3 Undervalued Stocks Estimated To Be Up To 49.1% Below Intrinsic Value

Reviewed by Simply Wall St

As global markets react to the recent U.S. election results, with major indices reaching record highs amid expectations of economic growth and regulatory changes, investors are keenly observing opportunities that may arise from these shifts. In this environment, identifying undervalued stocks can be particularly rewarding, as they offer potential for appreciation when market conditions align favorably with a company's intrinsic value.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Shenzhen King Explorer Science and Technology (SZSE:002917) | CN¥9.53 | CN¥18.84 | 49.4% |

| UMB Financial (NasdaqGS:UMBF) | US$123.80 | US$245.87 | 49.6% |

| NBT Bancorp (NasdaqGS:NBTB) | US$50.32 | US$99.93 | 49.6% |

| Decisive Dividend (TSXV:DE) | CA$6.18 | CA$12.23 | 49.5% |

| JYP Entertainment (KOSDAQ:A035900) | ₩53700.00 | ₩106760.01 | 49.7% |

| XPEL (NasdaqCM:XPEL) | US$45.62 | US$91.03 | 49.9% |

| Pinterest (NYSE:PINS) | US$29.98 | US$59.53 | 49.6% |

| GRCS (TSE:9250) | ¥1500.00 | ¥2976.24 | 49.6% |

| Medios (XTRA:ILM1) | €14.88 | €29.67 | 49.8% |

| Hotel ShillaLtd (KOSE:A008770) | ₩36900.00 | ₩73388.97 | 49.7% |

Let's dive into some prime choices out of the screener.

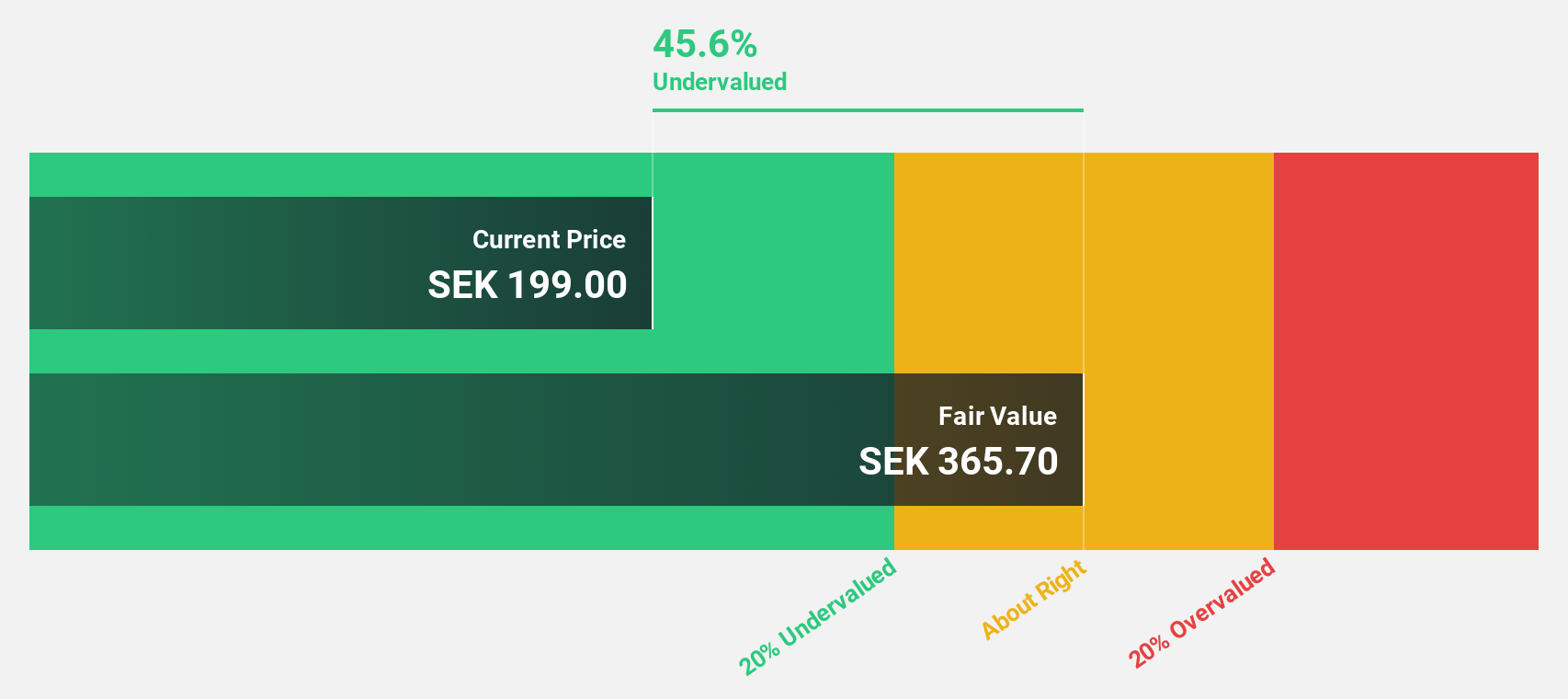

Lindab International (OM:LIAB)

Overview: Lindab International AB (publ) is a European manufacturer and seller of ventilation system products and solutions, with a market cap of SEK17.67 billion.

Operations: The company generates revenue primarily from its Ventilation Systems segment, which accounts for SEK10.10 billion, and its Profile Systems segment, contributing SEK3.23 billion.

Estimated Discount To Fair Value: 49.1%

Lindab International is trading at SEK 229.4, significantly below its estimated fair value of SEK 450.56, indicating potential undervaluation based on cash flows. Despite a recent decline in net income and earnings per share, Lindab's earnings are expected to grow significantly at 29.6% annually over the next three years, outpacing the Swedish market's growth rate of 15.6%. The company's strategic downsizing in the Czech Republic aims to enhance profitability moving forward.

- The analysis detailed in our Lindab International growth report hints at robust future financial performance.

- Click to explore a detailed breakdown of our findings in Lindab International's balance sheet health report.

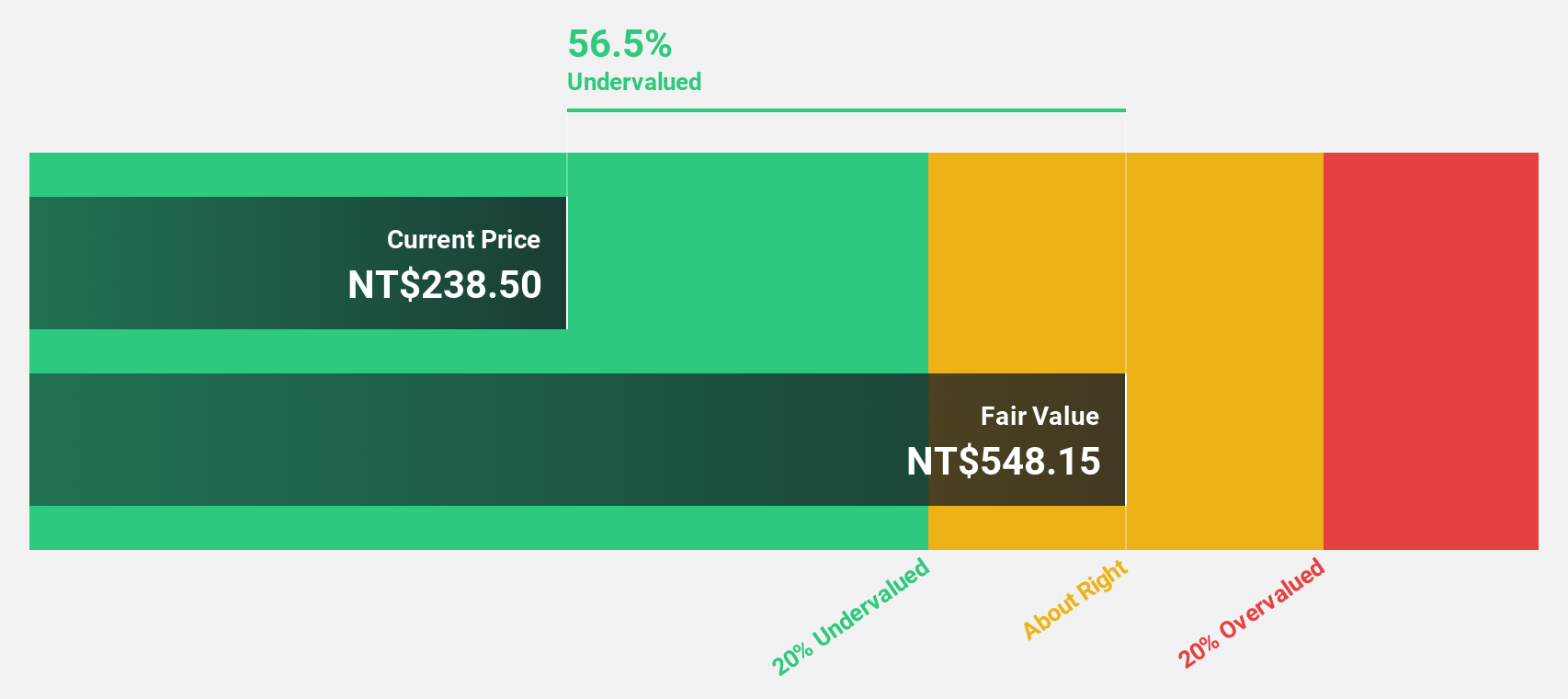

Alltop Technology (TPEX:3526)

Overview: Alltop Technology Co., Ltd. is involved in the design, manufacture, and sale of electrical connectors globally, with a market capitalization of NT$17.04 billion.

Operations: The company's revenue is primarily derived from its electronic coupling segment, generating NT$2.95 billion.

Estimated Discount To Fair Value: 48.8%

Alltop Technology is trading at NT$283, well below its estimated fair value of NT$552.98, highlighting potential undervaluation based on cash flows. Despite past shareholder dilution and a dividend not fully covered by free cash flows, the company reported strong third-quarter results with significant revenue and net income growth compared to the previous year. Earnings are forecast to grow significantly at 25.1% annually, surpassing market expectations in Taiwan.

- Our earnings growth report unveils the potential for significant increases in Alltop Technology's future results.

- Click here to discover the nuances of Alltop Technology with our detailed financial health report.

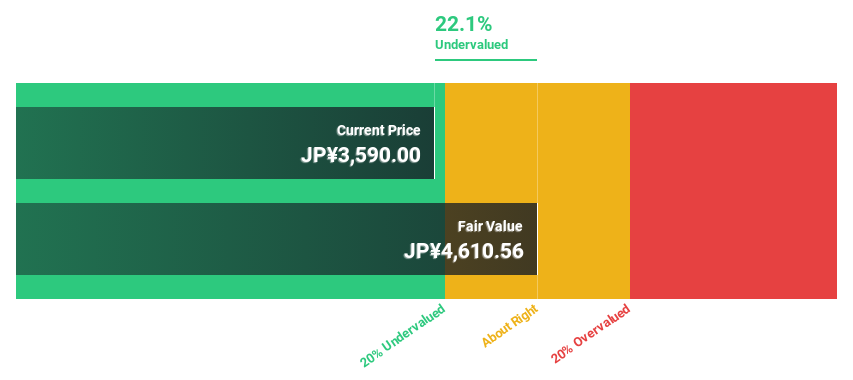

Gift Holdings (TSE:9279)

Overview: Gift Holdings Inc. operates restaurants in Japan, the Republic of South Korea, and internationally with a market cap of ¥71.87 billion.

Operations: The company's revenue is primarily derived from its Food and Beverage Business, which generated ¥26.94 billion.

Estimated Discount To Fair Value: 21.7%

Gift Holdings, trading at ¥3,600, is undervalued by over 20% compared to its fair value of ¥4,597.71. Despite a slight decline in sales percentages year-on-year, the company has shown robust earnings growth of 29.3% last year and is expected to continue growing at 26.22% annually—outpacing the Japanese market's average. The recent expansion into Shanghai with new store openings aligns with their aggressive growth strategy domestically and internationally.

- Insights from our recent growth report point to a promising forecast for Gift Holdings' business outlook.

- Delve into the full analysis health report here for a deeper understanding of Gift Holdings.

Taking Advantage

- Unlock our comprehensive list of 906 Undervalued Stocks Based On Cash Flows by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:LIAB

Lindab International

Manufactures and sells products and solutions for ventilation systems in Europe.

Reasonable growth potential with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives