- Taiwan

- /

- Electronic Equipment and Components

- /

- TPEX:6560

Trends At Appro Photoelectron (GTSM:6560) Point To A Promising Future

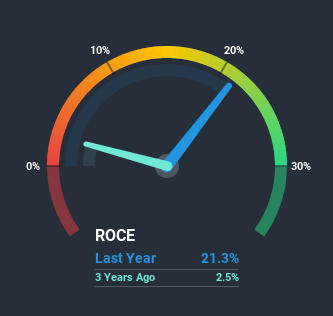

If we want to find a potential multi-bagger, often there are underlying trends that can provide clues. Ideally, a business will show two trends; firstly a growing return on capital employed (ROCE) and secondly, an increasing amount of capital employed. This shows us that it's a compounding machine, able to continually reinvest its earnings back into the business and generate higher returns. Ergo, when we looked at the ROCE trends at Appro Photoelectron (GTSM:6560), we liked what we saw.

Return On Capital Employed (ROCE): What is it?

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. Analysts use this formula to calculate it for Appro Photoelectron:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.21 = NT$77m ÷ (NT$542m - NT$177m) (Based on the trailing twelve months to September 2020).

So, Appro Photoelectron has an ROCE of 21%. In absolute terms that's a great return and it's even better than the Electronic industry average of 11%.

Check out our latest analysis for Appro Photoelectron

While the past is not representative of the future, it can be helpful to know how a company has performed historically, which is why we have this chart above. If you want to delve into the historical earnings, revenue and cash flow of Appro Photoelectron, check out these free graphs here.

The Trend Of ROCE

In terms of Appro Photoelectron's history of ROCE, it's quite impressive. The company has consistently earned 21% for the last five years, and the capital employed within the business has risen 40% in that time. Now considering ROCE is an attractive 21%, this combination is actually pretty appealing because it means the business can consistently put money to work and generate these high returns. If Appro Photoelectron can keep this up, we'd be very optimistic about its future.

Our Take On Appro Photoelectron's ROCE

In the end, the company has proven it can reinvest it's capital at high rates of returns, which you'll remember is a trait of a multi-bagger. And long term investors would be thrilled with the 132% return they've received over the last five years. So while investors seem to be recognizing these promising trends, we still believe the stock deserves further research.

Appro Photoelectron does come with some risks though, we found 4 warning signs in our investment analysis, and 1 of those is potentially serious...

High returns are a key ingredient to strong performance, so check out our free list ofstocks earning high returns on equity with solid balance sheets.

If you’re looking to trade Appro Photoelectron, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:6560

Appro Photoelectron

Operates as a design house for image products to enable customers to develop products in Taiwan.

Flawless balance sheet with low risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)