- Taiwan

- /

- Semiconductors

- /

- TWSE:3711

September 2024's Top Growth Companies With High Insider Ownership

Reviewed by Simply Wall St

As global markets grapple with economic slowdown concerns and a significant drop in the S&P 500 Index, investors are increasingly looking for resilient opportunities. In this environment, growth companies with high insider ownership can offer a unique advantage, as they often signal strong internal confidence and alignment with shareholder interests.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 11.9% | 20.6% |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 42.1% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 27.4% |

| People & Technology (KOSDAQ:A137400) | 16.5% | 35.6% |

| On Holding (NYSE:ONON) | 28.4% | 24.4% |

| KebNi (OM:KEBNI B) | 37.8% | 86.1% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.1% | 95.9% |

| Adocia (ENXTPA:ADOC) | 11.9% | 63% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.5% |

Let's review some notable picks from our screened stocks.

Giga-Byte Technology (TWSE:2376)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Giga-Byte Technology Co., Ltd. and its subsidiaries manufacture, process, and trade computer peripherals and component parts globally, with a market cap of NT$154.15 billion.

Operations: The company's revenue segments include the Brand Business Division, which generated NT$211.10 billion.

Insider Ownership: 10.4%

Revenue Growth Forecast: 18.7% p.a.

Giga-Byte Technology shows strong growth potential with earnings forecasted to grow 22.3% annually, outpacing the TW market's 18.2%. Recent financials highlight a significant year-over-year increase in net income from TWD 889.53 million to TWD 2,961.71 million for Q2 2024. Despite insider ownership stability and high return on equity projections (24.4%), dividend sustainability remains a concern due to inadequate free cash flow coverage, and recent board changes could impact strategic direction.

- Navigate through the intricacies of Giga-Byte Technology with our comprehensive analyst estimates report here.

- The analysis detailed in our Giga-Byte Technology valuation report hints at an deflated share price compared to its estimated value.

Quanta Computer (TWSE:2382)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Quanta Computer Inc. manufactures and sells notebook computers across Asia, the Americas, Europe, and internationally, with a market cap of NT$932.79 billion.

Operations: The company's revenue segments include NT$2.50 billion from The Electronics Sector.

Insider Ownership: 13.7%

Revenue Growth Forecast: 36.8% p.a.

Quanta Computer's earnings grew by 44.3% over the past year, with revenue forecasted to grow at 36.8% annually, outpacing the TW market. The company reported strong Q2 2024 results with net income rising from TWD 10.12 billion to TWD 15.13 billion year-over-year. Despite a highly volatile share price and no recent insider trading activity, Quanta trades at a significant discount to its fair value and offers a reliable dividend yield of 3.55%.

- Click here and access our complete growth analysis report to understand the dynamics of Quanta Computer.

- According our valuation report, there's an indication that Quanta Computer's share price might be on the cheaper side.

ASE Technology Holding (TWSE:3711)

Simply Wall St Growth Rating: ★★★★☆☆

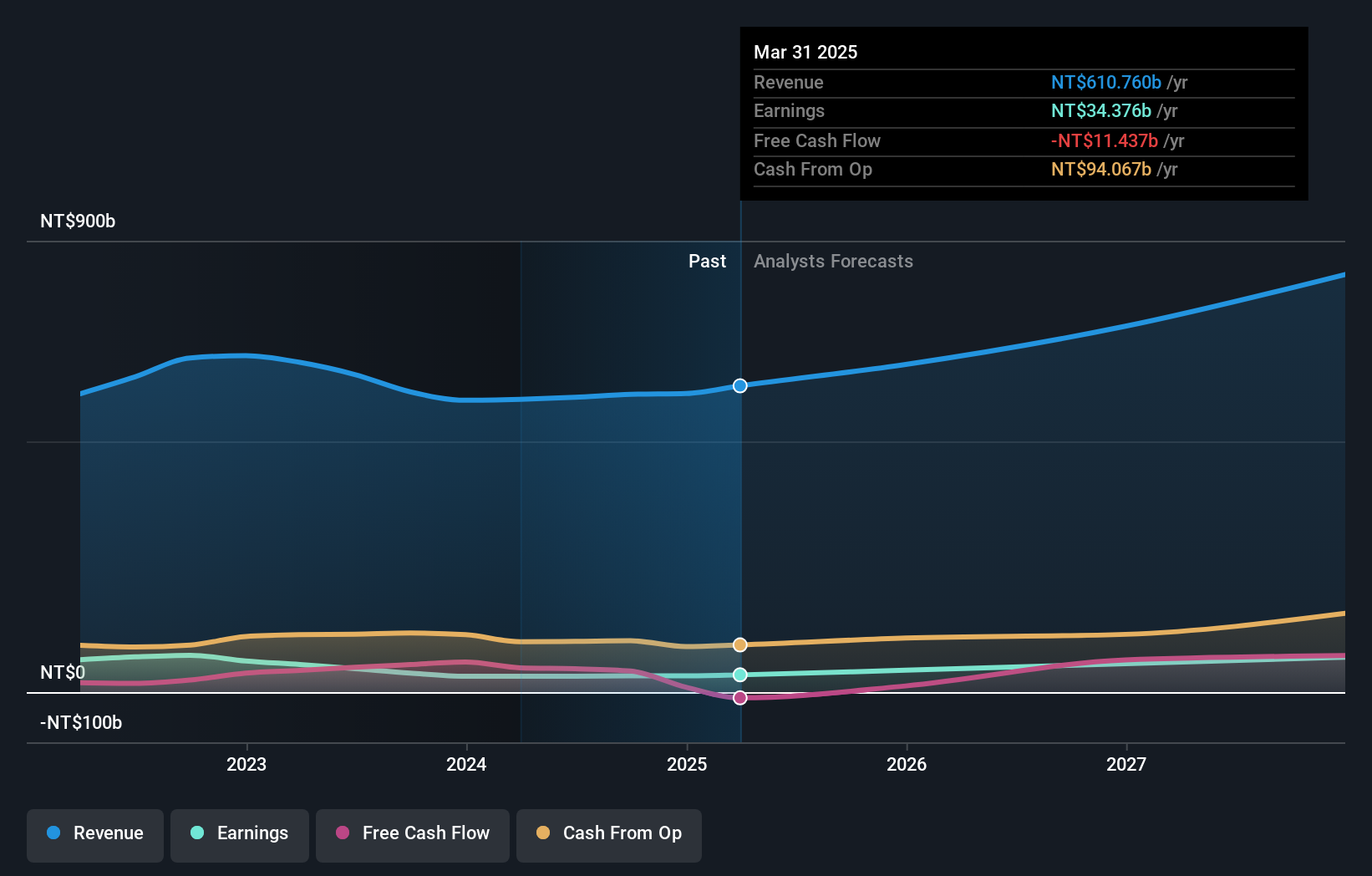

Overview: ASE Technology Holding Co., Ltd. and its subsidiaries offer semiconductor packaging and testing, as well as electronic manufacturing services globally, with a market cap of NT$613.05 billion.

Operations: ASE Technology Holding Co., Ltd.'s revenue segments include NT$51.27 billion from testing, NT$262.64 billion from packaging, and NT$302.07 billion from the electronic assembly department.

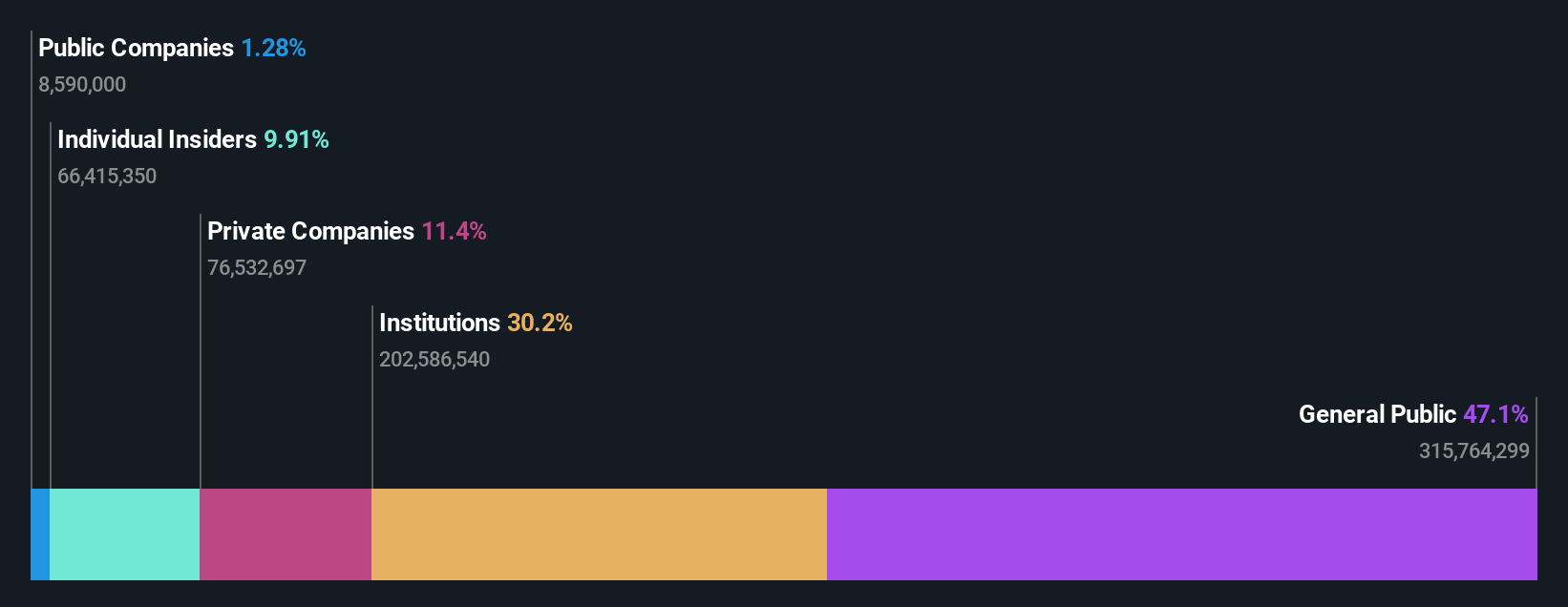

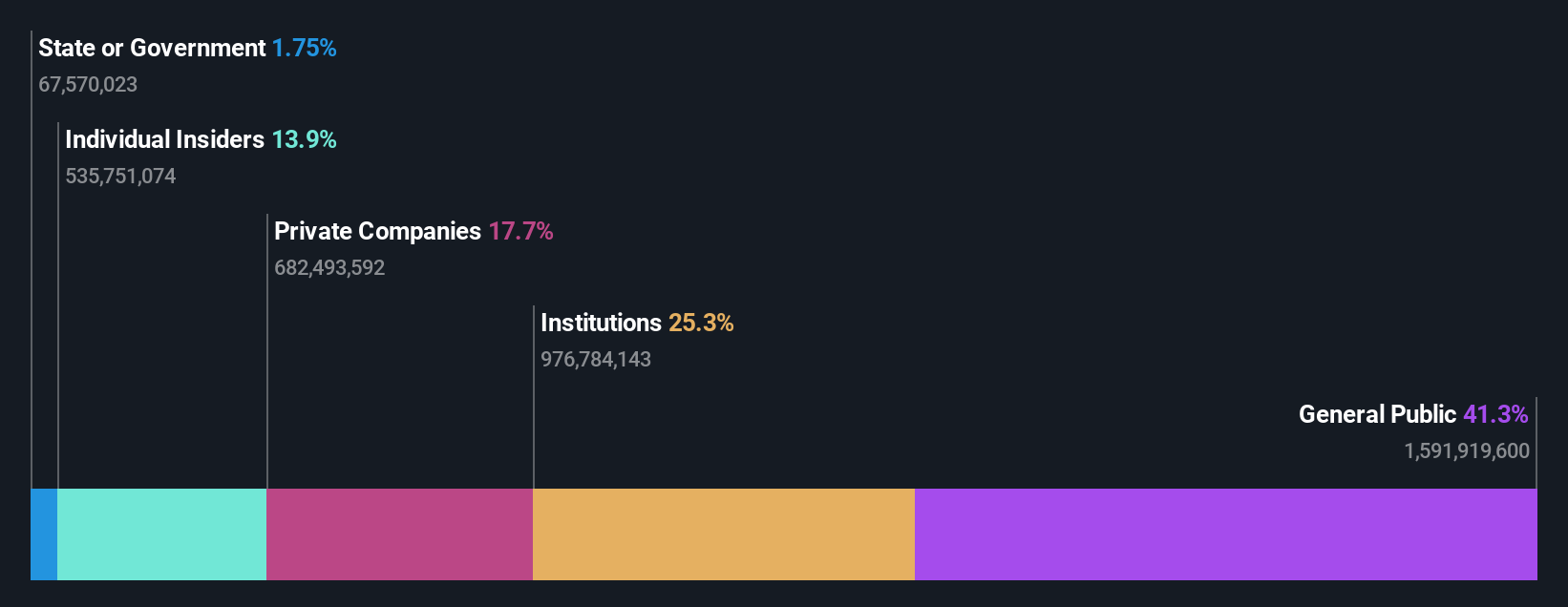

Insider Ownership: 28.6%

Revenue Growth Forecast: 11.8% p.a.

ASE Technology Holding's earnings are forecasted to grow significantly at 31.48% annually, outpacing the TW market. Despite a highly volatile share price, the stock trades at a substantial discount to its estimated fair value. Recent events include consistent revenue growth with August 2024 net revenues reaching TWD 52,930 million and significant contracts signed by its subsidiary SPIL Malaysia Sdn. Bhd., indicating robust operational activities and potential for sustained growth.

- Click to explore a detailed breakdown of our findings in ASE Technology Holding's earnings growth report.

- Upon reviewing our latest valuation report, ASE Technology Holding's share price might be too pessimistic.

Where To Now?

- Unlock more gems! Our Fast Growing Companies With High Insider Ownership screener has unearthed 1503 more companies for you to explore.Click here to unveil our expertly curated list of 1506 Fast Growing Companies With High Insider Ownership.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:3711

ASE Technology Holding

Provides semiconductors packaging and testing, and electronic manufacturing services in the United States, Taiwan, Asia, Europe, and internationally.

Flawless balance sheet and good value.