- Taiwan

- /

- Electronic Equipment and Components

- /

- TPEX:3491

High Growth Tech Stocks to Watch in January 2025

Reviewed by Simply Wall St

As global markets continue to react to policy changes and economic indicators, U.S. stocks have been buoyed by optimism surrounding potential trade agreements and advancements in artificial intelligence, with major indexes like the S&P 500 reaching new highs. In this context of heightened market activity and technological enthusiasm, identifying high-growth tech stocks involves looking for companies that are well-positioned to leverage emerging trends such as AI infrastructure development while maintaining robust fundamentals amidst evolving geopolitical landscapes.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Pharma Mar | 25.50% | 55.11% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 135.02% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Elliptic Laboratories | 61.01% | 121.13% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1231 stocks from our High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

Beijing Labtech Instruments (SHSE:688056)

Simply Wall St Growth Rating: ★★★★☆☆

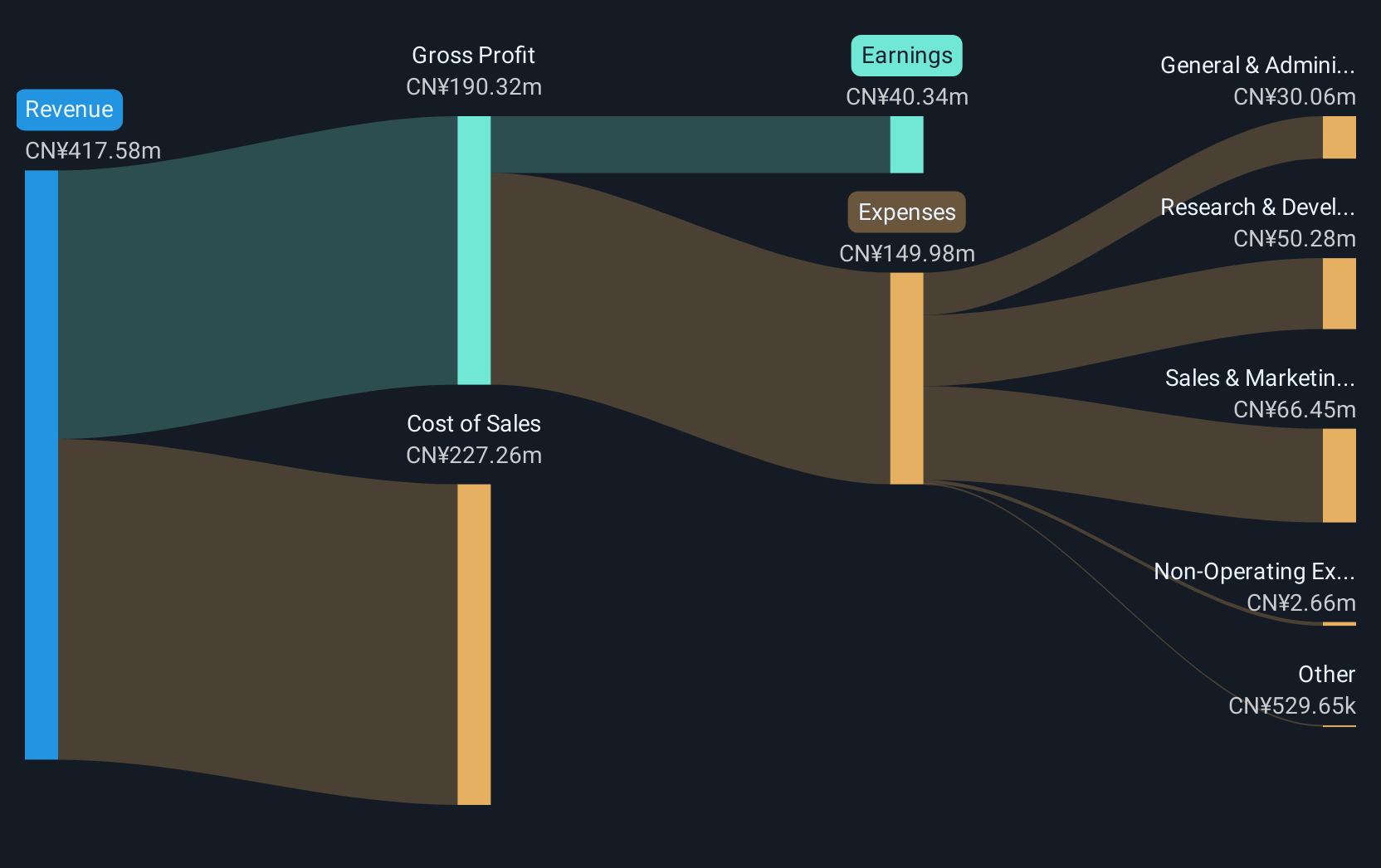

Overview: Beijing Labtech Instruments Co., Ltd. manufactures and supplies laboratory products and solutions to the global laboratory industry, with a market cap of CN¥2.03 billion.

Operations: Beijing Labtech Instruments Co., Ltd. focuses on producing and distributing laboratory products and solutions globally. The company's revenue streams are not specified, but it operates within the laboratory industry.

Beijing Labtech Instruments is navigating the competitive landscape of high-growth tech with robust financial indicators. With a projected annual earnings growth of 26.5% and revenue increases at 15.4%, the company outpaces the Chinese market averages, reflecting its effective adaptation and innovation strategies. Notably, its R&D expenditure has been pivotal, aligning with industry demands to foster advancements in electronic instruments. Despite a slight dip in earnings last year by -2.1%, recent strategic investments hint at promising future prospects, as evidenced in their latest earnings call which underscored strong Q3 performance and ongoing market expansion efforts.

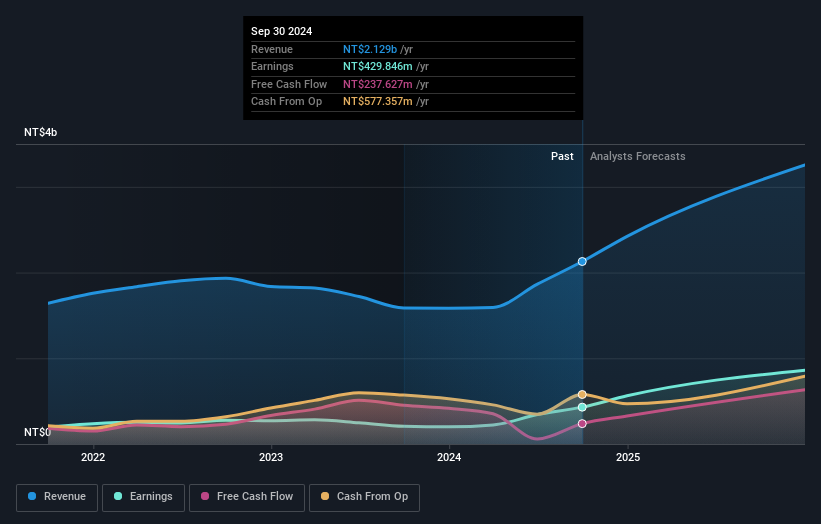

Universal Microwave Technology (TPEX:3491)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Universal Microwave Technology, Inc. operates in the microwave and millimeter wave wireless communication industry across Taiwan, China, Asia, Europe, the United States, and Oceania with a market cap of NT$28.92 billion.

Operations: The company generates revenue primarily from Radio Frequency Products (NT$1.06 billion) and Microwave/Millimeter Wave Products (NT$1.26 billion), with additional income from Communications Network Engineering Services (NT$214.58 million).

Universal Microwave Technology has demonstrated a remarkable financial trajectory, with earnings growth surging by 108.7% over the past year and revenue projected to expand at an annual rate of 33.8%. This performance significantly outstrips the broader Taiwanese market's growth, which stands at a mere 11.3% per year. The company's commitment to innovation is evident in its R&D spending, crucial for maintaining its competitive edge in the fast-evolving tech landscape. Recent earnings reports highlight strong quarterly results, with sales more than doubling from the previous year and net income nearly tripling—testaments to effective strategic maneuvers and robust market demand.

Alltop Technology (TPEX:3526)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Alltop Technology Co., Ltd. operates in Taiwan and China, focusing on the research, design, development, manufacture, and sale of electronic connectors with a market capitalization of NT$16.63 billion.

Operations: The company primarily generates revenue from the sale of electronic connectors, amounting to NT$2.95 billion. It operates in Taiwan and China, leveraging its expertise in research, design, and manufacturing within this sector.

Alltop Technology has demonstrated robust growth, with a 53.4% increase in earnings over the past year, outpacing the electronics industry's average of 6.6%. This surge is supported by significant R&D investments that fuel innovation and competitiveness in a rapidly evolving tech landscape. Recent financials reveal a striking rise in quarterly sales to TWD 907.73 million from TWD 682.38 million last year, alongside net income climbing to TWD 264.94 million from TWD 209.49 million, indicating strong operational efficiency and market demand responsiveness. Moreover, the appointment of Chang Yi Wei as Chief Sustainability Officer underscores Alltop’s commitment to sustainable practices, aligning with global corporate responsibility trends which may enhance its long-term viability and appeal in the technology sector.

- Click here and access our complete health analysis report to understand the dynamics of Alltop Technology.

Explore historical data to track Alltop Technology's performance over time in our Past section.

Where To Now?

- Dive into all 1231 of the High Growth Tech and AI Stocks we have identified here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:3491

Universal Microwave Technology

Operates in microwave/mmwave wireless communication industry in Taiwan, China, Asia, Europe, the United States, and Oceania.

High growth potential with solid track record.

Market Insights

Community Narratives