- Taiwan

- /

- Semiconductors

- /

- TWSE:3717

Excellence Optoelectronics Inc. (TWSE:6288) Doing What It Can To Lift Shares

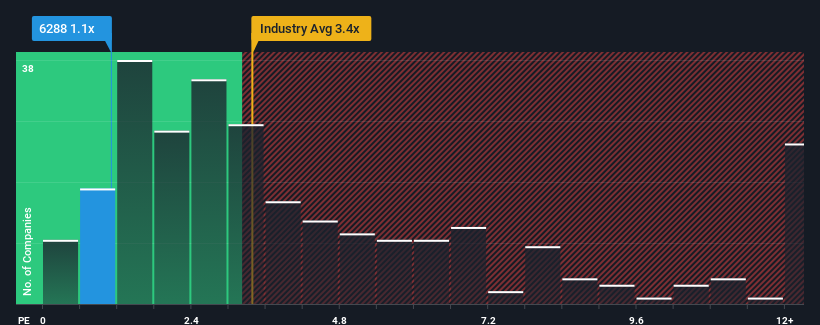

You may think that with a price-to-sales (or "P/S") ratio of 1.1x Excellence Optoelectronics Inc. (TWSE:6288) is definitely a stock worth checking out, seeing as almost half of all the Semiconductor companies in Taiwan have P/S ratios greater than 3.4x and even P/S above 7x aren't out of the ordinary. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Excellence Optoelectronics

What Does Excellence Optoelectronics' Recent Performance Look Like?

Recent times have been advantageous for Excellence Optoelectronics as its revenues have been rising faster than most other companies. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Excellence Optoelectronics.How Is Excellence Optoelectronics' Revenue Growth Trending?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Excellence Optoelectronics' to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 17%. As a result, it also grew revenue by 21% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Shifting to the future, estimates from the only analyst covering the company suggest revenue should grow by 35% over the next year. With the industry only predicted to deliver 26%, the company is positioned for a stronger revenue result.

In light of this, it's peculiar that Excellence Optoelectronics' P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What We Can Learn From Excellence Optoelectronics' P/S?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Excellence Optoelectronics' analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. There could be some major risk factors that are placing downward pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

Before you settle on your opinion, we've discovered 3 warning signs for Excellence Optoelectronics (2 shouldn't be ignored!) that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if EOI Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:3717

EOI Holding

Together with subsidiaries, engages in the design, development, testing, manufacturing, and sale of LED components, OEM/ODM, and LED modules for automotive industry in the United States, Asia, Europe, Taiwan, and Oceania.

Slightly overvalued with imperfect balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)