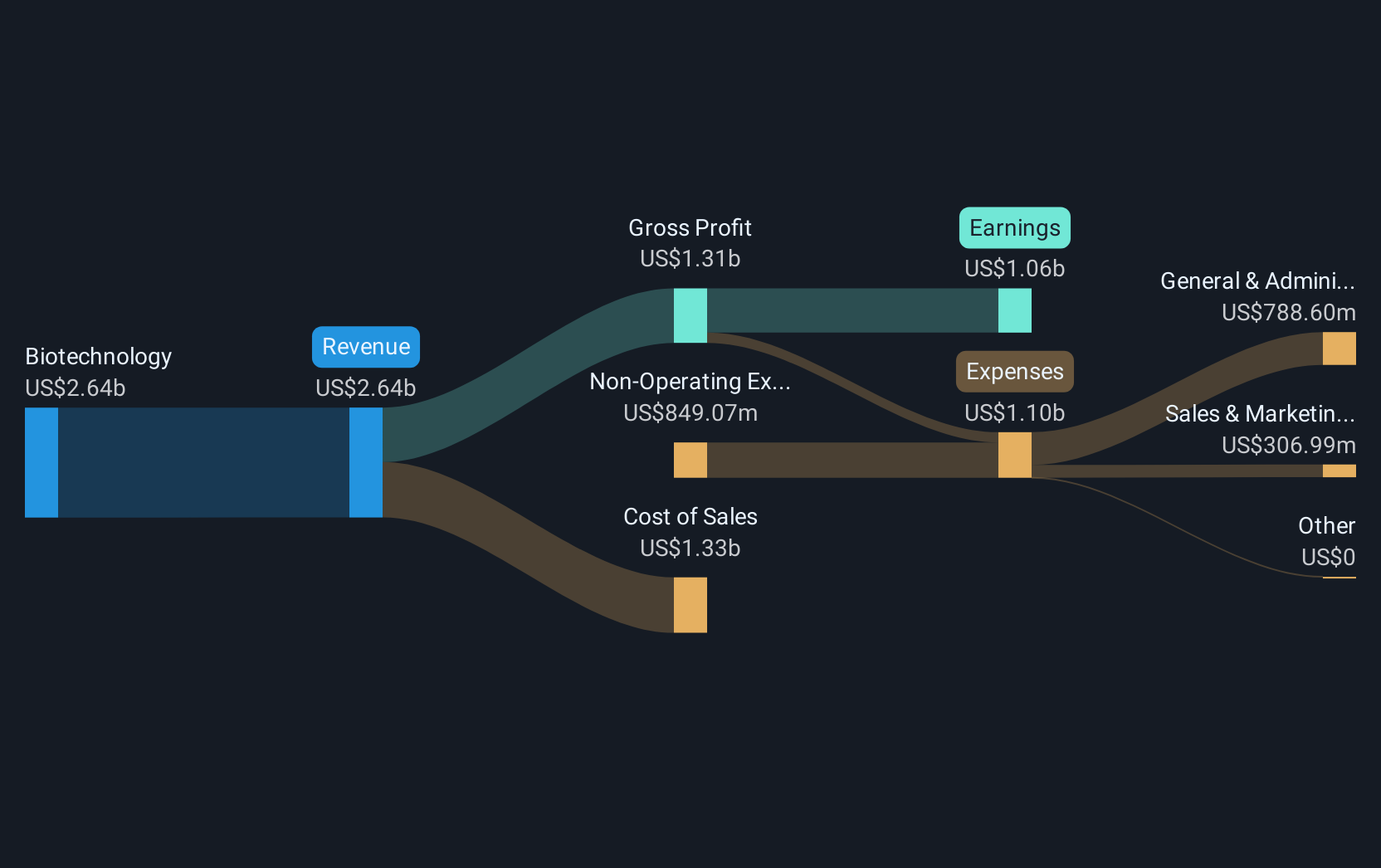

Overview: argenx SE is a biotechnology company focused on developing therapies for autoimmune diseases across multiple regions including the United States, Japan, Europe, Middle East, Africa, and China with a market cap of €36.22 billion.

Operations: With a focus on biotechnology, argenx SE generates revenue primarily from the development of therapies for autoimmune diseases, reporting $1.91 billion in this segment.

argenx's recent trajectory in the biotech sector underscores its commitment to innovation, particularly with the Japanese approval of VYVDURA for CIDP, marking a significant advancement in treatment options for this rare neuromuscular disorder. This approval not only enhances argenx's product portfolio but also demonstrates its R&D effectiveness, as evidenced by a substantial 22.3% annual revenue growth forecast. The company's strategic focus on developing treatments for complex diseases is further highlighted by ongoing Phase 2/3 trials in idiopathic inflammatory myopathies, promising to address severe autoimmune conditions with novel therapies. These developments reflect argenx’s potential to significantly impact patient care and achieve profitability within three years, aligning with an expected above-market profit growth rate.

- Delve into the full analysis health report here for a deeper understanding of argenx.

Evaluate argenx's historical performance by accessing our past performance report.

Doushen (Beijing) Education & Technology (SZSE:300010)

Simply Wall St Growth Rating: ★★★★☆☆

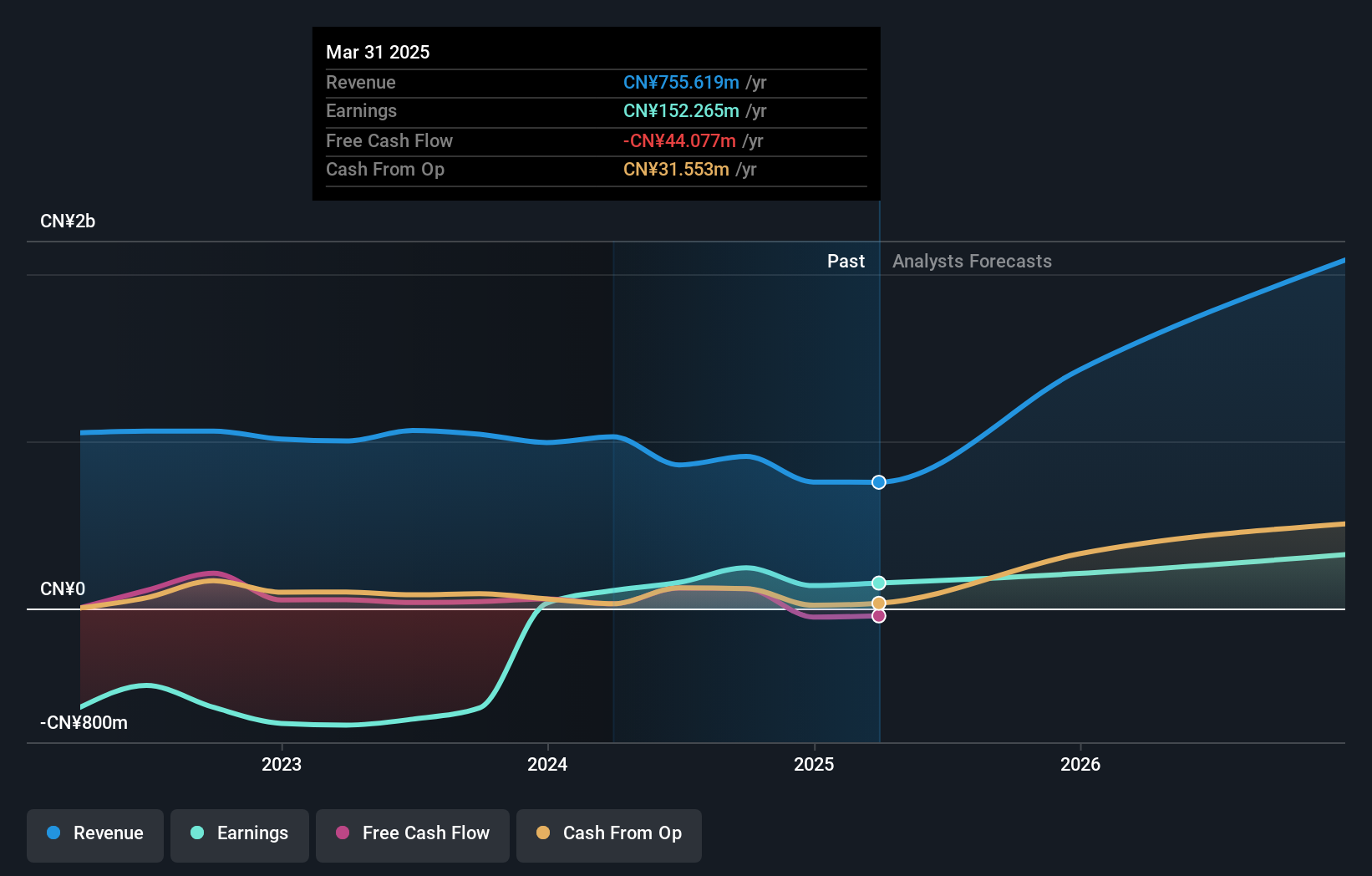

Overview: Doushen (Beijing) Education & Technology INC. is a company involved in the education and technology sector, with a market capitalization of CN¥12.83 billion.

Operations: Doushen focuses on the Information Technology Service segment, generating revenue of CN¥910.10 million.

Doushen (Beijing) Education & Technology has demonstrated a notable turnaround, transitioning from a net loss to reporting a net income of CNY 110.87 million within the last year, showcasing robust financial recovery. This shift is underscored by an impressive annual revenue growth rate of 38.4% and earnings growth forecast at 23.8% per year, signaling strong market performance and operational efficiency. Moreover, the company's recent shareholder meeting agenda to amend its system for independent directors reflects proactive governance enhancements, aligning with its strategic goals and potentially bolstering investor confidence in its future trajectory within the tech education sector.

E Ink Holdings (TPEX:8069)

Simply Wall St Growth Rating: ★★★★★★

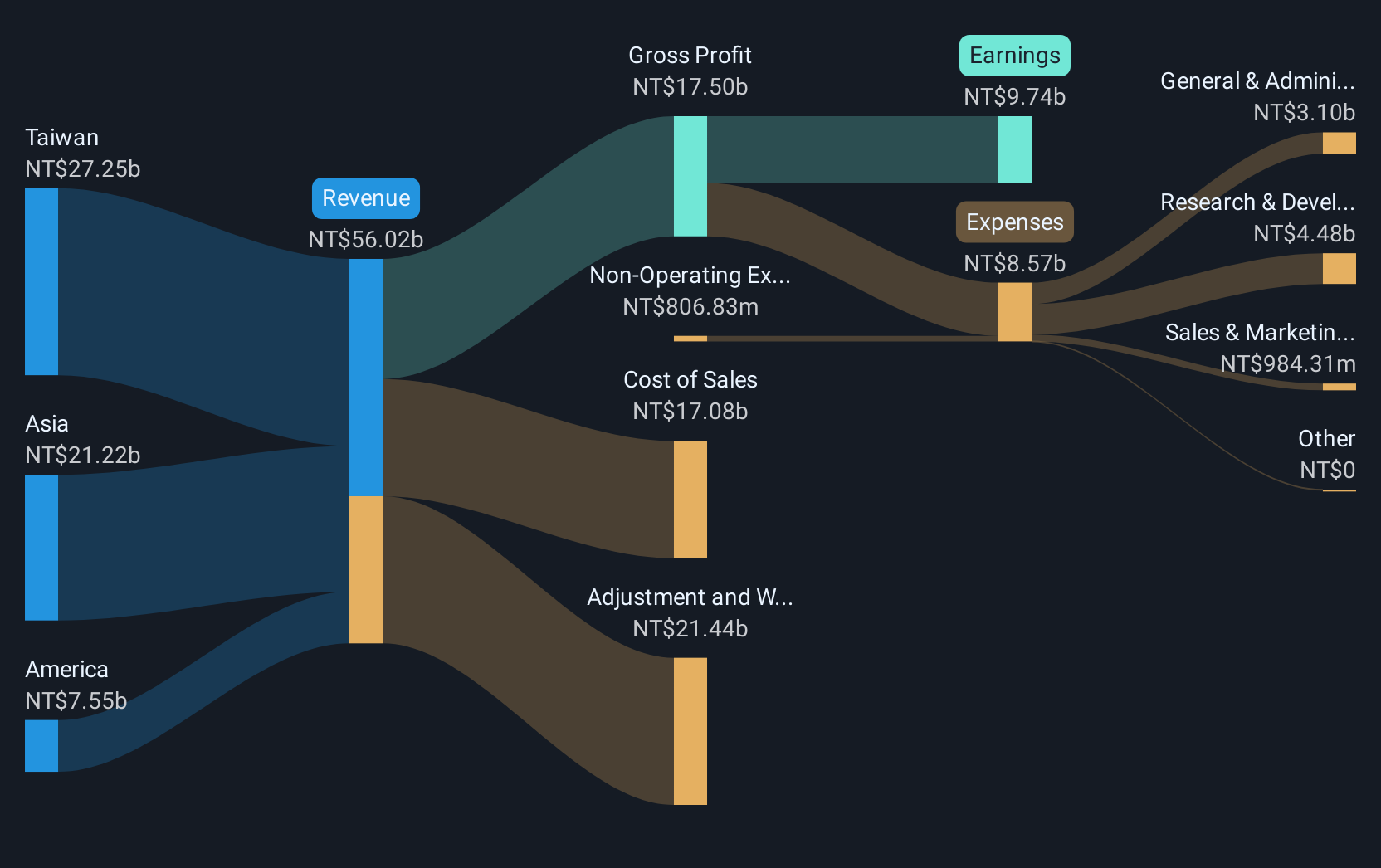

Overview: E Ink Holdings Inc. engages in the research, development, manufacturing, and sale of electronic paper display panels globally, with a market capitalization of NT$312.56 billion.

Operations: E Ink Holdings generates revenue primarily through the sale of electronic components and parts, amounting to NT$28.32 billion. The company focuses on the electronic paper display market, leveraging its expertise in research and development to drive its business operations globally.

E Ink Holdings has recently showcased a dynamic financial performance, with a notable increase in sales from TWD 6.82 billion to TWD 9.19 billion in the third quarter year-over-year. Despite a slight dip in net income and earnings per share during the same period, the company's annual revenue growth rate of 29.5% and an earnings growth forecast of 39.7% per year outpace industry averages significantly. These figures highlight E Ink's robust market position and potential for sustained growth, particularly as it continues to innovate within the electronic display sector—a key segment driving its financial success amidst evolving digital display demands.

Seize The Opportunity

- Take a closer look at our High Growth Tech and AI Stocks list of 1261 companies by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300010

Doushen (Beijing) Education & Technology

Doushen (Beijing) Education & Technology INC.

Reasonable growth potential with adequate balance sheet.