3 Stocks That May Be Trading At An Estimated Discount Of Up To 35.5%

Reviewed by Simply Wall St

As global markets navigate a period of mixed economic signals, including a dip in U.S. consumer confidence and fluctuating stock index performances, investors are increasingly focused on identifying opportunities amidst uncertainty. In such an environment, stocks that are perceived as undervalued can present potential advantages for those seeking to capitalize on discrepancies between current market prices and intrinsic value estimates.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Globetronics Technology Bhd (KLSE:GTRONIC) | MYR0.585 | MYR1.17 | 49.8% |

| First Solar (NasdaqGS:FSLR) | US$176.24 | US$350.71 | 49.7% |

| Strike CompanyLimited (TSE:6196) | ¥3655.00 | ¥7309.53 | 50% |

| S Foods (TSE:2292) | ¥2737.00 | ¥5472.35 | 50% |

| Cettire (ASX:CTT) | A$1.51 | A$3.02 | 50% |

| Charter Hall Group (ASX:CHC) | A$14.35 | A$28.66 | 49.9% |

| Medley (TSE:4480) | ¥3835.00 | ¥7652.96 | 49.9% |

| Ally Financial (NYSE:ALLY) | US$36.01 | US$71.71 | 49.8% |

| Progress Software (NasdaqGS:PRGS) | US$65.15 | US$129.60 | 49.7% |

| SkyCity Entertainment Group (NZSE:SKC) | NZ$1.45 | NZ$2.89 | 49.8% |

Let's review some notable picks from our screened stocks.

Yangmei ChemicalLtd (SHSE:600691)

Overview: Yangmei Chemical Co., Ltd. is involved in the research, development, production, and sale of chemical products in China with a market cap of CN¥5.27 billion.

Operations: Yangmei Chemical Ltd. generates its revenue from the research, development, production, and sale of chemical products in China.

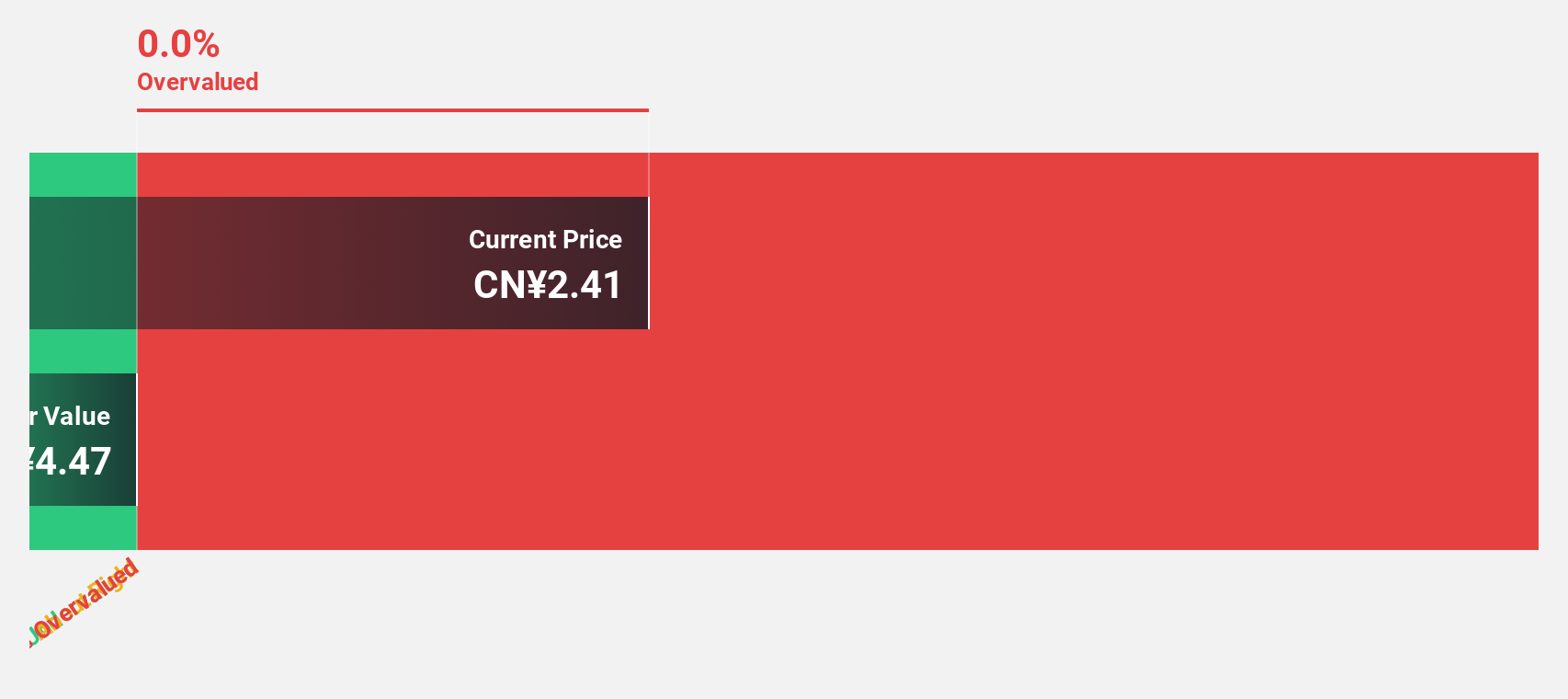

Estimated Discount To Fair Value: 31.7%

Yangmei Chemical Ltd. is trading at CN¥2.22, significantly below its estimated fair value of CN¥3.25, representing a discount of over 20%. Despite current financial challenges, including a net loss of CN¥387.08 million for the first nine months of 2024 and declining revenue compared to the previous year, the company is forecasted to achieve substantial revenue growth exceeding 21% annually and become profitable within three years, suggesting potential future value based on cash flows.

- Insights from our recent growth report point to a promising forecast for Yangmei ChemicalLtd's business outlook.

- Click to explore a detailed breakdown of our findings in Yangmei ChemicalLtd's balance sheet health report.

Computer Modelling Group (TSX:CMG)

Overview: Computer Modelling Group Ltd. is a software and consulting technology company that develops and licenses reservoir simulation and seismic interpretation software, with a market cap of CA$868.42 million.

Operations: The company generates revenue from its reservoir simulation and seismic interpretation software and services, with CA$34.74 million from BHV and CA$90.55 million from CMG.

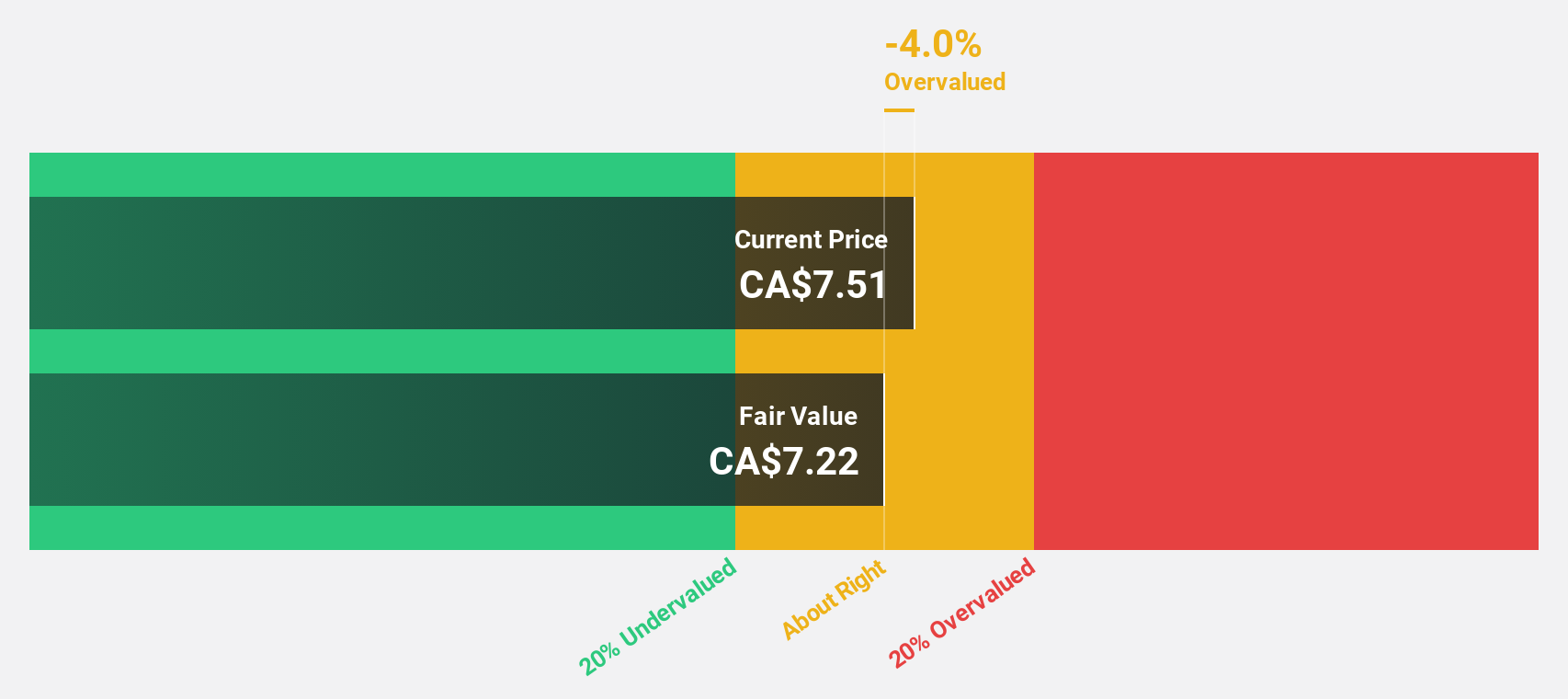

Estimated Discount To Fair Value: 14.4%

Computer Modelling Group is trading at CA$10.65, slightly below its estimated fair value of CA$12.44, indicating potential undervaluation based on cash flows. Despite a decline in net income for the recent quarter compared to last year, earnings are forecasted to grow significantly at 36.2% annually, outpacing the Canadian market's growth rate. The collaboration with NVIDIA aims to enhance simulation solutions and energy efficiency, potentially supporting future profitability and revenue growth amidst an unstable dividend track record and recent insider selling activity.

- Our expertly prepared growth report on Computer Modelling Group implies its future financial outlook may be stronger than recent results.

- Unlock comprehensive insights into our analysis of Computer Modelling Group stock in this financial health report.

Jamieson Wellness (TSX:JWEL)

Overview: Jamieson Wellness Inc. is a company that develops, manufactures, distributes, markets, and sells branded and customer-branded health products for humans across Canada, the United States, China, and internationally with a market cap of CA$1.54 billion.

Operations: The company's revenue is primarily derived from its Jamieson Brands segment, which accounts for CA$607.13 million, and its Strategic Partners segment, contributing CA$102.23 million.

Estimated Discount To Fair Value: 35.5%

Jamieson Wellness, priced at CA$36.71, trades significantly below its estimated fair value of CA$56.9, suggesting undervaluation based on cash flows. Earnings are projected to grow substantially at 61.8% annually, surpassing the Canadian market's growth rate of 15.5%. Recent earnings show increased quarterly sales but a decline in nine-month net income compared to last year. The addition of Diane Nyisztor to the board may enhance governance and strategic oversight moving forward.

- Upon reviewing our latest growth report, Jamieson Wellness' projected financial performance appears quite optimistic.

- Take a closer look at Jamieson Wellness' balance sheet health here in our report.

Key Takeaways

- Unlock more gems! Our Undervalued Stocks Based On Cash Flows screener has unearthed 867 more companies for you to explore.Click here to unveil our expertly curated list of 870 Undervalued Stocks Based On Cash Flows.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600691

Yangmei ChemicalLtd

Engages in the research, development, production, and sale of coal chemical products and chemical equipment in China.

Adequate balance sheet with moderate growth potential.

Market Insights

Community Narratives