Provision Information Co.,LTD's (GTSM:6590) Stock Is Going Strong: Is the Market Following Fundamentals?

Provision InformationLTD (GTSM:6590) has had a great run on the share market with its stock up by a significant 13% over the last three months. Given that the market rewards strong financials in the long-term, we wonder if that is the case in this instance. Particularly, we will be paying attention to Provision InformationLTD's ROE today.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. In short, ROE shows the profit each dollar generates with respect to its shareholder investments.

Check out our latest analysis for Provision InformationLTD

How Is ROE Calculated?

Return on equity can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Provision InformationLTD is:

17% = NT$78m ÷ NT$453m (Based on the trailing twelve months to September 2020).

The 'return' refers to a company's earnings over the last year. That means that for every NT$1 worth of shareholders' equity, the company generated NT$0.17 in profit.

Why Is ROE Important For Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

Provision InformationLTD's Earnings Growth And 17% ROE

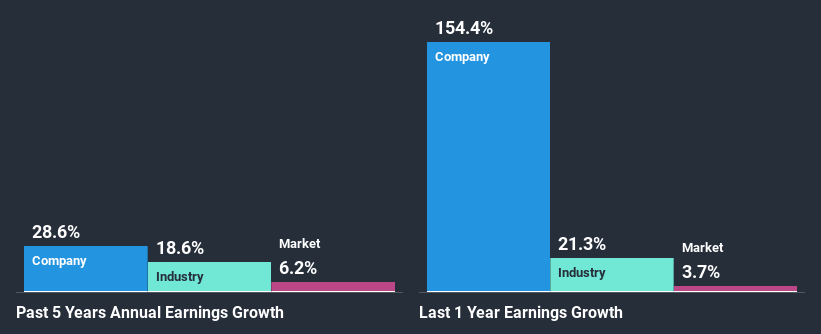

At first glance, Provision InformationLTD seems to have a decent ROE. Further, the company's ROE is similar to the industry average of 17%. Consequently, this likely laid the ground for the impressive net income growth of 29% seen over the past five years by Provision InformationLTD. However, there could also be other drivers behind this growth. For instance, the company has a low payout ratio or is being managed efficiently.

We then compared Provision InformationLTD's net income growth with the industry and we're pleased to see that the company's growth figure is higher when compared with the industry which has a growth rate of 19% in the same period.

Earnings growth is an important metric to consider when valuing a stock. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. This then helps them determine if the stock is placed for a bright or bleak future. If you're wondering about Provision InformationLTD's's valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Is Provision InformationLTD Making Efficient Use Of Its Profits?

The high three-year median payout ratio of 70% (implying that it keeps only 30% of profits) for Provision InformationLTD suggests that the company's growth wasn't really hampered despite it returning most of the earnings to its shareholders.

Additionally, Provision InformationLTD has paid dividends over a period of four years which means that the company is pretty serious about sharing its profits with shareholders.

Summary

In total, we are pretty happy with Provision InformationLTD's performance. We are particularly impressed by the considerable earnings growth posted by the company, which was likely backed by its high ROE. While the company is paying out most of its earnings as dividends, it has been able to grow its earnings in spite of it, so that's probably a good sign. Up till now, we've only made a short study of the company's growth data. You can do your own research on Provision InformationLTD and see how it has performed in the past by looking at this FREE detailed graph of past earnings, revenue and cash flows.

If you’re looking to trade Provision InformationLTD, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TPEX:6590

Provision InformationLtd

Provides payment, financial application, outsourcing services, and security solutions to the financial industry in Taiwan.

Excellent balance sheet and good value.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

<html><head></head><body><div dir="auto">This is true here, but always true in the case of Alpha leaders. Often is takes a turn or two to get it right, like Gates to Nardella,  or Anton to Pinchar. This is when succession planning has failed or never happened. </div><div><br></div> </body></html>