- Taiwan

- /

- Electronic Equipment and Components

- /

- TPEX:8358

Co-Tech Development (GTSM:8358) Has A Rock Solid Balance Sheet

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, Co-Tech Development Corporation (GTSM:8358) does carry debt. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for Co-Tech Development

What Is Co-Tech Development's Debt?

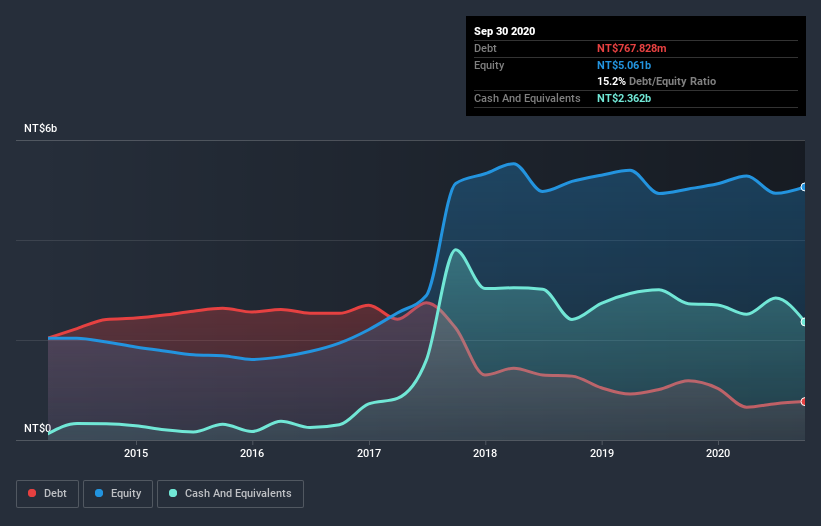

As you can see below, Co-Tech Development had NT$767.8m of debt at September 2020, down from NT$1.18b a year prior. But it also has NT$2.36b in cash to offset that, meaning it has NT$1.59b net cash.

A Look At Co-Tech Development's Liabilities

Zooming in on the latest balance sheet data, we can see that Co-Tech Development had liabilities of NT$1.26b due within 12 months and liabilities of NT$224.7m due beyond that. Offsetting this, it had NT$2.36b in cash and NT$1.68b in receivables that were due within 12 months. So it actually has NT$2.55b more liquid assets than total liabilities.

This excess liquidity suggests that Co-Tech Development is taking a careful approach to debt. Due to its strong net asset position, it is not likely to face issues with its lenders. Simply put, the fact that Co-Tech Development has more cash than debt is arguably a good indication that it can manage its debt safely.

In addition to that, we're happy to report that Co-Tech Development has boosted its EBIT by 40%, thus reducing the spectre of future debt repayments. When analysing debt levels, the balance sheet is the obvious place to start. But it is Co-Tech Development's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. Co-Tech Development may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. During the last three years, Co-Tech Development produced sturdy free cash flow equating to 75% of its EBIT, about what we'd expect. This free cash flow puts the company in a good position to pay down debt, when appropriate.

Summing up

While we empathize with investors who find debt concerning, you should keep in mind that Co-Tech Development has net cash of NT$1.59b, as well as more liquid assets than liabilities. And we liked the look of last year's 40% year-on-year EBIT growth. So we don't think Co-Tech Development's use of debt is risky. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. Consider risks, for instance. Every company has them, and we've spotted 2 warning signs for Co-Tech Development you should know about.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

If you’re looking to trade Co-Tech Development, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:8358

Co-Tech Development

Engages in the production and sale of copper foil for printed circuit board industry in Taiwan and China.

Exceptional growth potential with flawless balance sheet.

Market Insights

Weekly Picks

Ferrari's Intrinsic and Historical Valuation

Investment Thesis: Costco Wholesale (COST)

Undervalued Key Player in Magnets/Rare Earth

Recently Updated Narratives

Hims & Hers Health - Valuation

TAV Havalimanlari Holding will soar with €2.5 billion investments fueling future growth

Lexaria Bioscience's Breakthrough with DehydraTECH to Revolutionize Drug Delivery

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

<b>Reported:</b> Revenue growth: 2024 → 2025 sharp increase of approx. 165%. Assuming moderate annual growth of 40%, a fair value in three years would be approx. $170. Given the customer base and the story, this should be possible. I find the most valuable “property” particularly interesting, as it solves the electricity problem.

NVDA+AEVA Agreement is a game changer for the AEVA stock even though it is just a partnership and does not have a roll out until 2028 (which means receivables as early as 2027, I would imagine) This agreement effectively moves the goal posts of profitability for AEVA much closer since this is in addition to the recent Forterra agreement, as well as the (just announced) European carmaker agreement (which is believed to be Mercedes-Benz). Underneath all of this, AEVA has a pre-existing agreement with Daimler truck. So business seems to be booming, especially with really big name brands…which tends to bring in even more brand names (and thus more agreements/contracts/announcements, etc). This dynamic often creates more coverage from analysts (often with upside stock initial coverage) that I believe will be occurring over the next 3 to 6 months (as professional traders/analysts often research for 2 to 3 months before initiating coverage of a new issue). Anyway, this all just one opinion , so please do your own due diligence. Disclaimer: I/We DO trade in this stock from time to time and I/we may (or may not have) a position currently, so again, please do your own due diligence.