- Taiwan

- /

- Communications

- /

- TPEX:8176

Just Four Days Till Z-Com, Inc. (GTSM:8176) Will Be Trading Ex-Dividend

Readers hoping to buy Z-Com, Inc. (GTSM:8176) for its dividend will need to make their move shortly, as the stock is about to trade ex-dividend. Investors can purchase shares before the 17th of August in order to be eligible for this dividend, which will be paid on the 15th of September.

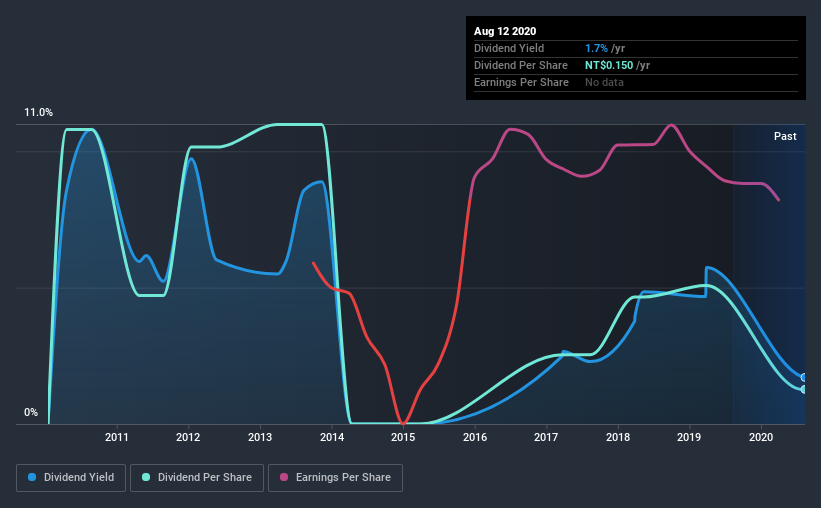

Z-Com's next dividend payment will be NT$0.15 per share. Last year, in total, the company distributed NT$0.15 to shareholders. Based on the last year's worth of payments, Z-Com has a trailing yield of 1.7% on the current stock price of NT$8.78. Dividends are an important source of income to many shareholders, but the health of the business is crucial to maintaining those dividends. We need to see whether the dividend is covered by earnings and if it's growing.

Check out our latest analysis for Z-Com

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. Z-Com's dividend is not well covered by earnings, as the company lost money last year. This is not a sustainable state of affairs, so it would be worth investigating if earnings are expected to recover. Given that the company reported a loss last year, we now need to see if it generated enough free cash flow to fund the dividend. If cash earnings don't cover the dividend, the company would have to pay dividends out of cash in the bank, or by borrowing money, neither of which is long-term sustainable. It paid out more than half (61%) of its free cash flow in the past year, which is within an average range for most companies.

Click here to see how much of its profit Z-Com paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Companies with consistently growing earnings per share generally make the best dividend stocks, as they usually find it easier to grow dividends per share. Investors love dividends, so if earnings fall and the dividend is reduced, expect a stock to be sold off heavily at the same time. Z-Com was unprofitable last year, but at least the general trend suggests its earnings have been improving over the past five years. Even so, an unprofitable company whose business does not quickly recover is usually not a good candidate for dividend investors.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. Z-Com's dividend payments per share have declined at 19% per year on average over the past 10 years, which is uninspiring.

Get our latest analysis on Z-Com's balance sheet health here.

Final Takeaway

From a dividend perspective, should investors buy or avoid Z-Com? First, it's not great to see the company paying a dividend despite being loss-making over the last year. On the plus side, the dividend was covered by free cash flow." In summary, it's hard to get excited about Z-Com from a dividend perspective.

With that being said, if dividends aren't your biggest concern with Z-Com, you should know about the other risks facing this business. For example, we've found 1 warning sign for Z-Com that we recommend you consider before investing in the business.

A common investment mistake is buying the first interesting stock you see. Here you can find a list of promising dividend stocks with a greater than 2% yield and an upcoming dividend.

If you’re looking to trade Z-Com, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Z-Com might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TPEX:8176

Z-Com

Engages in the research, development, manufacture, and sale of wireless networking solutions in Taiwan, and Mainland China.

Excellent balance sheet with acceptable track record.