- Taiwan

- /

- Semiconductors

- /

- TWSE:5471

Sonix TechnologyLtd's (TWSE:5471) Dividend Will Be Reduced To NT$1.20

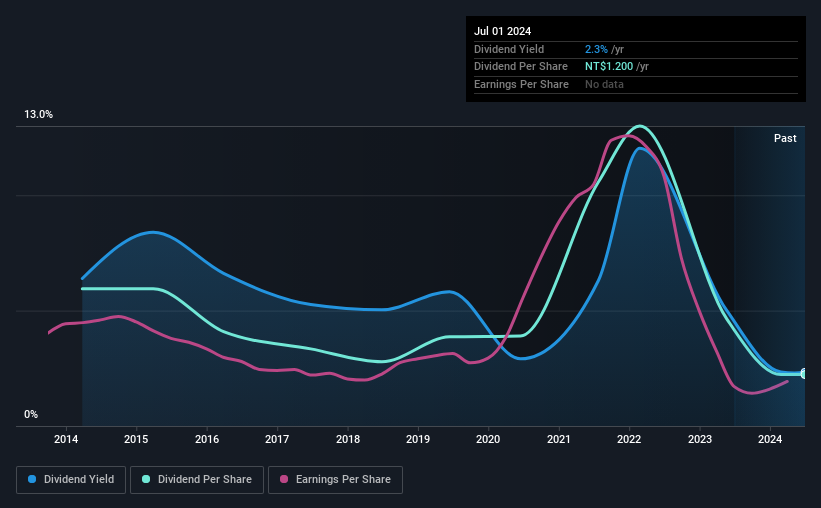

Sonix Technology Co.,Ltd. (TWSE:5471) has announced that on 8th of August, it will be paying a dividend ofNT$1.20, which a reduction from last year's comparable dividend. This payment takes the dividend yield to 2.3%, which only provides a modest boost to overall returns.

Check out our latest analysis for Sonix TechnologyLtd

Sonix TechnologyLtd Is Paying Out More Than It Is Earning

It would be nice for the yield to be higher, but we should also check if higher levels of dividend payment would be sustainable. The last payment made up 90% of earnings, but cash flows were much higher. Since the dividend is just paying out cash to shareholders, we care more about the cash payout ratio from which we can see plenty is being left over for reinvestment in the business.

If the company can't turn things around, EPS could fall by 8.7% over the next year. If the dividend continues along the path it has been on recently, the payout ratio in 12 months could be 103%, which is definitely a bit high to be sustainable going forward.

Dividend Volatility

While the company has been paying a dividend for a long time, it has cut the dividend at least once in the last 10 years. The annual payment during the last 10 years was NT$3.20 in 2014, and the most recent fiscal year payment was NT$1.20. This works out to be a decline of approximately 9.3% per year over that time. A company that decreases its dividend over time generally isn't what we are looking for.

Dividend Growth Is Doubtful

Given that dividend payments have been shrinking like a glacier in a warming world, we need to check if there are some bright spots on the horizon. Over the past five years, it looks as though Sonix TechnologyLtd's EPS has declined at around 8.7% a year. If earnings continue declining, the company may have to make the difficult choice of reducing the dividend or even stopping it completely - the opposite of dividend growth.

Our Thoughts On Sonix TechnologyLtd's Dividend

Overall, it's not great to see that the dividend has been cut, but this might be explained by the payments being a bit high previously. The company is generating plenty of cash, which could maintain the dividend for a while, but the track record hasn't been great. Overall, we don't think this company has the makings of a good income stock.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. However, there are other things to consider for investors when analysing stock performance. Case in point: We've spotted 3 warning signs for Sonix TechnologyLtd (of which 1 doesn't sit too well with us!) you should know about. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:5471

Sonix TechnologyLtd

Develops, designs, manufactures, and trades in semiconductors in Taiwan and internationally.

Flawless balance sheet with low risk.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026