- China

- /

- Electronic Equipment and Components

- /

- SHSE:688622

High Growth Tech Stocks Including These 3 Top Picks From None

Reviewed by Simply Wall St

In recent weeks, global markets have experienced a mix of gains and declines, with major indices like the Nasdaq Composite initially leading due to large-cap growth stocks before seeing a reversal in momentum. Amidst this backdrop of fluctuating consumer confidence and mixed economic indicators, high-growth tech stocks continue to attract attention for their potential to thrive despite broader market volatility. Identifying promising tech stocks often involves looking at companies that demonstrate strong innovation capabilities and the ability to adapt quickly in an ever-changing economic landscape.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Medley | 22.38% | 31.67% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Travere Therapeutics | 28.68% | 62.50% | ★★★★★★ |

Click here to see the full list of 1261 stocks from our High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

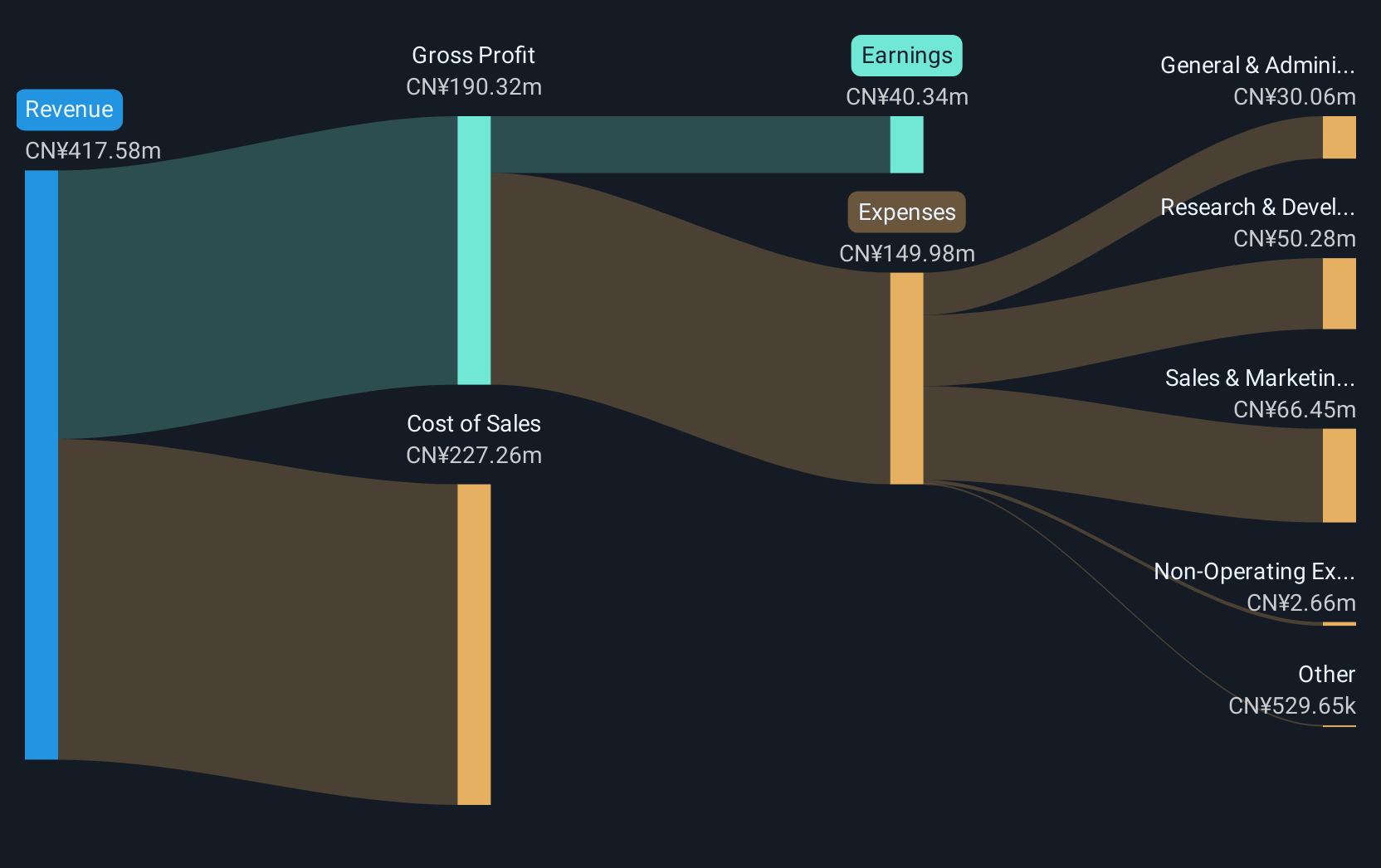

Guangzhou Fangbang ElectronicsLtd (SHSE:688020)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Guangzhou Fangbang Electronics Co., Ltd focuses on the research, development, production, sale, and service of electronic materials in China with a market capitalization of approximately CN¥2.84 billion.

Operations: Fangbang Electronics specializes in electronic materials, emphasizing R&D and production, with a focus on the Chinese market. The company operates within a competitive industry, leveraging its expertise to drive sales and provide comprehensive services.

Guangzhou Fangbang Electronics has demonstrated a significant turnaround, with its recent earnings report showing a reduction in net loss from CNY 52.46 million to CNY 39.63 million year-over-year, despite a dip in sales to CNY 241.56 million. This resilience is underscored by an impressive forecast of revenue growth at 60.9% annually, outpacing the Chinese market's average of 13.7%. Looking ahead, the company is expected to shift from unprofitability towards achieving profitability within three years, with projected earnings growth soaring at an annual rate of 237.8%. This potential for rapid financial improvement positions Guangzhou Fangbang Electronics favorably within the tech sector's dynamic landscape.

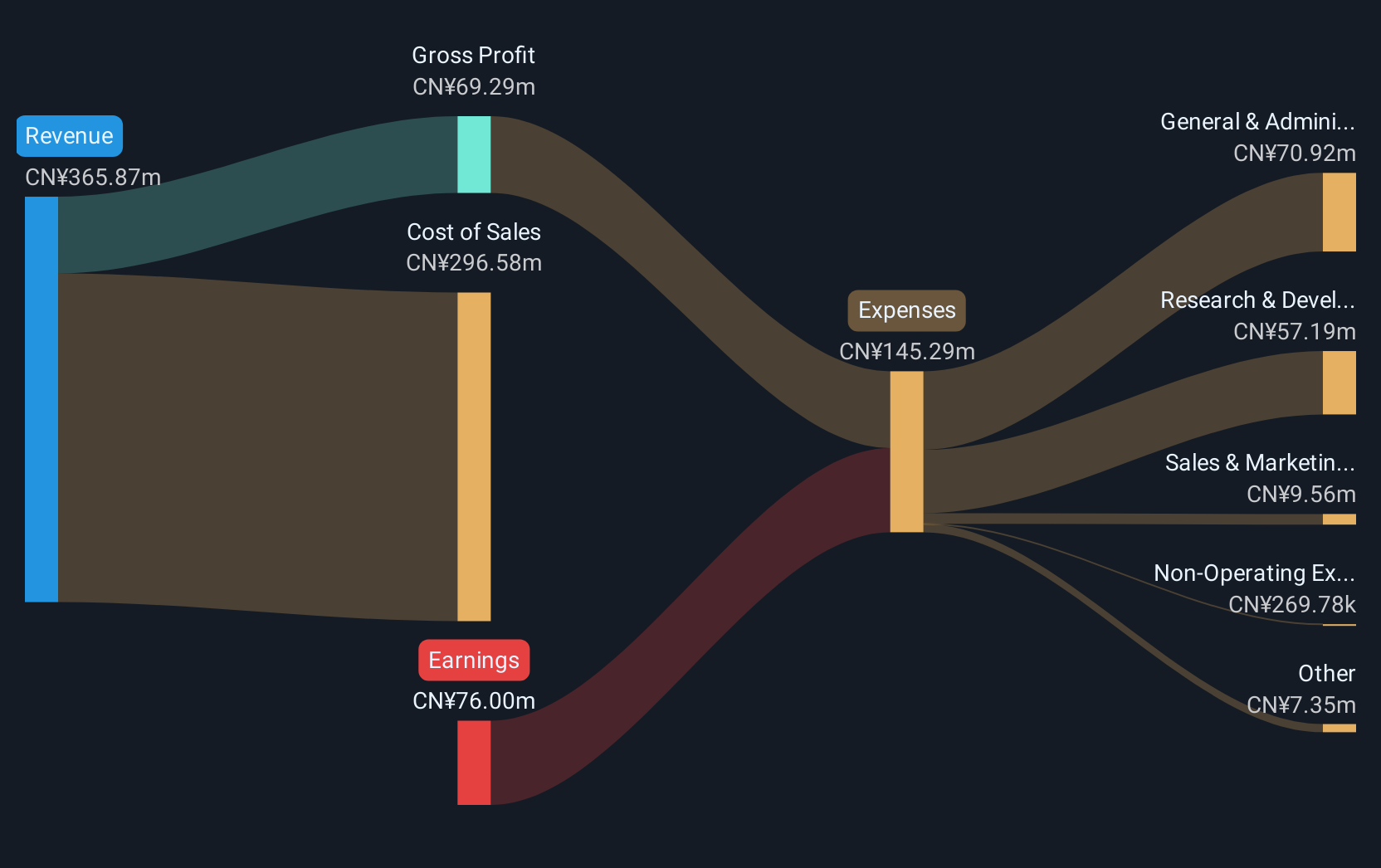

Beijing Labtech Instruments (SHSE:688056)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Beijing Labtech Instruments Co., Ltd. manufactures and supplies laboratory products and solutions to the global laboratory industry, with a market cap of CN¥1.94 billion.

Operations: Beijing Labtech Instruments focuses on producing and distributing laboratory products and solutions internationally. The company's operations are centered around the global laboratory industry, contributing to its market presence.

Beijing Labtech Instruments has shown a solid financial performance, with a notable increase in sales to CNY 311.09 million and net income rising to CNY 35.1 million over the past nine months, reflecting year-on-year growths of 3.7% and 31.7%, respectively. This uptick is supported by robust earnings per share growth from CNY 0.4 to CNY 0.53 during the same period, demonstrating an enhanced profitability trajectory. Despite facing challenges in surpassing the high industry growth rates, Beijing Labtech's commitment to innovation and market expansion is evident in its R&D investments and strategic earnings calls aimed at bolstering future growth prospects within the competitive tech landscape.

- Unlock comprehensive insights into our analysis of Beijing Labtech Instruments stock in this health report.

Understand Beijing Labtech Instruments' track record by examining our Past report.

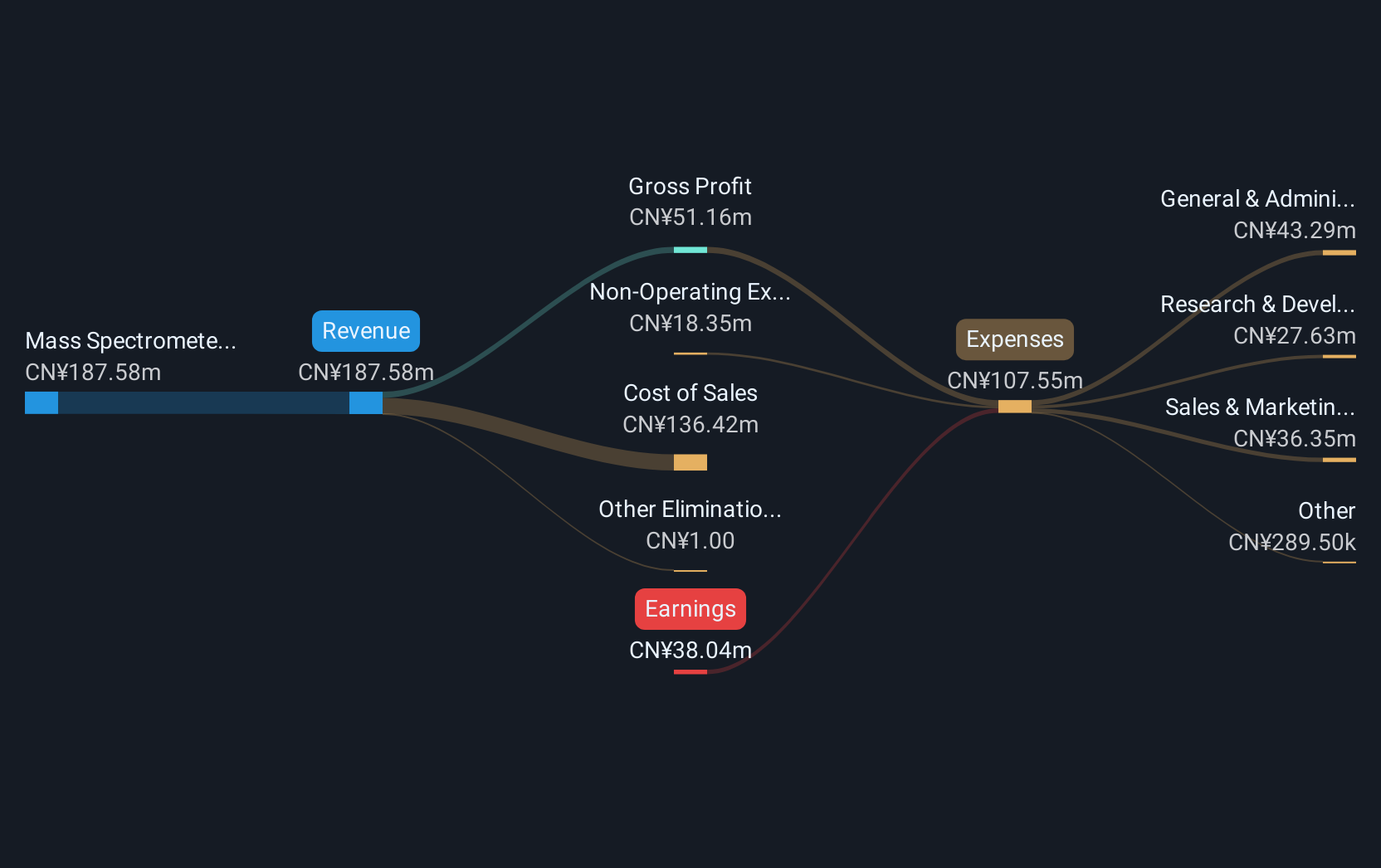

Guangzhou Hexin InstrumentLtd (SHSE:688622)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Guangzhou Hexin Instrument Co., Ltd. focuses on the research, development, production, sale, and technical services of mass spectrometry products in China with a market cap of CN¥4.24 billion.

Operations: The company generates revenue primarily from its Mass Spectrometer Business, amounting to CN¥266.19 million.

Guangzhou Hexin Instrument Co., Ltd. is navigating a transformative phase, evidenced by its 67% annual revenue growth which significantly outpaces the Chinese market's average of 13.7%. Despite current unprofitability, the company's aggressive R&D spending and strategic private placements signal a robust blueprint for future profitability, with earnings expected to surge by an impressive 201.5% annually. Recent financial maneuvers, including a notable private placement aimed at specific investors, underscore its commitment to solidifying its market stance amidst high volatility in share prices. The firm’s recent earnings call highlighted these strategic efforts alongside a reduction in net losses from CNY 55 million to CNY 22.15 million year-over-year, showcasing effective cost management and operational adjustments despite lower sales figures compared to the previous year. This proactive approach in scaling operations and enhancing technological capabilities might soon position Guangzhou Hexin Instrument Co., Ltd as a noteworthy contender in the high-tech instrumentation sector, leveraging innovation-driven growth to eventually achieve market profitability.

Summing It All Up

- Embark on your investment journey to our 1261 High Growth Tech and AI Stocks selection here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688622

Guangzhou Hexin InstrumentLtd

Engages in the research and development, production, sell, and technical services of mass spectrometry (MS) products in China.

Adequate balance sheet with limited growth.

Market Insights

Community Narratives