- Poland

- /

- Healthtech

- /

- WSE:SNT

Undiscovered Gems With Potential To Explore In February 2025

Reviewed by Simply Wall St

As global markets navigate a landscape marked by AI competition concerns and steady interest rates, small-cap stocks have shown resilience amidst the volatility. With indices like the S&P 600 reflecting these dynamics, investors are keenly observing potential opportunities that may arise from current economic conditions. In this environment, identifying stocks with strong fundamentals and growth prospects is essential for uncovering undiscovered gems that could thrive despite broader market challenges.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Canal Shipping Agencies | NA | 8.92% | 22.01% | ★★★★★★ |

| Central Forest Group | NA | 6.85% | 15.11% | ★★★★★★ |

| Suez Canal Company for Technology Settling (S.A.E) | NA | 22.31% | 13.60% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Chilanga Cement | NA | 13.46% | 35.92% | ★★★★★★ |

| La Forestière Equatoriale | NA | -58.49% | 45.78% | ★★★★★★ |

| First National Bank of Botswana | 24.77% | 10.64% | 15.30% | ★★★★★☆ |

| Societe de Limonaderies et de Boissons Rafraichissantes d'Afrique | 39.37% | 4.38% | -14.46% | ★★★★★☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Beijing UniStrong Science&TechnologyLtd (SZSE:002383)

Simply Wall St Value Rating: ★★★★☆☆

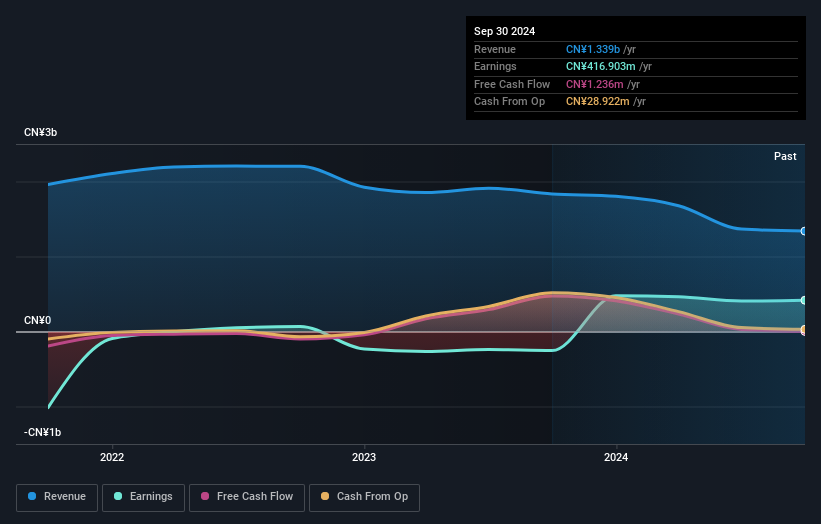

Overview: Beijing UniStrong Science & Technology Ltd (SZSE:002383) is a company engaged in the development and manufacturing of satellite navigation systems, with a market cap of CN¥5.53 billion.

Operations: UniStrong's primary revenue stream is derived from its satellite navigation system segment, which generated CN¥1.34 billion. The company's financial performance is influenced by its net profit margin trends over recent periods.

UniStrong, a promising player in the tech landscape, has recently turned profitable, setting it apart from the broader Communications industry which saw a -3% earnings growth. Its price-to-earnings ratio of 13.3x is notably lower than the CN market average of 34.7x, suggesting potential undervaluation. The company boasts a satisfactory net debt to equity ratio at 1.4%, having impressively reduced its debt from 81.7% to 21.5% over five years. Despite high volatility in its share price recently and insufficient data on interest coverage by EBIT, UniStrong's positive free cash flow indicates financial resilience moving forward.

Yuan High-Tech Development (TPEX:5474)

Simply Wall St Value Rating: ★★★★★★

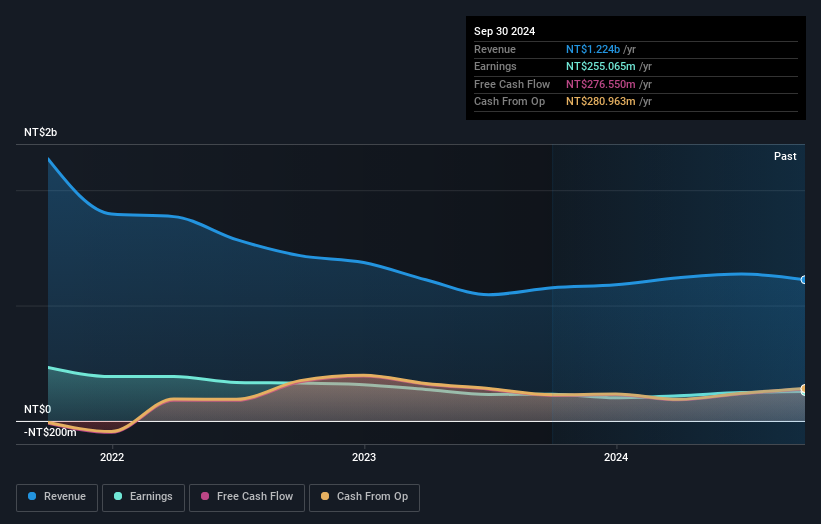

Overview: Yuan High-Tech Development Co., Ltd. specializes in providing video and audio products for system integrators and ODM customers, mainly in Taiwan, with a market capitalization of approximately NT$8.27 billion.

Operations: The primary revenue stream for Yuan High-Tech Development comes from computer peripherals, generating NT$1.22 billion. The company's market capitalization is approximately NT$8.27 billion.

Yuan High-Tech, a nimble player in the tech sector, has showcased its resilience with net income rising to TWD 76 million from TWD 66.33 million year-on-year for Q3 2024. Despite sales dipping to TWD 279.58 million from TWD 328.38 million, earnings per share improved to TWD 1.91 from TWD 1.67, signaling operational efficiency gains. Over nine months, revenue climbed to TWD 904.58 million while net income surged to TWD 198.42 million from last year's figures of TWD 861.42 and TWD144.89 respectively—an indication of robust profitability amidst a volatile market environment where the company remains debt-free and cash flow positive.

- Click to explore a detailed breakdown of our findings in Yuan High-Tech Development's health report.

Understand Yuan High-Tech Development's track record by examining our Past report.

Synektik Spólka Akcyjna (WSE:SNT)

Simply Wall St Value Rating: ★★★★★★

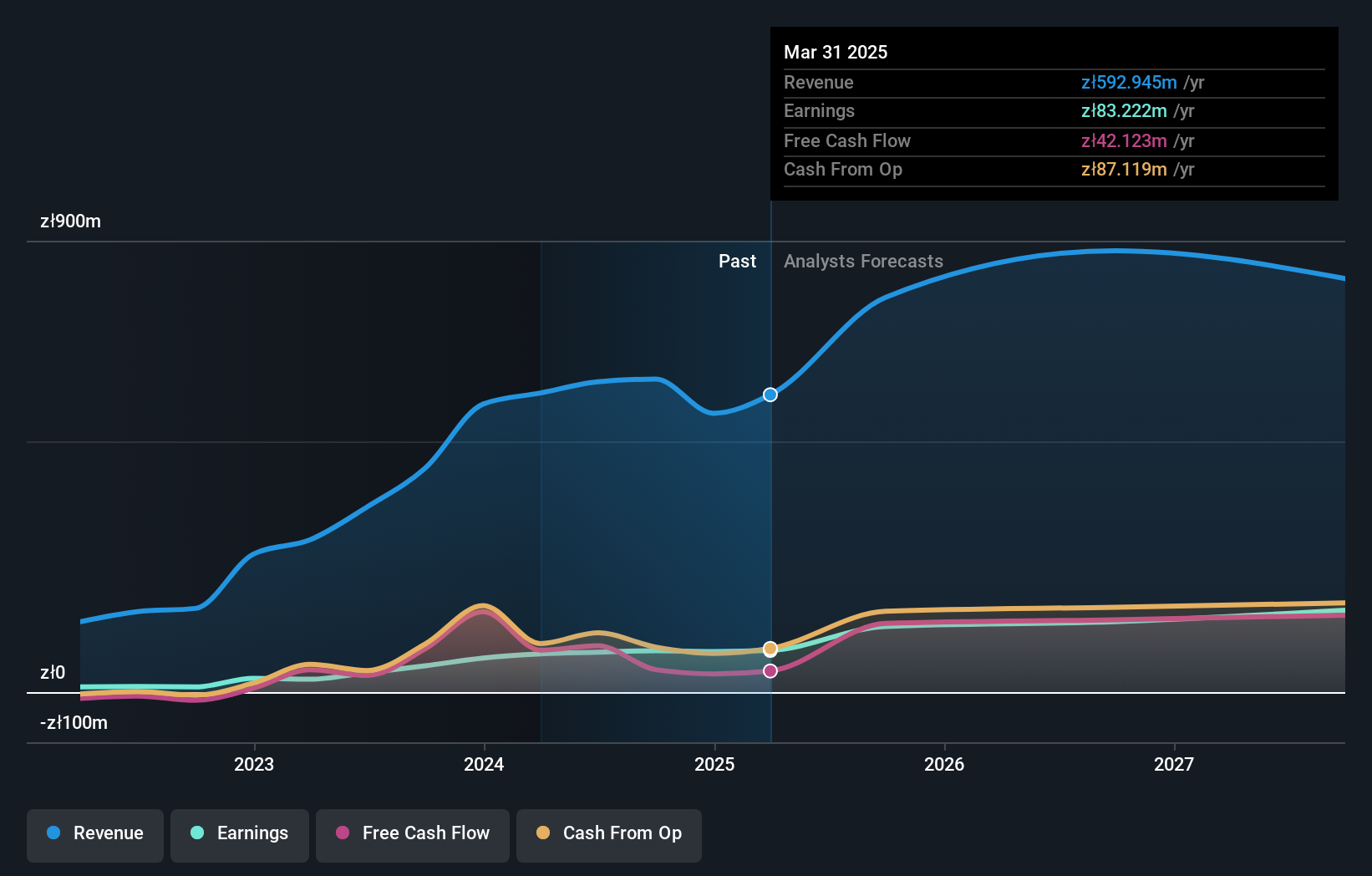

Overview: Synektik Spólka Akcyjna offers products, services, and IT solutions for surgery, diagnostic imaging, and nuclear medicine applications in Poland with a market cap of PLN1.88 billion.

Operations: Synektik Spólka Akcyjna generates revenue through its diverse offerings in surgery, diagnostic imaging, and nuclear medicine applications. The company's financial performance is highlighted by a market capitalization of PLN1.88 billion.

Synektik Spólka Akcyjna, a smaller player in the healthcare services sector, recently reported first-quarter revenue of PLN 203.13 million, down from PLN 271.3 million last year, while net income slightly dipped to PLN 33.13 million from PLN 34.67 million. Despite this, the company shows promise with earnings growth of 61% over the past year and a debt-to-equity ratio reduction from 16.4% to 10% over five years. Trading at nearly 28% under its estimated fair value and boasting well-covered interest payments at fourteen times EBIT coverage, Synektik seems poised for continued robust performance in its industry context.

- Click here to discover the nuances of Synektik Spólka Akcyjna with our detailed analytical health report.

Learn about Synektik Spólka Akcyjna's historical performance.

Turning Ideas Into Actions

- Embark on your investment journey to our 4710 Undiscovered Gems With Strong Fundamentals selection here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:SNT

Synektik Spólka Akcyjna

Provides products, services, and IT solutions for surgery, diagnostic imaging, and nuclear medicine applications in Poland.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives